Request Council Tax Bill

When it comes to managing your finances and understanding your financial obligations, one crucial aspect is navigating the world of council tax. Council tax is a local tax levied by local authorities in the United Kingdom to fund various public services. If you're a homeowner or a tenant, it's essential to know how to request your council tax bill and understand the process involved.

Understanding Council Tax

Council tax is a mandatory payment for individuals who own or rent a property in the UK. It contributes to the funding of local services such as education, social care, waste management, and more. The amount of council tax you pay depends on factors like the value of your property, the number of occupants, and any applicable discounts or exemptions.

Why Request Your Council Tax Bill?

There are several reasons why you might need to request your council tax bill. Perhaps you’re a new homeowner or tenant, and you want to ensure you have all the necessary information about your financial obligations. Maybe you’ve recently moved and need to update your details with the local authority. Requesting your council tax bill allows you to:

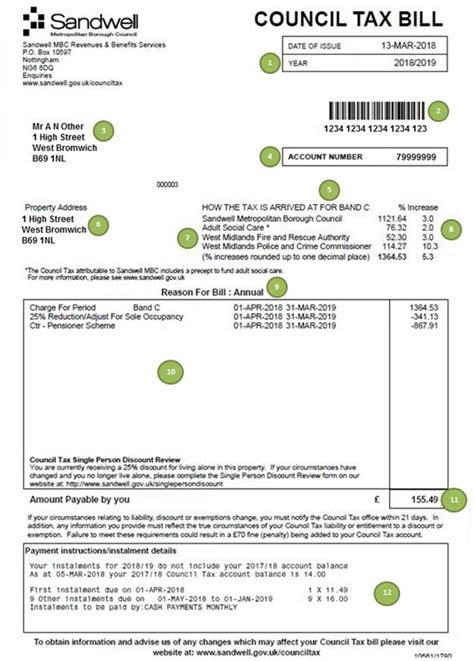

- Understand your payment schedule and due dates.

- Verify the accuracy of your council tax band and valuation.

- Check for any applicable discounts or exemptions you may be eligible for.

- Address any discrepancies or errors in your bill promptly.

Step-by-Step Guide to Requesting Your Council Tax Bill

Requesting your council tax bill is a straightforward process, and most local authorities provide multiple options for you to do so. Here’s a step-by-step guide to help you navigate the process:

-

Contact Your Local Authority

The first step is to identify and contact your local authority. You can usually find their contact details on their official website or by searching for their name followed by “council tax” on a search engine. Make a note of their contact information, including phone numbers, email addresses, and postal addresses.

-

Choose Your Preferred Method of Contact

Most local authorities offer various methods to request your council tax bill. You can choose the one that suits you best:

- Online Request: Many councils provide an online form on their website where you can submit your details and request your bill. This method is convenient and often the fastest way to receive your bill.

- Email: If you prefer a more direct approach, you can send an email to the council’s council tax department. Include your name, address, and any relevant details in the email.

- Phone Call: Calling the council’s customer service line is another option. Be prepared to provide your personal information and answer a few questions to verify your identity.

- Postal Request: You can also send a letter to the council’s address, requesting your council tax bill. Ensure you include all necessary details and a self-addressed envelope for their response.

-

Provide Necessary Information

Regardless of the method you choose, you’ll need to provide certain information to request your council tax bill. This typically includes:

- Your full name.

- The address of the property for which you want the bill.

- Your contact details (phone number and email address).

