Report A Change Of Circumstances

Reporting a Change of Circumstances: A Comprehensive Guide

Dealing with a change in your personal or financial situation can be a challenging and often confusing process, especially when it comes to informing the necessary authorities and organizations. Whether it’s a new job, a move to a different country, or a change in your marital status, it’s crucial to report these changes to ensure you remain compliant with legal requirements and maintain access to the benefits and services you may be entitled to. This guide will walk you through the steps to effectively report a change of circumstances, covering various scenarios and providing insights to make the process as smooth as possible.

Understanding the Importance of Reporting Changes

Reporting a change of circumstances is not just a bureaucratic formality; it’s a crucial step to maintain accuracy in official records and ensure you receive the correct entitlements and services. Failure to report changes can lead to a range of issues, including overpayments, underpayments, or even legal consequences. For instance, if you continue to receive benefits after starting a new job without informing the relevant authorities, you may be required to repay the excess payments, and in some cases, face penalties.

Common Changes to Report

There are numerous life events that may require you to report a change of circumstances. Here are some of the most common:

Change of Address: Moving to a new home, whether within the same country or internationally, is a significant change that should be reported to a variety of organizations, including government agencies, financial institutions, and utility providers.

Change in Marital Status: Getting married, divorced, or becoming a widow/widower can impact your eligibility for certain benefits and tax obligations. It’s essential to notify the relevant authorities to ensure your records are up-to-date.

Employment Status: Starting a new job, becoming self-employed, or losing your job are all changes that should be reported. This is particularly important for benefits such as unemployment insurance or tax credits.

Health Status: Changes in your health, such as becoming disabled or requiring long-term care, can impact your eligibility for certain benefits and services. It’s crucial to report these changes to ensure you receive the support you need.

Change in Family Composition: The birth of a child, adoption, or becoming a foster parent are all changes that may affect your benefits and tax obligations. Reporting these changes ensures you receive the correct entitlements for your new family situation.

Step-by-Step Guide to Reporting Changes

Reporting a change of circumstances typically involves the following steps:

Identify the Relevant Authorities: Depending on the type of change, you may need to notify multiple organizations. For example, a change of address might require you to inform your local council, the tax office, and your utility providers, while a change in employment status might involve notifying the Department of Social Security and your employer.

Gather the Necessary Documentation: You will often need to provide proof of the change, such as a marriage certificate, a new employment contract, or a letter from your doctor. Ensure you have all the required documents before starting the reporting process.

Contact the Authorities: Reach out to the relevant organizations to inform them of the change. This can be done via phone, email, or in person. Be prepared to provide details of the change and any supporting documentation.

