The Ultimate 5Step Guide To Creating Your Council Tax Email

Are you a council or local government representative looking to streamline your tax-related communications? Crafting an effective email is crucial for engaging with taxpayers and ensuring timely payments. In this comprehensive guide, we'll walk you through the essential steps to create an impactful council tax email that leaves a lasting impression.

Step 1: Define Your Objective

Before diving into the creative process, clearly define the purpose of your email. Is it to remind taxpayers about an upcoming payment deadline? Or perhaps you want to inform them about new tax rates or policies? Understanding your objective will guide the tone, content, and call to action of your email.

Step 2: Gather Relevant Information

To create an informative email, gather all the necessary details. This includes tax rates, due dates, payment options, and any changes or updates taxpayers need to know. Ensure you have accurate and up-to-date information to avoid confusion or errors.

Step 3: Craft an Engaging Subject Line

The subject line is your first chance to grab attention. Keep it concise, clear, and relevant. Here are some examples:

- “Council Tax Reminder: Avoid Late Fees”

- “Important Update on 2023 Tax Rates”

- “Your Council Tax Payment Options”

Step 4: Structure Your Email

A well-structured email enhances readability and keeps your message organized. Consider the following sections:

Introduction

Start with a friendly greeting and a brief overview of the email’s purpose. Acknowledge the recipient’s role as a taxpayer and express gratitude for their contributions.

Body

This is where you present the main content. Break it down into digestible paragraphs, each focusing on a specific topic. Use simple language and avoid jargon to ensure understanding.

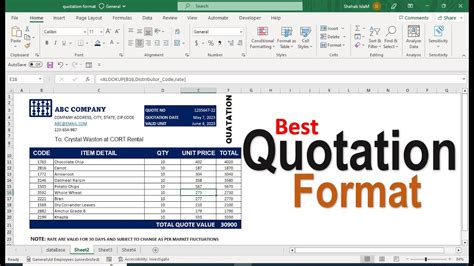

Tax Information

Provide a clear breakdown of tax rates, due dates, and any applicable discounts or penalties. Use a table or list format to make it easily scannable.

| Tax Category | Rate | Due Date |

|---|---|---|

| Residential Property | 2% | March 31st |

| Commercial Property | 3% | June 30th |

| Vehicle Tax | 1.5% | September 15th |

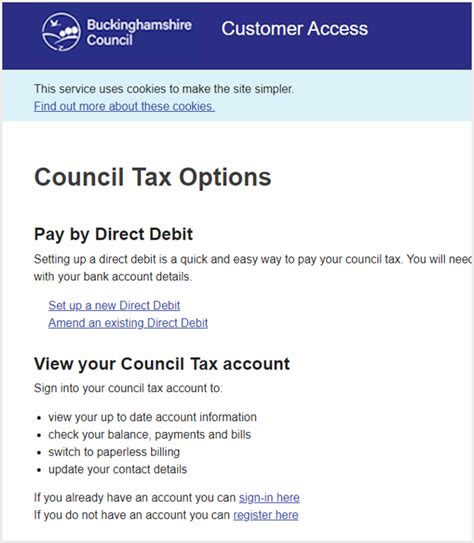

Payment Options

Detail the various payment methods available, such as online portals, direct debit, or in-person payments. Provide links or instructions for each option.

Contact Information

Include the contact details of your council’s tax office or customer service team. This allows taxpayers to reach out with queries or concerns.

Call to Action

Guide taxpayers on the next steps. Encourage them to take action, whether it’s making a payment, setting up a direct debit, or simply acknowledging receipt of the email. Provide clear instructions and any necessary links.

Step 5: Design and Formatting

While content is crucial, design plays a significant role in engaging readers. Consider the following tips:

- Use a professional and consistent email template that aligns with your council’s branding.

- Incorporate visually appealing elements like relevant images or infographics to break up text and enhance comprehension.

- Ensure your email is optimized for different devices, including mobile, to cater to various reading preferences.

- Avoid excessive use of colors or fonts, as it may distract from the main message.

Conclusion: Nurturing Taxpayer Engagement

Creating an effective council tax email is a powerful tool to nurture taxpayer engagement and ensure timely payments. By following these steps, you can craft a clear, informative, and engaging email that leaves a positive impression. Remember, clear communication builds trust and strengthens the relationship between your council and the community it serves.

How often should I send council tax emails?

+

It’s recommended to send reminder emails at least a month before the due date and then again closer to the deadline. You can also send informative emails when there are significant changes to tax rates or policies.

What if taxpayers have questions or need assistance?

+

Include a dedicated section in your email with contact information for your council’s tax office or customer service team. This allows taxpayers to reach out for clarification or support.

How can I track the success of my council tax emails?

+

Utilize email marketing tools that provide analytics. Monitor open rates, click-through rates, and conversion rates to gauge the effectiveness of your emails and make improvements for future campaigns.