Tax At Work

The world of taxes can be a complex and often daunting one, but understanding its intricacies is crucial for both individuals and businesses. In this blog post, we delve into the realm of tax, exploring its various aspects and providing valuable insights to help you navigate this essential financial obligation.

Understanding the Basics of Taxation

Taxation is a fundamental concept in any functioning economy, serving as a primary source of revenue for governments. It is a mandatory contribution made by individuals and businesses to fund public expenditures, such as infrastructure development, social services, and national defense.

The tax system is designed to be progressive, meaning that higher-income earners typically pay a larger proportion of their income in taxes. This approach aims to ensure fairness and maintain a balanced distribution of resources within society.

Types of Taxes

There are several types of taxes, each serving a specific purpose and applicable to different entities:

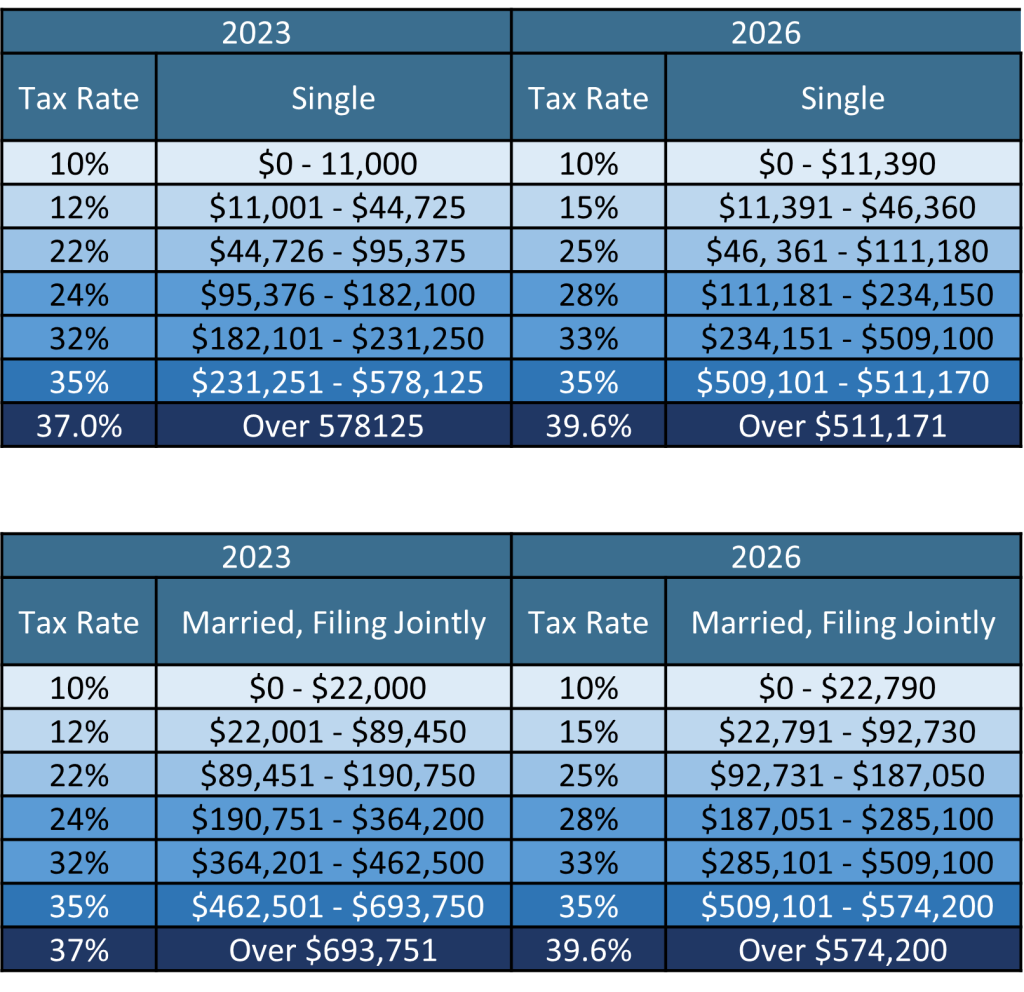

- Income Tax: This is perhaps the most well-known tax, levied on an individual's or business's income. It is a key source of revenue for governments and is typically calculated based on a progressive tax rate structure.

- Sales Tax: Applied to the sale of goods and services, sales tax is an indirect tax collected by businesses and remitted to the government. It is often used to fund specific projects or initiatives.

