Tax Online Account

Managing your taxes can be a daunting task, especially when it comes to keeping track of various accounts and ensuring compliance with the law. One efficient way to streamline this process is by utilizing online tax accounts. These digital platforms offer a range of benefits, from simplified record-keeping to convenient access to tax-related information. In this comprehensive guide, we will explore the advantages of online tax accounts, how to choose the right one for your needs, and provide a step-by-step tutorial on setting up and managing your account effectively.

Benefits of Online Tax Accounts

Online tax accounts have revolutionized the way individuals and businesses handle their tax obligations. Here are some key advantages that make them an attractive choice:

- Convenience and Accessibility: Online tax accounts provide 24/7 access to your tax information from any device with an internet connection. This level of convenience allows you to manage your taxes whenever and wherever it suits you.

- Streamlined Record-Keeping: These platforms offer a centralized location to store and organize all your tax-related documents, receipts, and records. Say goodbye to cluttered filing cabinets and hello to a digital, easily searchable archive.

- Real-Time Updates: With online tax accounts, you can stay up-to-date with the latest tax laws and regulations. Many platforms offer notifications and alerts to keep you informed about any changes that may impact your tax situation.

- Efficient Tax Preparation: The intuitive interfaces of online tax accounts guide you through the tax preparation process step by step. This simplifies the often complex task of filing taxes, making it more accessible for individuals and small businesses.

- Cost-Effectiveness: Online tax accounts are generally more affordable than traditional tax preparation methods, especially for those who prepare their own taxes. Some platforms even offer free basic services, making tax management accessible to a wider range of users.

Choosing the Right Online Tax Account

With numerous options available, selecting the right online tax account for your needs can be a challenging task. Here are some key factors to consider when making your choice:

- User-Friendliness: Opt for a platform with an intuitive and easy-to-navigate interface. The last thing you want is to be overwhelmed by a complex system during tax season.

- Features and Functionality: Assess your specific tax needs and choose a platform that offers the features you require. Look for options like expense tracking, tax deduction calculators, and integration with other financial software.

- Security and Privacy: Ensure that the online tax account you choose prioritizes data security and privacy. Check for encryption protocols, two-factor authentication, and regular security audits to protect your sensitive tax information.

- Support and Customer Service: Consider the availability and quality of customer support. Look for platforms that offer multiple contact options, such as live chat, email, and phone support, to assist you with any issues or queries you may have.

- Cost and Pricing Plans: Evaluate the pricing structure of different online tax accounts. Some offer flat-rate pricing, while others charge based on the complexity of your tax situation. Choose a plan that aligns with your budget and tax needs.

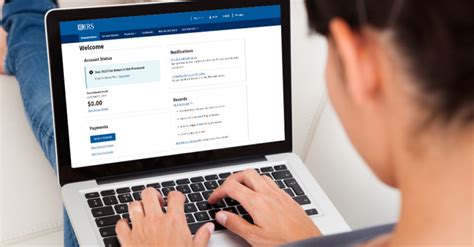

Setting Up and Managing Your Online Tax Account

Now that you've chosen the right online tax account, it's time to set it up and start managing your taxes effectively. Follow these step-by-step instructions to get started:

-

Sign Up and Create an Account:

- Visit the website of your chosen online tax account provider.

- Locate the "Sign Up" or "Create Account" button and click on it.

- Provide the required information, such as your name, email address, and a secure password.

- Verify your email address by clicking on the confirmation link sent to your inbox.

-

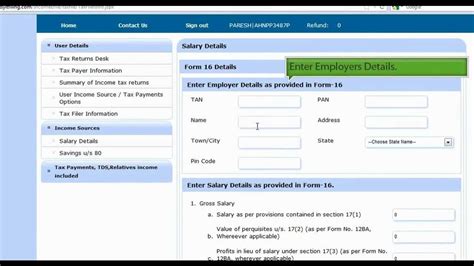

Personalize Your Profile:

- Log in to your newly created account.

- Access the profile settings or personal information section.

- Update your personal details, including your full name, address, and contact information.

- Ensure that all information is accurate and up-to-date.

-

Connect Your Financial Accounts:

- Locate the "Connect Accounts" or "Add Accounts" option in your online tax account.

- Follow the prompts to link your bank accounts, credit cards, and other financial institutions.

- This step ensures that your online tax account has access to your financial data for accurate tax reporting.

