Road Tax Gov Uk

The process of paying road tax in the United Kingdom, also known as Vehicle Excise Duty (VED), is an essential aspect of vehicle ownership. It is a legal requirement for all vehicles used on public roads to be properly taxed, and understanding the steps involved can ensure a smooth and hassle-free experience. In this comprehensive guide, we will walk you through the entire process of paying road tax, from gathering the necessary documents to making the payment and keeping your vehicle legally compliant.

Understanding Road Tax and Vehicle Excise Duty

Road tax, or VED, is an annual fee that vehicle owners must pay to the Driver and Vehicle Licensing Agency (DVLA) in the UK. It contributes to the maintenance and improvement of the country's road infrastructure. The amount of road tax you need to pay depends on various factors, including the type of vehicle, its fuel type, and its carbon dioxide (CO2) emissions.

The revenue generated from road tax is used to fund essential road projects, repair and maintenance, and improve road safety measures. By paying road tax, vehicle owners contribute to the overall development and sustainability of the transportation network in the UK.

Gathering the Required Documents

Before you begin the road tax payment process, it is crucial to have the following documents ready:

- Vehicle Registration Document (V5C): This is the official document that provides information about your vehicle, including its make, model, and registration details. It is essential to have the V5C to prove your vehicle's ownership and ensure accurate taxation.

- Proof of Identity: You will need valid identification documents, such as a driving license or passport, to verify your identity during the payment process.

- Payment Method: Choose a convenient payment method, such as a debit or credit card, to complete the road tax payment. Ensure that your card has sufficient funds to cover the tax amount.

Additionally, it is recommended to have your vehicle's logbook (V5C) and any relevant insurance documents readily available. These documents will provide important details about your vehicle and help streamline the payment process.

Checking Your Vehicle's Road Tax Status

Before making a road tax payment, it is advisable to check the current status of your vehicle's tax. This step ensures that you are not overpaying or paying for a period that has already been covered. You can check your vehicle's road tax status by visiting the DVLA website or using their online services.

On the DVLA website, you will find a dedicated section for checking vehicle tax. You can enter your vehicle's registration number and other required details to retrieve information about the tax due date, the amount owed, and any other relevant details.

By checking your vehicle's tax status, you can avoid unnecessary payments and ensure that you are only paying for the required period. This step also helps identify any potential issues or discrepancies with your vehicle's taxation, allowing you to address them promptly.

Calculating the Road Tax Amount

The amount of road tax you need to pay is determined by several factors. The DVLA has a comprehensive online tool that calculates the VED based on your vehicle's specifications. Here are the key factors considered in the road tax calculation:

- Vehicle Type: Different vehicle categories, such as cars, motorcycles, and heavy goods vehicles, have different tax rates.

- Fuel Type: The fuel used by your vehicle, whether it is petrol, diesel, electric, or hybrid, impacts the tax amount.

- CO2 Emissions: The level of carbon dioxide emissions your vehicle produces is a significant factor in determining the road tax. Vehicles with lower emissions are often eligible for reduced tax rates.

- Vehicle Age: Older vehicles may have different tax rates compared to newer models. The age of your vehicle can impact the overall cost of road tax.

The DVLA's online calculator takes into account these factors and provides an accurate estimate of the road tax amount you need to pay. It is essential to use this tool to ensure you are aware of the correct tax rate for your vehicle.

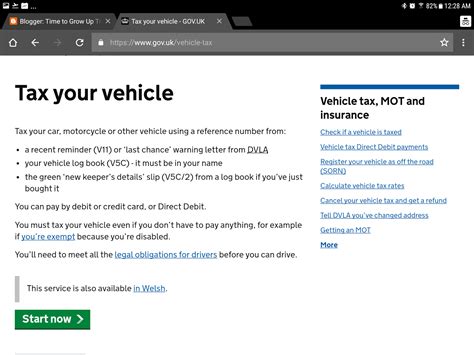

Making the Road Tax Payment

Once you have gathered the necessary documents and calculated the road tax amount, it is time to make the payment. The DVLA offers several convenient payment methods to suit your preferences:

- Online Payment: The most common and efficient way to pay road tax is through the DVLA's official website. You can make the payment using a debit or credit card. The online payment process is secure and allows you to complete the transaction quickly.

- Telephone Payment: If you prefer not to use online services, you can make a road tax payment over the phone. The DVLA provides a dedicated telephone number for this purpose. You will need to have your vehicle details and payment information ready when calling.

- Post Office Payment: In some cases, you may choose to pay your road tax at a local Post Office. This option is particularly useful if you prefer a more traditional payment method or have difficulty accessing online services. The Post Office will guide you through the payment process and provide the necessary receipts.

