The Ultimate Guide To Making Rent Payments Online: 15+ Easy Steps For Stressfree Tenancy

Renting a property and managing your tenancy has become more convenient with the advent of online rent payment systems. These digital platforms offer a seamless and secure way to pay rent, providing tenants with greater flexibility and control over their financial obligations. In this comprehensive guide, we will walk you through the process of making rent payments online, covering everything from choosing the right payment method to troubleshooting common issues. By following these steps, you can ensure a stress-free tenancy and build a positive relationship with your landlord.

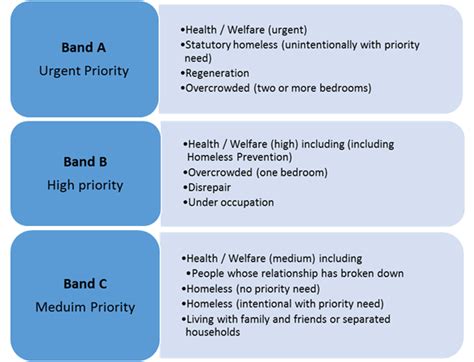

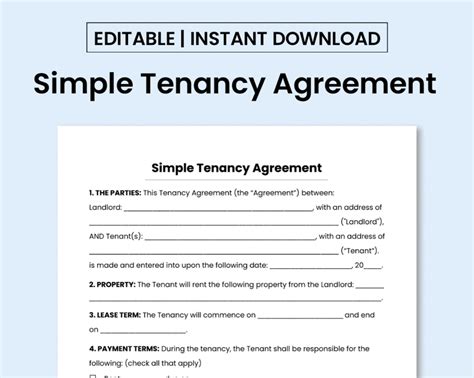

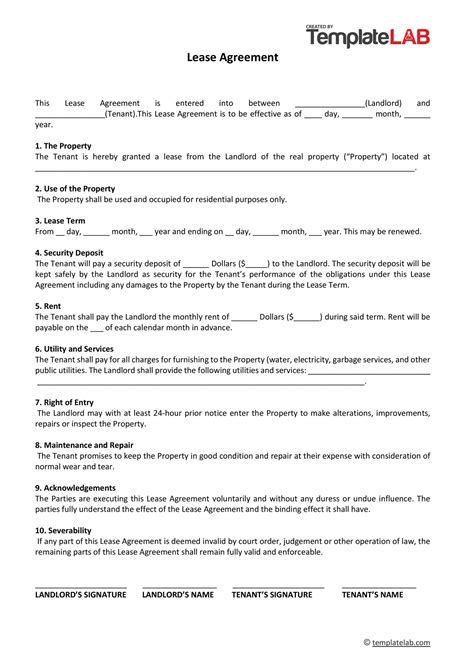

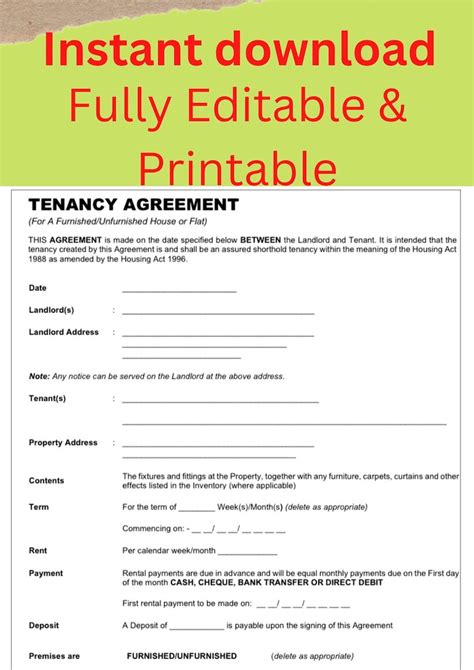

Step 1: Understand Your Lease Agreement

Before diving into online rent payments, it’s crucial to review your lease agreement. Your lease will outline the terms and conditions of your tenancy, including rent due dates, late fees, and accepted payment methods. Make sure you are familiar with these details to avoid any misunderstandings or penalties.