-

Import Tax Documents:

- Upload or scan your tax-related documents, such as W-2 forms, 1099s, and receipts.

- Organize these documents into appropriate categories or folders for easy retrieval.

- Some online tax accounts offer the option to take photos of physical documents using your smartphone, simplifying the import process.

-

Set Up Automated Expense Tracking:

- If your online tax account offers expense tracking, take advantage of this feature.

- Link your financial accounts to automatically categorize and track expenses relevant to your taxes.

- This helps you identify deductions and ensure accurate reporting.

-

Review and Analyze Your Tax Information:

- Utilize the analytics and reporting tools provided by your online tax account.

- Review your tax situation, identify potential deductions, and make informed decisions regarding your tax strategy.

- Some platforms offer insights and suggestions to optimize your tax position.

-

Prepare and File Your Taxes:

- Follow the step-by-step instructions provided by your online tax account to prepare and file your taxes.

- Double-check all information for accuracy before submitting.

- Take advantage of any tax-saving opportunities identified by the platform.

-

Stay Informed and Updated:

- Regularly check your online tax account for updates and notifications.

- Stay informed about any changes in tax laws or regulations that may impact your situation.

- Keep your profile and financial information up-to-date to ensure accurate tax reporting.

Advanced Features and Tips

To get the most out of your online tax account, consider these advanced features and tips:

- Tax Deduction Maximization: Explore the tax deduction tools and calculators offered by your online tax account. These features can help you identify and maximize deductions, resulting in potential tax savings.

- Tax Planning and Strategy: Use the insights and reports generated by your online tax account to plan your tax strategy for the upcoming year. This proactive approach can help you make informed financial decisions.

- Collaborative Features: If you work with a tax professional or have a business partner, look for online tax accounts that offer collaborative features. These allow multiple users to access and work on the same account, streamlining the tax preparation process.

- Regularly Review and Update Your Profile: Keep your online tax account profile current by updating any changes in your personal or financial situation. This ensures that your tax calculations and recommendations remain accurate.

Common Challenges and How to Overcome Them

While online tax accounts offer numerous benefits, you may encounter some common challenges. Here's how to tackle them:

- Data Security Concerns:

- Choose an online tax account provider that prioritizes data security. Look for encryption protocols, two-factor authentication, and regular security audits.

- Regularly update your password and avoid sharing your login credentials with others.

- Complex Tax Situations:

- If your tax situation is complex, consider seeking the assistance of a tax professional. They can provide expert guidance and ensure accurate tax preparation.

- Some online tax accounts offer advanced features and support for complex tax scenarios, so choose a platform that aligns with your needs.

- Technical Issues:

- In case of technical difficulties, reach out to the customer support team of your online tax account provider.

- They can assist with troubleshooting and ensure a smooth experience.

Conclusion

Online tax accounts have transformed the way we manage our taxes, offering convenience, accessibility, and efficient record-keeping. By choosing the right platform, setting up your account effectively, and utilizing advanced features, you can streamline your tax obligations and potentially save time and money. Remember to stay informed about tax laws, keep your profile updated, and seek professional assistance when needed. With the right online tax account, you can navigate the tax landscape with confidence and ease.

What are the benefits of using an online tax account?

+

Online tax accounts offer convenience, accessibility, streamlined record-keeping, real-time updates, and efficient tax preparation. They are cost-effective and provide a centralized location for all your tax-related information.

How do I choose the right online tax account for my needs?

+

Consider factors such as user-friendliness, features and functionality, security and privacy, support and customer service, and cost and pricing plans. Assess your specific tax needs and choose a platform that aligns with your requirements.

What steps should I follow to set up and manage my online tax account effectively?

+

Follow the step-by-step instructions provided in the blog, including signing up, personalizing your profile, connecting financial accounts, importing tax documents, setting up automated expense tracking, reviewing tax information, and preparing and filing your taxes.

Are there any advanced features I should consider to maximize the benefits of my online tax account?

+

Yes, advanced features such as tax deduction maximization tools, tax planning insights, and collaborative features can enhance your tax management experience. Regularly review and update your profile to ensure accurate tax calculations.

How can I overcome common challenges when using an online tax account?

+

Address data security concerns by choosing a secure platform and regularly updating your password. For complex tax situations, consider seeking professional assistance. In case of technical issues, reach out to the customer support team for assistance.