Regardless of the payment method you choose, ensure that you have the correct vehicle details and payment information ready. This will help expedite the process and avoid any delays in taxing your vehicle.

Receiving Your Road Tax Disc or Certificate

After making a successful road tax payment, you will receive a confirmation of the transaction. This confirmation serves as proof that your vehicle is legally taxed and can be used on public roads.

The DVLA has phased out the traditional road tax disc, which was previously displayed on the windscreen of vehicles. Instead, they now issue a Certificate of Motor Insurance, which provides evidence of your vehicle's tax status. This certificate is typically sent to you by post within a few days of making the payment.

It is essential to keep this certificate in a safe place and carry it with you whenever you are driving your vehicle. In the event of a police check or an accident, you will need to present this certificate as proof of your vehicle's tax compliance.

Renewing Your Road Tax

Road tax is typically valid for a specific period, usually 6 or 12 months. It is crucial to renew your road tax before the current tax period expires to avoid any legal consequences or penalties.

The DVLA will send you a reminder notification before your road tax expires. This reminder will provide important information about the upcoming renewal, including the due date and the amount owed. It is essential to keep an eye out for these reminders and act promptly to avoid any lapses in your vehicle's taxation.

The renewal process is similar to the initial road tax payment. You can choose to renew your road tax online, over the phone, or at a Post Office. Ensure that you have the necessary documents, such as your vehicle registration details and payment method, ready for a smooth renewal process.

What to Do If You Sell or Transfer Your Vehicle

If you decide to sell or transfer ownership of your vehicle, it is important to understand the implications for road tax. When you sell a vehicle, the new owner becomes responsible for paying the road tax. However, you must ensure that you cancel the existing road tax to avoid any further charges.

To cancel your road tax, you will need to inform the DVLA about the change in ownership. You can do this by completing an online form or contacting them directly. The DVLA will then issue a refund for the remaining period of the road tax, which will be paid to the new owner.

It is crucial to keep a record of the cancellation and provide it to the new owner. This documentation will serve as proof that the road tax has been transferred and that the new owner is responsible for any future payments.

Keeping Your Vehicle Tax-Compliant

Maintaining your vehicle's tax compliance is essential to avoid legal issues and penalties. Here are some key points to remember to ensure your vehicle remains tax-compliant:

- Regularly check your vehicle's tax status and ensure it is up-to-date.

- Keep your Certificate of Motor Insurance with you at all times when driving.

- Renew your road tax before the current tax period expires.

- Inform the DVLA about any changes in ownership or vehicle details promptly.

- Report any changes in your personal information, such as address or contact details, to the DVLA.

By staying informed and proactive about your vehicle's tax status, you can avoid unnecessary complications and ensure a smooth driving experience.

Conclusion

Paying road tax in the UK is a straightforward process when you have the right information and documentation. By understanding the requirements, calculating the correct tax amount, and choosing a convenient payment method, you can ensure that your vehicle is legally taxed and ready for the roads. Remember to keep your tax-related documents and certificates safe and up-to-date to avoid any potential issues.

With the DVLA's user-friendly online services and various payment options, paying road tax has become more accessible and efficient. By following the steps outlined in this guide, you can navigate the road tax process with ease and contribute to the development and maintenance of the UK's road infrastructure.

What happens if I don’t pay my road tax on time?

+

Failing to pay your road tax on time can result in penalties and legal consequences. You may receive a fine, and your vehicle could be subject to enforcement action, including the possibility of being clamped or even seized by the authorities. It is important to ensure timely payment to avoid these issues.

Can I pay road tax for a vehicle that is not currently in use?

+

Yes, you can pay road tax for a vehicle that is not currently in use. This is known as a “Statutory Off-Road Notification” (SORN). By declaring your vehicle as SORN, you can avoid paying road tax while it is off the road. However, you must ensure that the vehicle is not used on public roads during this period.

How often do I need to renew my road tax?

+

The frequency of road tax renewal depends on the period for which you initially paid. If you paid for a 6-month period, you will need to renew your road tax every 6 months. For a 12-month period, you will renew it annually. It is important to keep track of the renewal dates to avoid any lapses in your vehicle’s taxation.

Can I get a refund if I sell my vehicle before the road tax expires?

+

Yes, you can apply for a refund if you sell your vehicle before the road tax expires. You will need to inform the DVLA about the change in ownership and provide them with the necessary details. The DVLA will then process the refund, which will be paid to the new owner.

What if I have multiple vehicles? Do I need to pay road tax for all of them?

+

Yes, if you own multiple vehicles, you are required to pay road tax for each of them. The road tax is vehicle-specific, and each vehicle must have valid taxation to be legally driven on public roads. Ensure that you keep track of the tax status for all your vehicles to avoid any non-compliance issues.