- Property Tax: Property owners are subject to this tax, which is based on the value of their real estate holdings. Property tax is commonly used to finance local government operations and public services.

- Corporate Tax: Businesses, particularly corporations, are subject to corporate tax on their profits. This tax contributes to the overall revenue of a country and helps fund various government programs.

- Capital Gains Tax: When individuals or businesses sell assets, such as stocks or property, they may incur capital gains tax on the profits made from these transactions.

The Role of Tax in Society

Taxation plays a vital role in shaping the economic landscape and ensuring the smooth functioning of society. Here are some key aspects of its significance:

Revenue Generation

Taxes are the primary means by which governments raise revenue to fund essential services and infrastructure. This revenue is crucial for maintaining public order, providing education and healthcare, and supporting social welfare programs.

Redistribution of Wealth

The progressive nature of tax systems aims to redistribute wealth more equitably. By taxing higher-income earners at a higher rate, governments can address income inequality and provide support to those in need.

Economic Stability

A well-designed tax system can contribute to economic stability by encouraging investment, promoting business growth, and preventing excessive concentration of wealth. It helps maintain a balanced economy and reduces the risk of economic downturns.

Navigating the Tax System

For individuals and businesses, understanding and complying with tax regulations can be a complex task. Here are some key considerations to keep in mind:

Tax Planning

Effective tax planning involves optimizing your financial strategies to minimize your tax liability while remaining compliant with the law. This may include utilizing tax-efficient investment vehicles, taking advantage of deductions and credits, and structuring your business to maximize tax benefits.

Record Keeping

Maintaining accurate and organized financial records is essential for tax purposes. Proper record-keeping ensures that you have the necessary documentation to support your tax returns and helps prevent potential audits or penalties.

Seeking Professional Advice

The tax landscape can be intricate, and staying up-to-date with changing regulations can be challenging. Consider seeking advice from tax professionals, such as accountants or tax advisors, who can provide expert guidance tailored to your specific circumstances.

International Tax Considerations

In an increasingly globalized world, understanding international tax regulations is crucial for businesses operating across borders. Here are some key aspects to consider:

Transfer Pricing

Transfer pricing refers to the pricing of goods and services between related parties, such as parent and subsidiary companies. It is essential to set transfer prices at arm's length to avoid tax implications and ensure compliance with international tax laws.

Double Taxation Agreements

To prevent double taxation, many countries have entered into double taxation agreements (DTAs) with other nations. These agreements outline the rules for taxing income earned in one country by residents of another, ensuring that individuals and businesses are not taxed twice on the same income.

Withholding Taxes

When making payments to non-residents, such as for goods or services, withholding taxes may be applicable. These taxes are deducted at the source and remitted to the appropriate tax authority. Understanding the withholding tax requirements in different jurisdictions is crucial for international businesses.

Conclusion

Taxation is a complex but essential aspect of our economic system. By understanding the basics, recognizing the role of tax in society, and navigating the system effectively, individuals and businesses can ensure compliance and make the most of the opportunities presented by the tax landscape. Remember, seeking professional advice and staying informed about tax regulations is key to successful tax management.

What is the difference between income tax and sales tax?

+Income tax is levied on an individual’s or business’s income, while sales tax is applied to the sale of goods and services. Income tax is typically calculated based on a progressive rate structure, whereas sales tax is a flat rate applied to the purchase price.

How can I minimize my tax liability?

+Minimizing tax liability involves effective tax planning, which may include utilizing tax-efficient investment strategies, claiming deductions and credits, and structuring your business to take advantage of tax benefits. Consulting with a tax professional can provide tailored advice to your specific situation.

What are the consequences of non-compliance with tax regulations?

+Non-compliance with tax regulations can result in significant penalties, interest charges, and even legal consequences. It is crucial to maintain accurate records, file tax returns on time, and seek professional advice to ensure compliance and avoid potential issues.

How do I stay updated with changing tax laws and regulations?

+Staying informed about tax laws and regulations can be challenging due to frequent changes. Subscribing to tax-related newsletters, following reputable tax blogs, and consulting with tax professionals can help you stay up-to-date and ensure compliance with the latest regulations.

What is the purpose of double taxation agreements (DTAs)?

+Double taxation agreements (DTAs) are treaties between countries to prevent the double taxation of income earned in one country by residents of another. These agreements outline the rules for taxing cross-border income, ensuring that individuals and businesses are not taxed twice on the same income.