Step 2: Research Available Payment Methods

Explore the various payment options offered by your landlord or property management company. Common methods include:

- Online Banking Transfer: Transfer funds directly from your bank account to your landlord’s account using your online banking platform.

- Mobile Payment Apps: Utilize popular mobile apps like Venmo, Zelle, or PayPal to send rent payments securely.

- Rent Payment Platforms: Specialized websites or apps, such as RentPayment or Cozy, facilitate rent payments and offer additional features like payment tracking and maintenance requests.

- Pre-Authorized Debit: Set up automatic rent payments by providing your bank account information to your landlord, who will then withdraw the rent amount on the due date.

Step 3: Choose a Secure Payment Method

Select a payment method that aligns with your preferences and offers the highest level of security. Consider factors such as ease of use, transaction fees, and the ability to track your payments.

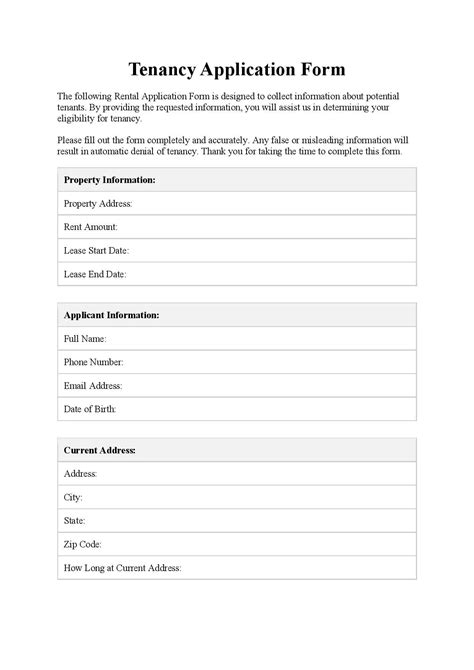

Step 4: Gather Necessary Information

Before initiating your rent payment, gather the following information:

- Your landlord’s name and contact details.

- The rental property address.

- Your landlord’s bank account details (if using online banking transfer or pre-authorized debit).

- Your landlord’s email address (if using mobile payment apps or rent payment platforms).

- The amount due for rent and any additional fees.

Step 5: Set Up Your Payment Profile

If you’re using a rent payment platform or mobile payment app, create an account and set up your payment profile. Provide accurate personal and financial information to ensure a smooth payment process.

Step 6: Schedule Your Rent Payment

Decide whether you want to make a one-time payment or set up recurring payments. Most platforms allow you to schedule payments in advance, ensuring your rent is paid on time every month.

Step 7: Double-Check Payment Details

Before finalizing your payment, carefully review the following details:

- The recipient’s name and account information.

- The amount being transferred.

- The due date of the payment.

- Any additional instructions or notes.

Step 8: Make the Payment

Initiate the payment process through your chosen method. Follow the instructions provided by the platform or app, ensuring you complete all the necessary steps.

