Sutton Council Tax

Sutton Council Tax is a vital component of the local government's revenue, playing a crucial role in funding essential services and infrastructure within the borough. Understanding how it works and what it covers is essential for residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of Sutton Council Tax, exploring its structure, calculation methods, and the services it supports. By the end of this article, you will have a clear understanding of your council tax obligations and the impact it has on your community.

Understanding Sutton Council Tax

Council Tax is a local taxation system implemented across England, Scotland, and Wales. It is a property-based tax, meaning it is levied on residential properties based on their value and certain other factors. Sutton, a borough in South London, utilizes this system to generate revenue for the local council, which, in turn, provides various services to its residents.

The primary purpose of Sutton Council Tax is to finance a wide range of public services and amenities, ensuring the smooth functioning and development of the borough. These services include but are not limited to:

- Local policing and crime prevention.

- Waste management and recycling initiatives.

- Maintenance of parks, open spaces, and recreational facilities.

- Funding for education, including schools and adult learning programs.

- Social care services for vulnerable individuals.

- Road maintenance and transportation infrastructure.

- Cultural and leisure activities.

- Environmental protection and sustainability projects.

By contributing to Sutton Council Tax, residents actively participate in the decision-making process regarding the allocation of resources, ensuring that their needs and priorities are addressed effectively.

How is Sutton Council Tax Calculated?

The calculation of Sutton Council Tax involves several factors, including the property's valuation band, the number of occupants, and any applicable discounts or exemptions. Here's a breakdown of the key elements:

Valuation Bands

Sutton, like other local authorities, assigns properties to specific valuation bands based on their open-market capital value as of 1st April 1991. These bands are as follows:

| Valuation Band | Capital Value Range |

|---|---|

| Band A | Up to £40,000 |

| Band B | £40,001 - £52,000 |

| Band C | £52,001 - £68,000 |

| Band D | £68,001 - £88,000 |

| Band E | £88,001 - £120,000 |

| Band F | £120,001 - £160,000 |

| Band G | £160,001 - £320,000 |

| Band H | Over £320,000 |

The higher the valuation band, the higher the Council Tax liability.

Number of Occupants

The number of people living in a property can also impact the Council Tax bill. Properties with a single occupant may be eligible for a 25% discount, while those with two or more occupants are charged the full amount.

Discounts and Exemptions

Sutton Council offers various discounts and exemptions to certain individuals or properties. These include:

- Discounts for students, full-time further education students, and apprentices.

- Exemptions for empty properties (up to a maximum period of six months) or those undergoing major structural repairs.

- Discounts for residents receiving certain benefits or facing financial hardship.

- Exemptions for care homes, hostels, and other specific property types.

It's important to note that eligibility criteria and conditions may vary, so it's advisable to check with the council for the most accurate and up-to-date information.

Paying Sutton Council Tax

Sutton Council provides flexible payment options to accommodate residents' financial situations. These options include:

- Direct Debit: A convenient and secure method to pay Council Tax in regular installments.

- Online Payments: Residents can make secure payments using their debit or credit card via the council's website.

- Phone Payments: Payment can be made over the phone using a debit or credit card.

- Postal Payments: Residents can send a cheque or postal order to the council's address.

- In-Person Payments: Payments can be made at designated council offices or local PayPoint locations.

It's crucial to ensure that payments are made on time to avoid penalties and additional charges. Late payments may result in a reminder notice, followed by a formal demand if the outstanding amount remains unpaid.

Challenging Your Council Tax Band

If you believe your property has been incorrectly valued or placed in the wrong valuation band, you have the right to challenge it. The process involves submitting an appeal to the Valuation Office Agency (VOA), which is responsible for assessing and maintaining property values for Council Tax purposes.

To initiate an appeal, you must first contact the VOA and provide evidence supporting your claim. This may include recent sales of similar properties, expert valuations, or any other relevant information. The VOA will carefully review your case and make a decision, which can be further appealed if necessary.

🌟 Note: Challenging your Council Tax band can be a complex process, and it's advisable to seek professional advice or assistance to increase your chances of a successful outcome.

