Tax Refund Online

Tax refunds can be a great way to boost your finances, and with the convenience of online filing, the process has become more accessible and efficient. In this comprehensive guide, we will walk you through the steps to claim your tax refund online, providing valuable insights and tips to ensure a smooth and successful experience.

Understanding Tax Refunds

A tax refund is a reimbursement of the excess taxes you’ve paid throughout the year. It occurs when your total tax liability is less than the amount of tax withheld from your income or paid directly to the government. This can happen for various reasons, such as changes in your financial situation, deductions, or credits you’re eligible for.

By filing your taxes online, you can take advantage of the benefits it offers, including:

- Convenience: Online filing allows you to complete the process from the comfort of your home, eliminating the need for in-person visits to tax offices.

- Speed: Electronic filing often results in faster processing times, with refunds being deposited directly into your bank account.

- Accuracy: Online tax software can help reduce errors and provide guidance through the complex tax system.

- Accessibility: Many online platforms offer user-friendly interfaces, making it easier for individuals with varying levels of tax knowledge to navigate the process.

Preparing for Online Tax Filing

Before diving into the online tax filing process, it's essential to gather all the necessary documents and information. Here's a checklist to help you get organized:

- Personal Information: Have your personal details, such as your full name, date of birth, and social security number, readily available.

- Income Documents: Collect all income-related documents, including W-2 forms from your employer(s), 1099 forms for freelance work, and any other income statements.

- Deduction and Credit Information: Gather records of eligible deductions and credits, such as mortgage interest, medical expenses, charitable contributions, and education-related expenses.

- Previous Year's Tax Return: If available, refer to your previous tax return to ensure accuracy and identify any changes in your financial situation.

- Bank Account Details: Ensure you have your bank account information on hand for direct deposit of your refund.

Choosing an Online Tax Filing Platform

There are numerous online platforms available to assist with tax filing. Here are some popular options to consider:

- TurboTax: A user-friendly platform offering guidance and support throughout the filing process. It provides various pricing plans, including free options for simple tax situations.

- H&R Block: Another well-known platform with a range of tools and resources. H&R Block offers personalized support and ensures accuracy with its online tax software.

- TaxAct: Known for its affordability, TaxAct provides basic and premium plans for different tax scenarios. It offers a simple interface and helpful customer support.

- FreeTaxUSA: As the name suggests, FreeTaxUSA offers free tax filing for eligible individuals. It's a great option for those with straightforward tax situations.

When choosing a platform, consider your specific needs and preferences. Some platforms may specialize in certain tax situations, such as self-employment or investment income, so choose one that aligns with your requirements.

Step-by-Step Guide to Online Tax Filing

Now, let’s walk through the process of filing your taxes online:

Step 1: Create an Account

Visit the website of your chosen online tax filing platform and create an account. Provide your personal information, including your name, email address, and a secure password.

Step 2: Enter Your Income Information

Start by entering your income details. This includes wages, salaries, tips, and any other sources of income. Upload or enter the necessary forms, such as W-2s or 1099s, to ensure accuracy.

Step 3: Claim Deductions and Credits

Explore the platform’s tools to claim deductions and credits. This step can significantly reduce your tax liability and increase your refund. Common deductions include mortgage interest, student loan interest, and charitable contributions. Credits, such as the Child Tax Credit or Education Credits, can provide substantial savings.

Step 4: Review and Submit

Once you’ve entered all the necessary information, carefully review your tax return. Check for any errors or discrepancies and make sure all the details are accurate. If you’re satisfied, proceed to submit your tax return electronically.

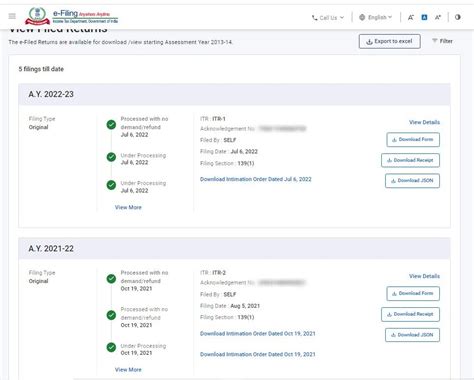

Step 5: Track Your Refund

After submitting your tax return, you can track the status of your refund. Most online platforms provide a tracking feature, allowing you to monitor the progress of your refund. Additionally, you can check the IRS website or use their refund status tool for updates.

Maximizing Your Tax Refund

To make the most of your tax refund, consider the following strategies:

- Direct Deposit: Opt for direct deposit instead of a paper check to receive your refund faster. It's a secure and efficient way to receive your money.

- Choose a Refund Advance: Some tax preparation companies offer refund advance loans, allowing you to access your refund amount immediately. This can be beneficial if you need funds right away.

- Consider a Split Refund: You can split your refund between multiple accounts, such as your checking and savings accounts, to help manage your finances effectively.

Common Tax Refund Scams

Unfortunately, tax refund season also attracts scammers. Be vigilant and watch out for these common scams:

- Phishing Emails: Scammers may send emails claiming to be from the IRS or tax preparation companies, asking for personal or financial information. Never respond to or click links in these emails.

- Fake Tax Software: Be cautious when downloading tax software. Stick to reputable platforms and avoid downloading from unknown sources.

- Identity Theft: Scammers may attempt to steal your identity by asking for personal information over the phone or through fake websites. Always verify the identity of the person or organization before sharing any sensitive data.

Seeking Professional Help

If you have a complex tax situation or prefer professional assistance, consider hiring a tax professional or enrolling agent. They can provide expert guidance and ensure your tax return is accurate and compliant with the latest tax laws.

Conclusion

Filing your taxes online can be a straightforward and efficient process with the right tools and preparation. By following the steps outlined in this guide, you can navigate the online tax filing journey with confidence. Remember to stay organized, choose a reputable platform, and take advantage of the benefits of electronic filing. With a tax refund in your pocket, you can plan for your financial future and make the most of your hard-earned money.

What if I need help with my tax return?

+

Most online tax filing platforms offer customer support through email, live chat, or phone. You can also seek assistance from tax professionals or consult the IRS website for guidance.

How long does it take to receive my tax refund?

+

The processing time for tax refunds can vary. Typically, it takes around 21 days for the IRS to issue a refund. However, factors like filing errors or additional reviews can delay the process.

Can I file my taxes online for free?

+

Yes, several online platforms offer free tax filing for eligible individuals with simple tax situations. These platforms often have basic plans that cover common tax scenarios.

What happens if I make a mistake on my tax return?

+

If you discover a mistake on your tax return, you can file an amended return to correct it. The process involves completing Form 1040X and submitting it to the IRS. It’s important to address any errors promptly to avoid penalties or further complications.

Are there any benefits to filing my taxes early?

+

Filing your taxes early can provide peace of mind and ensure you receive your refund promptly. It also reduces the risk of identity theft, as scammers often target late filers.