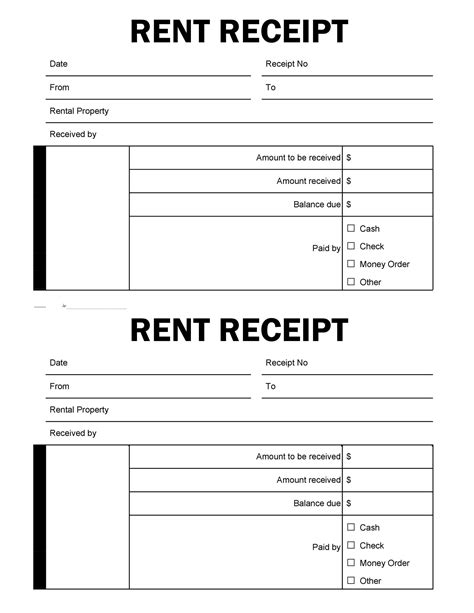

Step 9: Receive Payment Confirmation

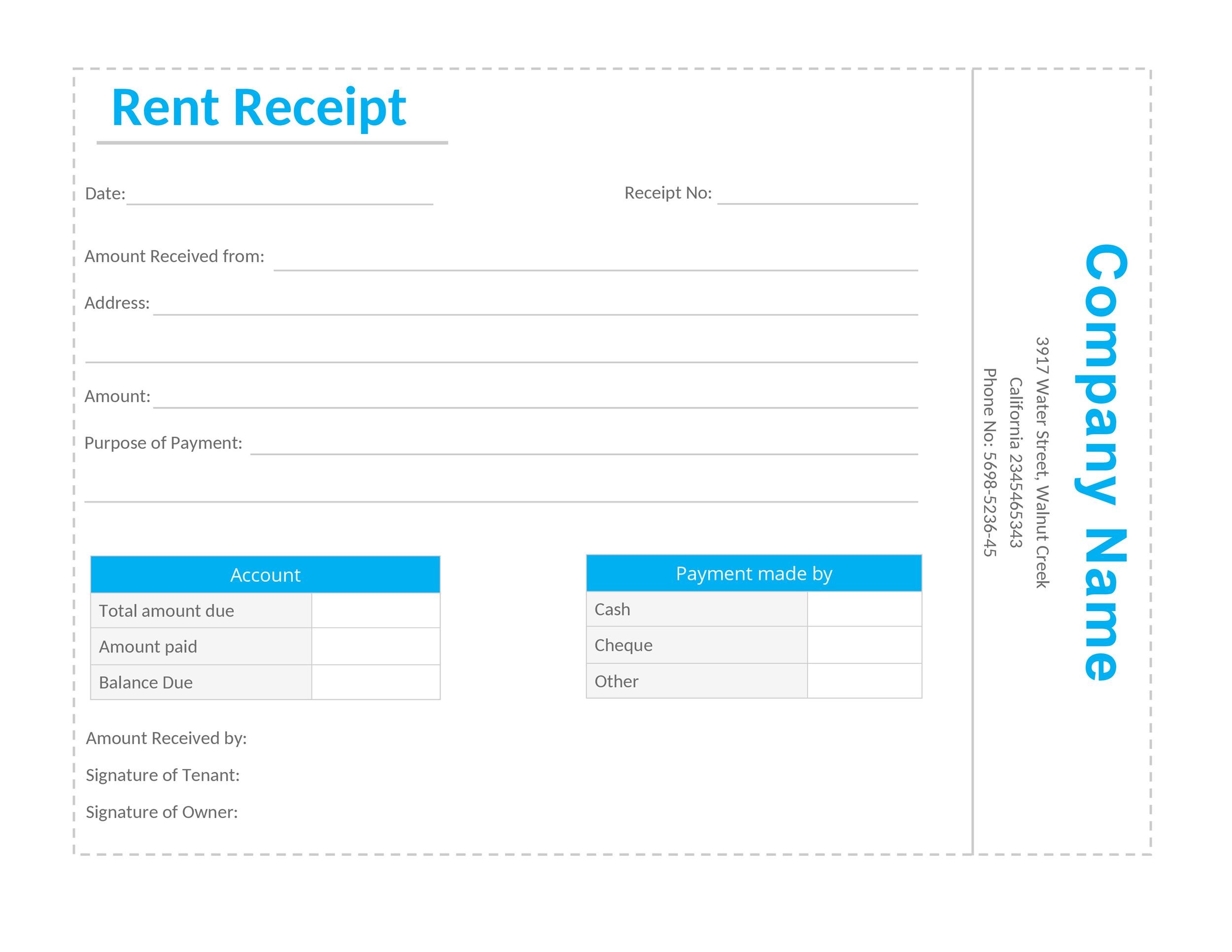

Once your payment is processed, you should receive a confirmation email or notification. Keep this confirmation as proof of payment and for future reference.