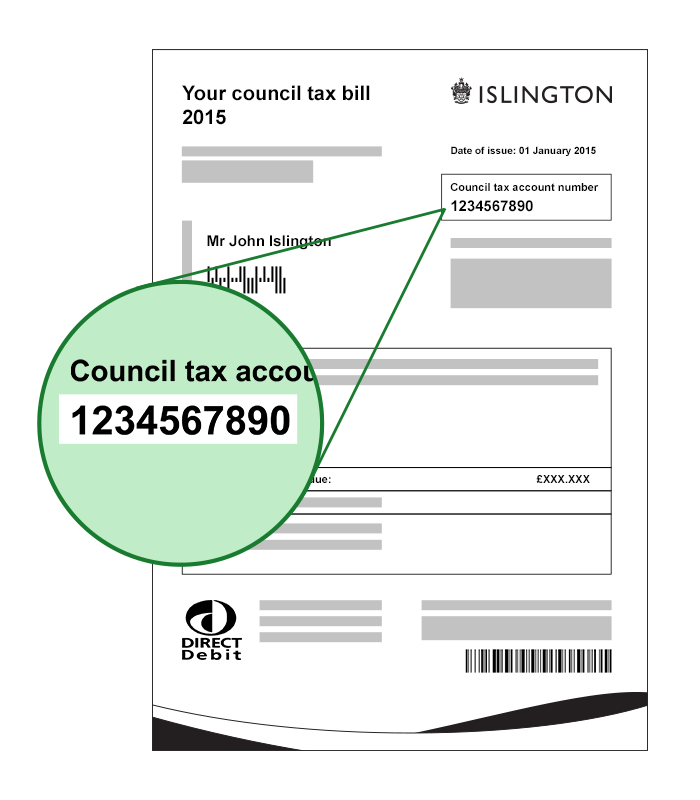

- Any relevant account or reference numbers (if you have them).

-

Wait for the Response

Once you’ve submitted your request, it’s a matter of waiting for the council to process it. The time it takes to receive your bill may vary depending on the council and the method you chose. Online requests and emails are usually processed faster, while postal requests may take a bit longer.

-

Review and Understand Your Bill

When you receive your council tax bill, take the time to review it carefully. Ensure that all the information is accurate, including your name, address, and the valuation of your property. Pay attention to the payment schedule, due dates, and any discounts or exemptions applied.

-

Take Action if Needed

If you notice any errors or discrepancies in your bill, it’s essential to contact the council promptly. They will guide you through the process of correcting any mistakes and ensure you’re paying the correct amount.

Tips for Managing Your Council Tax

Here are some additional tips to help you manage your council tax effectively:

- Set up a direct debit with your local authority to ensure timely payments and avoid late fees.

- Keep track of your payment schedule and due dates to avoid any missed payments.

- If you’re eligible for discounts or exemptions, ensure you apply for them to reduce your council tax liability.

- Stay informed about any changes in council tax rates or policies to plan your finances accordingly.

- Consider seeking advice from financial experts or tax professionals if you have complex financial circumstances.

Conclusion

Requesting your council tax bill is an essential step in understanding and managing your financial obligations as a homeowner or tenant in the UK. By following the simple steps outlined above, you can ensure you have all the necessary information to make informed decisions about your council tax payments. Remember, staying organized and proactive can help you avoid any unexpected financial surprises and ensure a smooth process.

How often do I need to request my council tax bill?

+

You typically only need to request your council tax bill once when you move into a new property or if you notice any changes in your circumstances that may affect your bill. The council will send you an updated bill automatically if there are any changes to your council tax band or valuation.

Can I request my council tax bill online?

+

Yes, most local authorities provide an online form on their website where you can request your council tax bill. This is often the fastest and most convenient method.

What if I don’t agree with the valuation of my property on the council tax bill?

+

If you believe the valuation of your property is incorrect, you can challenge it by contacting the council’s valuation office. They will guide you through the process of appealing the valuation and provide information on the steps you need to take.

Are there any discounts or exemptions available for council tax?

+

Yes, there are various discounts and exemptions available for council tax. These include discounts for single-occupancy households, students, people with disabilities, and more. Check with your local authority to see if you’re eligible for any of these benefits.

What happens if I don’t pay my council tax on time?

+If you fail to pay your council tax on time, you may be charged late payment fees and interest. In extreme cases, the council may take legal action to recover the outstanding amount. It’s important to stay on top of your payments to avoid any penalties.