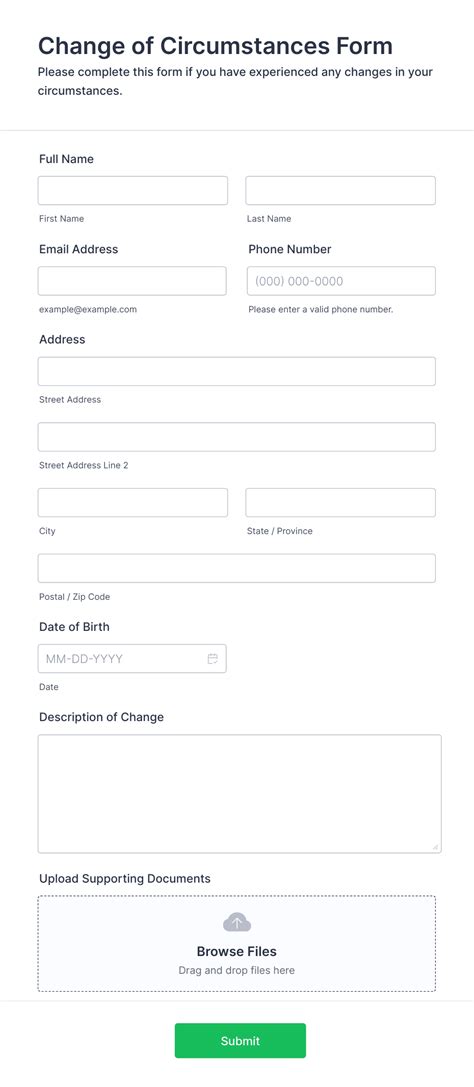

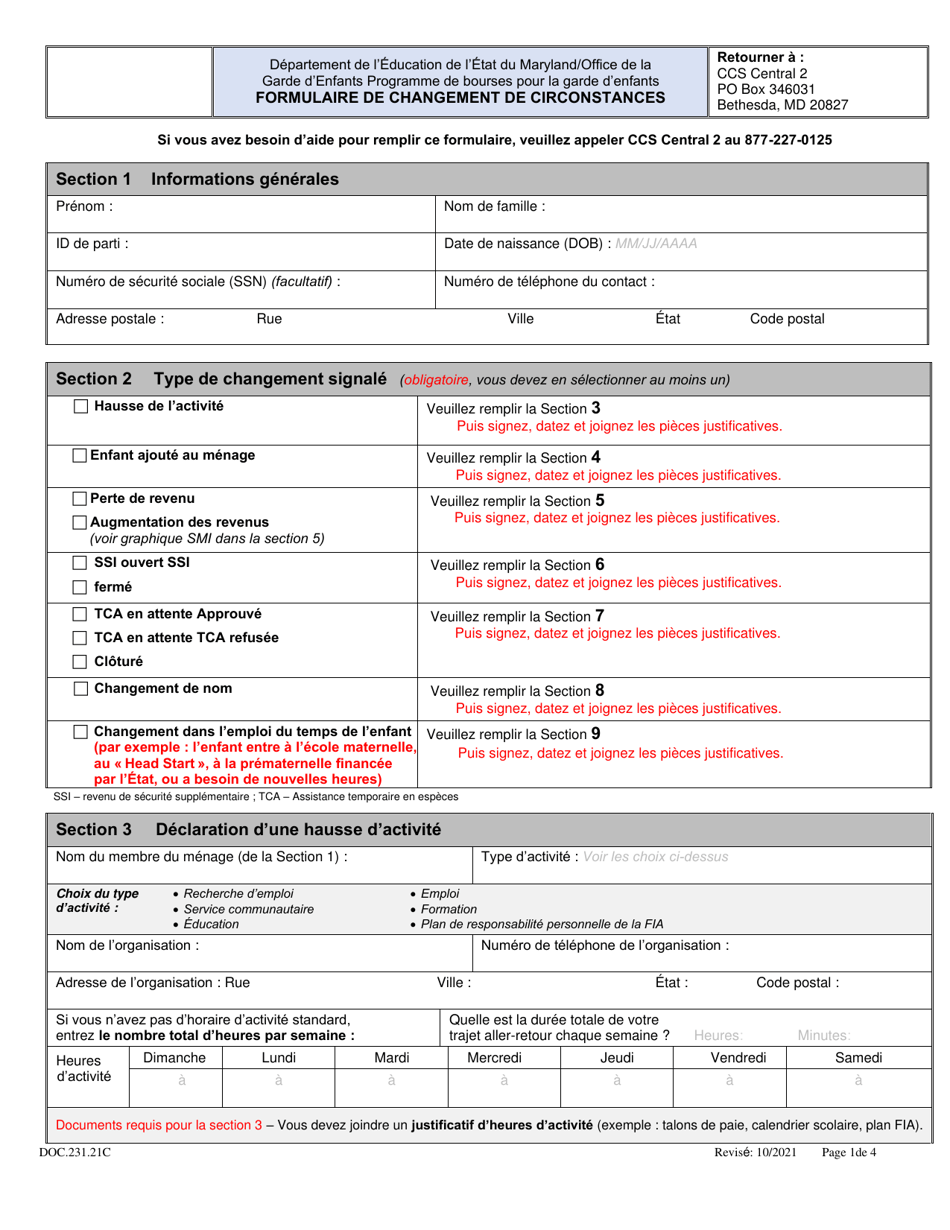

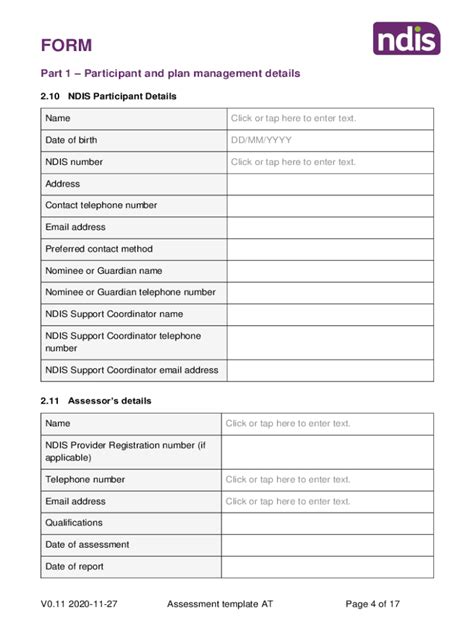

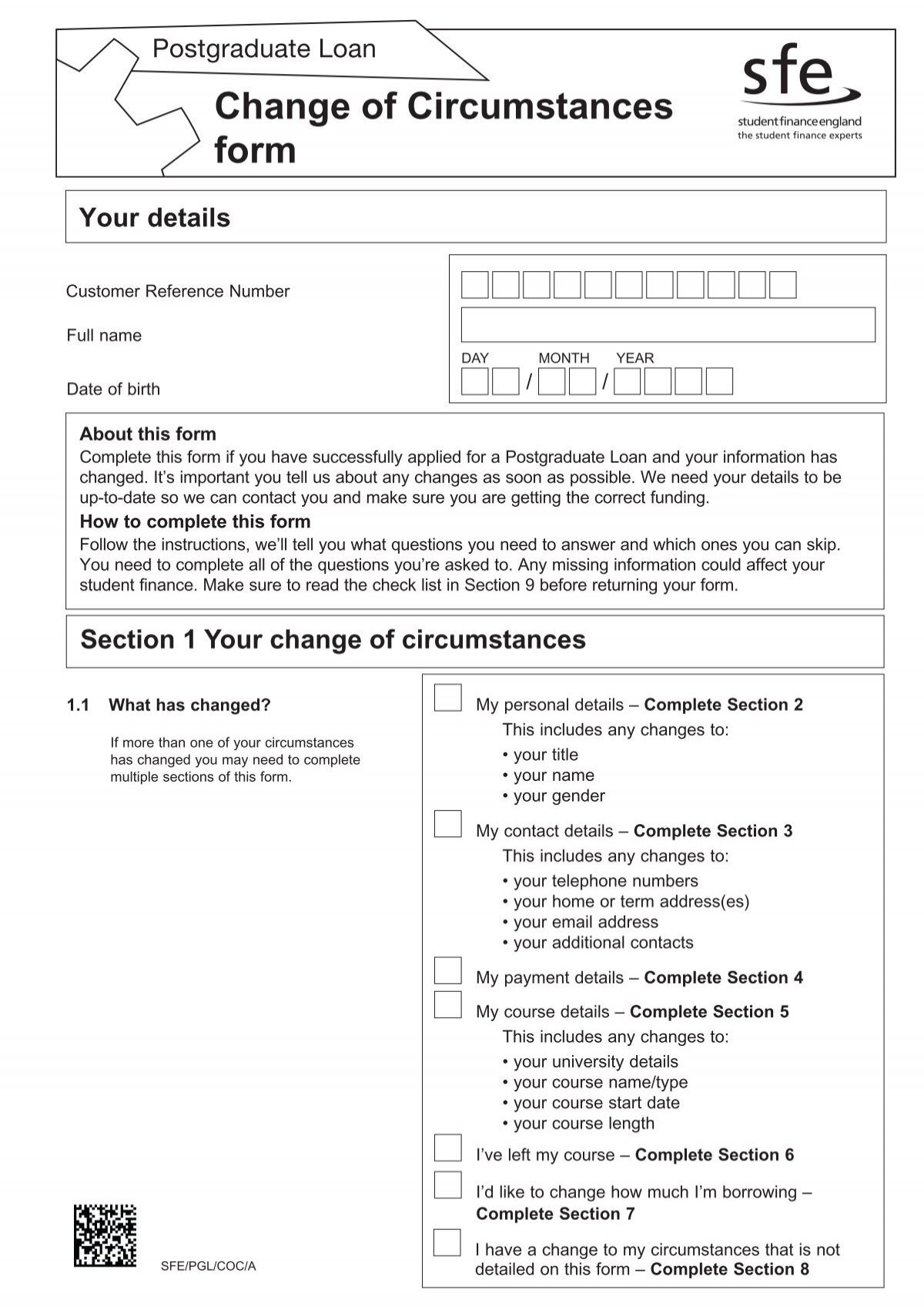

Complete the Required Forms: Many organizations will have specific forms or applications that you need to complete to report the change. Make sure you understand the requirements and fill out the forms accurately.

Keep Records: It’s important to keep a record of your communication with the authorities, including the date and time of your contact, the name of the person you spoke to, and any reference numbers or case numbers provided. This can be useful if you need to follow up on your case.

Follow Up: If you haven’t received a response within a reasonable timeframe, it’s important to follow up with the authorities. This shows that you are proactive and helps to ensure that your case is not overlooked.

Reporting Changes for Specific Circumstances

Depending on your specific situation, there may be additional steps or considerations when reporting a change of circumstances. Here are some examples:

Change of Address

Notify the Post Office: Inform the post office of your new address to ensure your mail is forwarded to your new location. This can be done by filling out a change of address form.

Update Your Driver’s License: If you have a driver’s license, you may need to update your address with the relevant authority. This is particularly important if you move to a different state or country.