Step 10: Track Your Payment Status

Most online rent payment platforms and apps provide real-time payment tracking. Monitor the status of your payment to ensure it has been received and processed successfully.

Step 11: Keep Records of Your Payments

Maintain a record of all your rent payments, including dates, amounts, and methods of payment. This documentation will be valuable for tax purposes and in case of any disputes.

Step 12: Communicate with Your Landlord

Inform your landlord about your preferred payment method and provide them with the necessary details. Keep them updated on any changes to your payment schedule or method.

Step 13: Stay Informed About Payment Due Dates

Mark your rent due dates on your calendar or set reminders to ensure you never miss a payment. Late payments can result in fees and damage your relationship with your landlord.

Step 14: Troubleshoot Common Issues

If you encounter any problems during the payment process, such as payment errors or failed transactions, reach out to your landlord or the support team of the payment platform for assistance.

Step 15: Explore Additional Features

Many online rent payment platforms offer additional features beyond basic payments. Explore these features, such as maintenance request tracking, lease renewal options, and communication tools, to enhance your tenancy experience.

Step 16: Stay Up-to-Date with Payment Policies

Keep yourself informed about any changes in your landlord’s payment policies or the terms of your lease agreement. Stay proactive in understanding your financial obligations as a tenant.

Step 17: Build a Positive Relationship with Your Landlord

By consistently making timely rent payments and maintaining open communication, you can foster a positive relationship with your landlord. This can lead to a more harmonious tenancy and potentially open doors for future opportunities.

Step 18: Review and Optimize Your Payment Process

Regularly review your rent payment process to identify areas for improvement. Look for ways to streamline payments, reduce fees, and enhance the overall efficiency of your tenancy management.

Step 19: Seek Professional Advice

If you have any concerns or questions about your rent payments or tenancy rights, don’t hesitate to seek advice from a legal professional or a tenant advocacy organization. They can provide expert guidance tailored to your specific situation.

Conclusion

Making rent payments online offers a convenient and secure way to manage your tenancy. By following the steps outlined in this guide, you can ensure a smooth and stress-free payment process. Remember to stay organized, maintain open communication with your landlord, and explore the additional features provided by online rent payment platforms. With a proactive approach to your tenancy, you can build a positive and harmonious relationship with your landlord and enjoy a hassle-free living experience.

Can I use multiple payment methods for my rent payments?

+

Yes, you can use different payment methods for your rent payments. However, it’s essential to communicate your preferred method to your landlord and ensure they accept the chosen option. Some landlords may have specific preferences or restrictions on payment methods.

Are there any fees associated with online rent payments?

+

Online rent payment methods may incur fees, depending on the platform or app you use. These fees can vary, so it’s crucial to review the terms and conditions of your chosen payment method to understand any associated costs. Some platforms offer fee-free options, while others may charge a small transaction fee.

What happens if my rent payment is late or missed?

+

Late or missed rent payments can result in penalties, such as late fees or potential legal consequences. It’s important to communicate with your landlord if you anticipate any payment delays and work out a solution together. Keeping an open line of communication can help prevent any misunderstandings or negative impacts on your tenancy.

Can I make partial rent payments online?

+

The ability to make partial rent payments online depends on the payment platform or method you use. Some platforms may allow for partial payments, while others may require the full rent amount. It’s best to check with your landlord or the platform’s support team to confirm their policies regarding partial payments.

Is it safe to provide my bank account information for online rent payments?

+

Providing your bank account information for online rent payments is generally safe when using reputable payment platforms or secure online banking systems. Ensure that the platform or app you choose has robust security measures in place to protect your financial information. Additionally, always verify the legitimacy of the payment platform before sharing sensitive details.