Pro's Guide: Update Council Tax Info Now!

Council tax is a vital aspect of local government funding in the United Kingdom, and staying updated with the latest information is crucial for both residents and property owners. This comprehensive guide aims to provide an in-depth understanding of council tax, covering its purpose, calculation, and the steps involved in updating your details to ensure accuracy and avoid any potential penalties.

Understanding Council Tax

Council tax is a local taxation system in the UK, introduced in 1993 to replace the previous system of community charge. It is a vital source of revenue for local authorities, helping to fund essential services such as education, social care, waste management, and more.

Every residential property in the UK is assigned a council tax band, which determines the amount of tax payable. The bands are based on the value of the property as of April 1991 in England and Scotland, and April 2003 in Wales. Properties are assessed and allocated to one of eight bands (A to H), with band H having the highest council tax liability.

Who Pays Council Tax and How Much?

Council tax is payable by the resident(s) occupying a property. If the property is owned, the owner is responsible for paying the tax. However, if the property is rented, the liability usually falls on the tenant(s). In some cases, a landlord may choose to include council tax in the rent, but this is not a common practice.

The amount of council tax due depends on various factors, including the property's band, the local authority's council tax rate, and any applicable discounts or exemptions. Council tax rates can vary significantly between different local authorities, so it's essential to check with your local council for the specific rate applicable to your area.

Calculating Council Tax

The calculation of council tax involves several steps. Firstly, the local authority sets a "band D" rate, which serves as a benchmark for all other bands. The band D rate is then multiplied by a set of factors specific to each band to determine the council tax liability for that band.

For example, if the band D rate is £1,500 and the property is in band C, the council tax liability would be calculated as follows: £1,500 x 0.8 = £1,200. This means that the council tax for a band C property would be 80% of the band D rate.

It's important to note that the band D rate and the factors used to calculate council tax can change annually, so it's essential to stay updated with the latest information.

Updating Council Tax Information

Keeping your council tax information up-to-date is crucial to ensure you are paying the correct amount and receiving any applicable discounts or exemptions. Here are the key steps to update your council tax details:

1. Check Your Current Council Tax Band

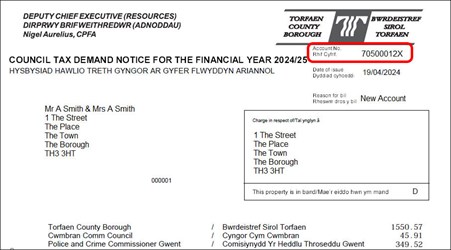

Start by verifying your current council tax band. You can find this information on your council tax bill or by contacting your local council. If you believe your property has been incorrectly banded, you have the right to appeal.

2. Notify Changes in Circumstance

If there have been any changes in your circumstances that may affect your council tax liability, it's essential to notify your local council promptly. This includes changes such as:

- Moving into a new property

- Becoming an empty home

- Changes in occupancy (e.g., new tenants, additional residents)

- Marital status changes

- Becoming a student

- Receiving certain benefits or allowances

3. Apply for Discounts and Exemptions

Certain individuals or households may be eligible for council tax discounts or exemptions. Common examples include:

- Single occupancy discount (25% discount for properties with only one adult resident)

- Disability reduction (up to 100% discount for properties where a resident has a severe mental impairment)

- Student exemption (students living in a property may be exempt from council tax)

- Council tax support (for low-income households)

Check with your local council to understand the specific discounts and exemptions available in your area and the application process.

4. Update Your Contact Details

If your contact information, such as your address or email, has changed, ensure you update it with your local council. This will help ensure you receive important council tax-related communications and avoid any delays or penalties.

5. Review Your Council Tax Bill Regularly

It's good practice to review your council tax bill each year to ensure the information is accurate and up-to-date. Check for any changes in your band, the local authority's council tax rate, and the amount due. If you notice any discrepancies, contact your local council promptly to resolve the issue.

Council Tax Payment Options

There are various payment options available for council tax, and it's essential to choose the one that suits your needs and preferences. Common payment methods include:

- Direct Debit: A convenient and popular option, allowing you to pay your council tax in regular installments automatically deducted from your bank account.

- Online Payment: Many local councils offer the option to pay council tax online through their website, using a debit or credit card.

- Telephone Payment: You can call your local council's payment line and make a payment over the phone using your card details.

- Post Office: Some councils accept council tax payments at designated Post Office branches.

- Cheque or Cash: You can also pay your council tax by cheque or in cash at your local council's offices.

It's important to note that late payment of council tax can result in penalties and additional charges, so it's best to choose a payment method that ensures timely payments.

Council Tax Reduction Schemes

For those struggling to pay their council tax, several reduction schemes are available to provide financial support. These schemes vary depending on your local authority and personal circumstances, but they generally aim to help low-income households and those on benefits.

To apply for a council tax reduction, you will need to provide evidence of your income, benefits, and any other relevant information. The local council will assess your application and determine your eligibility for a reduction. It's important to note that reduction schemes have specific criteria, and not everyone may be eligible.

Appealing Your Council Tax Band

If you believe your property has been incorrectly banded, you have the right to appeal. The first step is to contact your local council's valuation office and request a review. They will assess your property and determine if a rebanding is necessary.