Transfer Your Utilities: Contact your utility providers (e.g., electricity, gas, water) to transfer your services to your new address or to cancel them if you’re moving out of your current residence.

Change in Marital Status

Inform Your Employer: If you have benefits through your employer, such as health insurance, you may need to update your marital status to ensure you’re eligible for the correct coverage.

Update Your Will: A change in marital status may impact your estate planning. Consider updating your will or seeking legal advice to ensure your wishes are reflected accurately.

Employment Status

Notify the Tax Office: If you start a new job or become self-employed, you will need to inform the tax office to ensure your tax obligations are met. This may involve registering for a new tax file number or updating your existing details.

Apply for Benefits: If you become unemployed, you may be eligible for benefits such as unemployment insurance or jobseeker’s allowance. Make sure you understand the application process and provide all the necessary information to receive these benefits.

Tips for a Smooth Reporting Process

To make the process of reporting a change of circumstances as seamless as possible, consider the following tips:

Plan Ahead: If you know a change is coming, such as a planned move or a new job start date, start gathering the necessary documentation and information well in advance. This will save you time and stress when it’s time to report the change.

Use Online Services: Many organizations now offer online reporting and application processes. Take advantage of these services to save time and avoid the need for in-person visits.

Keep a Calendar: Mark important dates, such as when you need to report the change, when forms are due, and when you expect a response from the authorities. This will help you stay organized and ensure you meet all the necessary deadlines.

Seek Help if Needed: If you’re unsure about the reporting process or have difficulty understanding the requirements, don’t hesitate to seek help. You can contact the relevant organizations for guidance or consider seeking assistance from a trusted advisor or legal professional.

Case Study: Reporting a Change of Address

Let’s look at an example to better understand the process of reporting a change of circumstances. Imagine you’re moving from one city to another within the same country. Here’s a step-by-step breakdown of what you might need to do:

Notify the Post Office: Fill out a change of address form with the post office to ensure your mail is forwarded to your new address.

Update Your Driver’s License: Contact the relevant authority to update your driver’s license with your new address. This may involve providing proof of your new residence, such as a utility bill or a lease agreement.

Transfer Your Utilities: Contact your electricity, gas, and water providers to transfer your services to your new address. You may need to provide your new account details and set up a payment method.

Inform Government Agencies: Depending on your situation, you may need to notify various government agencies, such as the tax office, the social security office, and the electoral commission. Each agency may have its own process for reporting a change of address, so be sure to follow their guidelines.

Update Your Bank and Other Financial Institutions: Inform your bank and any other financial institutions you use, such as credit card companies or loan providers, of your new address. This ensures that important documents and statements are sent to the correct location.

Keep Records: Throughout the process, keep a record of all the organizations you’ve contacted, the dates of your communications, and any reference numbers provided. This will be useful for future reference and can help you track the progress of your change of address notifications.

Reporting Changes: A Summary

Reporting a change of circumstances is an important responsibility that ensures your personal and financial records remain accurate and up-to-date. By understanding the common changes that need to be reported and following the step-by-step guide provided, you can navigate the process with confidence. Remember to identify the relevant authorities, gather the necessary documentation, and follow up on your case to ensure a smooth transition.

Stay organized, plan ahead, and don’t hesitate to seek help if needed. By taking these steps, you can ensure that your change of circumstances is reported accurately and efficiently, allowing you to focus on the more important aspects of your life.

FAQ

How long does it usually take to process a change of circumstances report?

+

The processing time can vary depending on the organization and the complexity of the change. Some changes may be processed within a few days, while others may take several weeks. It’s important to allow sufficient time and to follow up if you haven’t received a response within a reasonable timeframe.

Can I report a change of circumstances online?

+

Yes, many organizations now offer online reporting and application processes. Check the website of the relevant authority to see if you can report your change of circumstances online. This can often be a faster and more convenient option.

What happens if I don’t report a change of circumstances?

+Failing to report a change of circumstances can lead to a range of issues, including overpayments, underpayments, and legal consequences. It’s important to report changes promptly to avoid any potential penalties and to ensure you receive the correct entitlements and services.

Are there any fees associated with reporting a change of circumstances?

+In most cases, there are no fees associated with reporting a change of circumstances. However, there may be fees for specific services or applications, such as updating your driver’s license or applying for certain benefits. It’s best to check with the relevant organization to understand any potential costs.

Can I report multiple changes at once, or should I do them separately?

+It’s generally recommended to report changes separately, especially if they involve different organizations or have different reporting processes. This ensures that each change is properly documented and processed. However, if the changes are related and involve the same organization, you may be able to report them together.