Services Funded by Sutton Council Tax

The revenue generated from Sutton Council Tax supports a wide array of vital services and initiatives within the borough. Here's an overview of some key areas where your Council Tax contributions make a difference:

Local Policing and Crime Prevention

Council Tax funds contribute to local policing efforts, ensuring a safer community for all residents. This includes funding for police officers, community support officers, and various crime prevention programs.

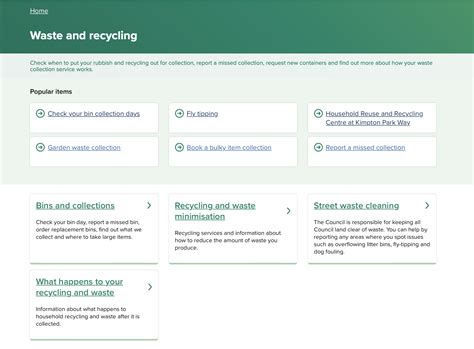

Waste Management and Recycling

Effective waste management and recycling initiatives are crucial for maintaining a clean and sustainable environment. Council Tax funds help finance the collection, disposal, and recycling of waste, promoting a greener and healthier borough.

Parks and Open Spaces

Sutton's parks and open spaces provide residents with recreational opportunities and contribute to the overall well-being of the community. Council Tax revenue supports the maintenance and improvement of these areas, ensuring they remain accessible and enjoyable for all.

Education and Learning

Education is a top priority for Sutton Council, and Council Tax funds play a significant role in funding local schools, early years education, and adult learning programs. This investment helps nurture the next generation and provides lifelong learning opportunities for residents.

Social Care Services

Council Tax contributions also extend to social care services, supporting vulnerable individuals and families within the community. These services include home care, respite care, and assistance for those with disabilities or complex needs.

Transport and Infrastructure

A well-maintained transportation network is essential for the smooth flow of traffic and the overall development of the borough. Council Tax funds contribute to road maintenance, public transport improvements, and infrastructure projects, enhancing connectivity and accessibility.

Cultural and Leisure Activities

Sutton Council Tax supports cultural and leisure activities, promoting a vibrant and engaging community. This includes funding for local arts initiatives, libraries, sports facilities, and community events, enriching the lives of residents and fostering a sense of belonging.

Environmental Protection

Council Tax funds play a crucial role in environmental protection and sustainability projects. These initiatives aim to reduce the borough's carbon footprint, promote energy efficiency, and preserve natural habitats, ensuring a greener and more sustainable future for Sutton.

Conclusion: Your Impact on Sutton's Future

Sutton Council Tax is not just a financial obligation; it is an investment in the future of your community. By understanding how Council Tax works and the services it supports, you can actively participate in shaping the borough's development and ensuring a high quality of life for all residents. Whether it's through paying your Council Tax on time, exploring discounts and exemptions, or challenging your valuation band, your actions have a direct impact on the services and initiatives that make Sutton a desirable place to live, work, and thrive.

What happens if I don’t pay my Sutton Council Tax on time?

+Failure to pay your Council Tax on time may result in a reminder notice, followed by a formal demand. If the outstanding amount remains unpaid, the council has the authority to take legal action, which could lead to court proceedings and potential enforcement measures.

Are there any discounts available for Council Tax in Sutton?

+Yes, Sutton Council offers various discounts, including a 25% discount for single-occupant properties, discounts for students and full-time further education students, and exemptions for empty properties undergoing major repairs. It’s advisable to check with the council for the latest information on eligibility criteria.

How can I challenge my Council Tax band in Sutton?

+To challenge your Council Tax band, you must contact the Valuation Office Agency (VOA) and provide evidence supporting your claim. This may include recent sales of similar properties, expert valuations, or other relevant information. The VOA will review your case and make a decision, which can be further appealed if necessary.

What happens if I’m struggling to pay my Council Tax in Sutton?

+If you’re facing financial difficulties, Sutton Council may be able to offer support. Contact the council to discuss your situation and explore potential options, such as payment plans, discounts, or exemptions. It’s important to communicate your circumstances to avoid penalties and additional charges.

How can I stay updated on Council Tax changes and initiatives in Sutton?

+Sutton Council provides regular updates and information on its website. You can also sign up for email alerts or follow the council’s social media channels to stay informed about Council Tax changes, payment options, and initiatives that impact your community.