If you are still dissatisfied with the outcome, you can appeal to an independent valuation tribunal. This process can be complex, so it's advisable to seek professional advice or support from organizations such as the Citizens Advice Bureau.

Council Tax for Second Homes and Empty Properties

If you own a second home or have an empty property, you may be subject to additional council tax charges. Local councils can charge a premium on these properties to encourage occupancy and prevent properties from lying empty.

The amount of the premium can vary, and it's essential to check with your local council for specific details. In some cases, you may be eligible for a discount if you are taking steps to sell or let the property, or if it is undergoing significant renovations.

Council Tax and Student Accommodation

Council tax rules for student accommodation can be complex, and it's important to understand your rights and responsibilities. If you are a student living in a property with other students, you may be exempt from council tax. However, if you are living with non-students, you may be liable for council tax.

It's essential to check with your local council and the specific rules in your area. Some councils may offer discounts or exemptions for student households, so it's worth exploring these options.

Council Tax and Business Rates

It's important to note that council tax and business rates are two separate taxes. Council tax applies to residential properties, while business rates are levied on non-domestic properties used for business purposes. The calculation and payment process for business rates differ from council tax, and it's essential to understand your obligations as a business owner.

Council Tax and Renting

If you are renting a property, it's crucial to understand your responsibilities regarding council tax. As mentioned earlier, the liability for council tax usually falls on the tenant(s). However, it's essential to check your tenancy agreement and clarify with your landlord or letting agent regarding council tax payments.

Some landlords may choose to include council tax in the rent, while others may require tenants to pay it separately. It's important to have a clear understanding of your obligations to avoid any disputes or penalties.

Council Tax and Moving House

When moving to a new property, it's essential to notify your local council promptly. This will ensure that your council tax liability is correctly calculated for your new address. You will need to provide your new address and the date you moved in. The council will then update your records and send you a new council tax bill.

It's also important to notify your previous local council if you are moving out of their area. This will help ensure you are not charged council tax for a property you no longer occupy.

Council Tax and Overseas Property Owners

If you are a non-UK resident and own a property in the UK, you are still liable for council tax. The rules and obligations are the same as for UK residents. It's essential to understand your responsibilities and ensure you pay your council tax on time to avoid any penalties or legal issues.

Council Tax and Property Valuation

The valuation of properties for council tax purposes is a complex process. Properties are assessed and valued by the Valuation Office Agency (VOA) in England and Wales, and by the Scottish Assessors in Scotland. These organizations determine the property's band based on its value as of the specified date (April 1991 or April 2003, depending on the country).

If you believe your property has been incorrectly valued or banded, you have the right to appeal. The process for appealing a valuation can be complex, and it's advisable to seek professional advice or support.

Council Tax and Local Services

Council tax is a vital source of funding for local services, and it's important to understand how your council tax contributions are used. The revenue generated from council tax is invested in various areas, including:

- Education: Funding schools, maintaining educational facilities, and providing support for students.

- Social Care: Supporting vulnerable individuals, providing care services, and funding social work.

- Waste Management: Collecting and disposing of waste, promoting recycling, and maintaining clean and safe environments.

- Transport: Maintaining roads, providing public transport, and supporting cycling and walking initiatives.

- Leisure and Culture: Funding libraries, museums, arts, and cultural events.

- Environmental Services: Managing parks and open spaces, controlling pests, and protecting the environment.

By paying your council tax, you are contributing to the funding of these essential services and helping to improve your local community.

Conclusion

Council tax is a crucial aspect of local government funding, and staying informed about its calculation, payment options, and discounts is essential. By keeping your council tax information up-to-date, you can ensure you are paying the correct amount and receiving any applicable benefits. Remember to review your council tax bill regularly, notify changes in circumstance, and explore the various payment options available.

Understanding your rights and responsibilities regarding council tax is vital, whether you are a homeowner, tenant, student, or business owner. By staying informed and proactive, you can navigate the council tax system effectively and contribute to the funding of vital local services.

What happens if I don’t pay my council tax on time?

+

Failure to pay your council tax on time can result in penalties and additional charges. The local council may send reminder notices and, if payment is still not made, issue a court summons. It’s important to keep up with your council tax payments to avoid these consequences.

Can I pay my council tax in installments?

+

Yes, many local councils offer the option to pay your council tax in regular installments. This can be done through a direct debit arrangement, allowing you to spread the cost over the year. Contact your local council to set up a payment plan that suits your financial situation.

How do I apply for a council tax reduction or exemption?

+

To apply for a council tax reduction or exemption, you will need to contact your local council and provide the necessary information and documentation. This may include details of your income, benefits, and household circumstances. The council will assess your application and determine your eligibility.

What should I do if I disagree with my council tax band?

+

If you believe your property has been incorrectly banded, you have the right to appeal. Contact your local council’s valuation office and request a review. They will assess your property and determine if a rebanding is necessary. If you are still dissatisfied, you can appeal to an independent valuation tribunal.

Are there any council tax discounts for pensioners or disabled individuals?

+

Yes, certain discounts and exemptions are available for pensioners and disabled individuals. These may include a single occupancy discount, a disability reduction, or other specific allowances. Check with your local council to understand the specific discounts and the application process.