The Ultimate Guide To Property Investment In Birmingham: 10+ Tips For Success

Are you considering investing in property in Birmingham? This vibrant city offers a wealth of opportunities for investors, and with the right strategies, you can achieve success in the competitive Birmingham property market. In this comprehensive guide, we will explore over ten essential tips to help you navigate the world of property investment in Birmingham and maximize your chances of a profitable venture.

Understanding the Birmingham Property Market

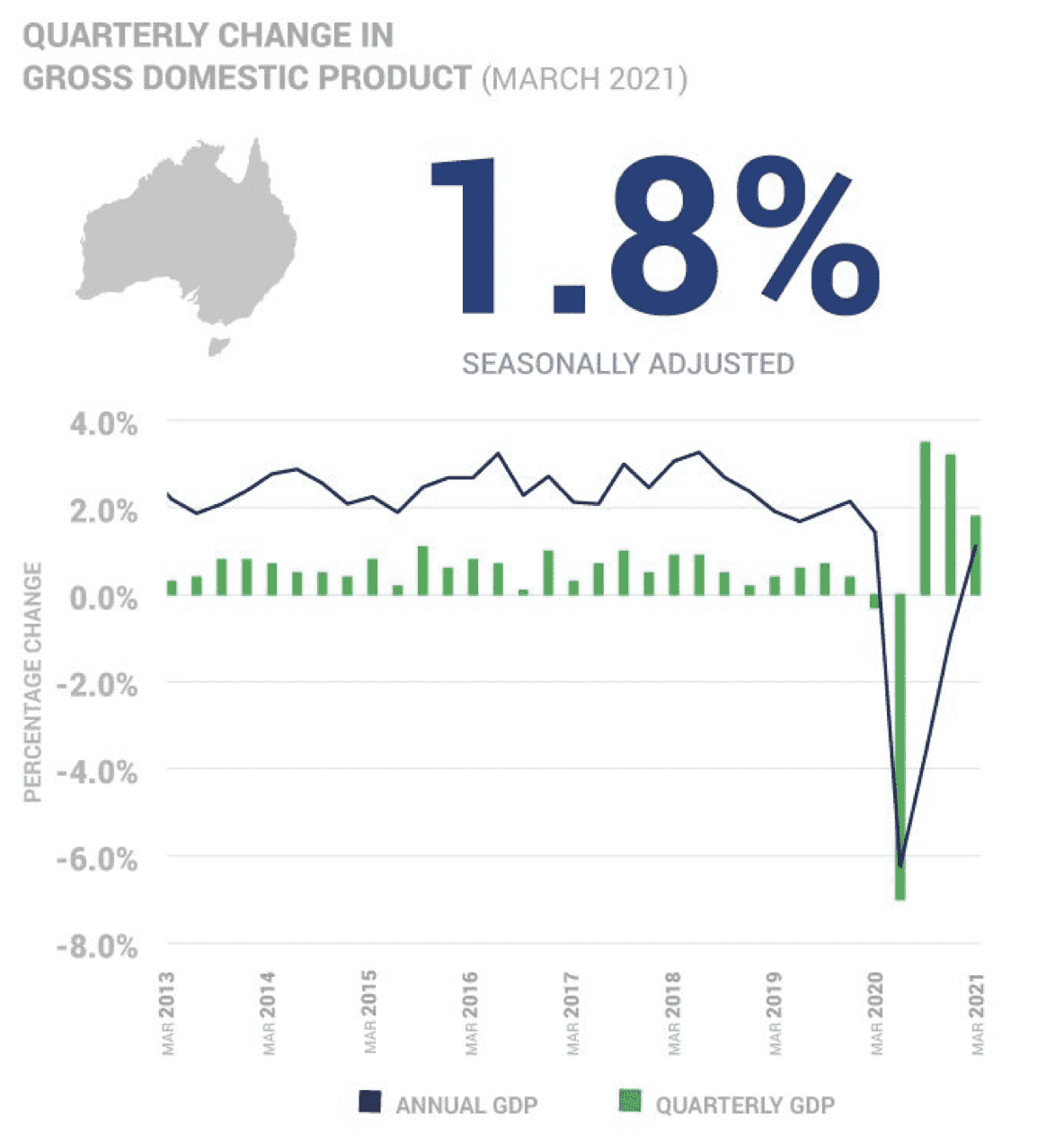

Before diving into property investment, it's crucial to gain a deep understanding of the Birmingham property market. Researching market trends, analyzing data, and staying updated on local developments will provide valuable insights into the city's real estate landscape. This knowledge will enable you to make informed decisions and identify the most promising investment opportunities.

Market Trends and Analysis

- Study historical price trends and growth patterns in different Birmingham neighborhoods.

- Identify areas with high rental demand and potential for capital appreciation.

- Stay informed about upcoming infrastructure projects and developments that may impact property values.

Local Knowledge and Expertise

Building a network of local connections and experts can be invaluable. Consider collaborating with:

- Real estate agents specializing in Birmingham properties.

- Property developers with insights into new construction projects.

- Financial advisors who can offer guidance on investment strategies and tax implications.

Setting Clear Investment Goals

Defining your investment goals is a crucial step in property investment. Are you aiming for long-term capital growth, or do you prioritize generating a steady income through rentals? Understanding your objectives will shape your investment strategy and help you make informed decisions.

Long-Term Capital Growth

- Identify areas with potential for significant price appreciation over time.

- Consider investing in up-and-coming neighborhoods with good infrastructure and development plans.

- Research historical data to find patterns of growth and identify areas with high potential.

Rental Income Focus

- Look for properties in areas with high rental demand, such as student accommodations or professional rentals.

- Calculate potential rental yields and ensure they align with your financial goals.

- Consider the cost of maintenance and property management when evaluating rental properties.

Conducting Thorough Property Research

Due diligence is essential when investing in property. Conducting comprehensive research will help you avoid potential pitfalls and make informed decisions. Here are some key aspects to consider:

Property Condition and Maintenance

- Inspect the property thoroughly, or hire a professional inspector to assess its condition.

- Consider the age of the property and any potential maintenance issues that may arise.

- Evaluate the cost of necessary repairs or renovations before making an offer.

Location and Amenities

- Research the neighborhood and its proximity to essential amenities like schools, hospitals, and transport hubs.

- Consider the area's safety, crime rates, and overall desirability.

- Evaluate the potential for future development and its impact on property values.

Financial Planning and Budgeting

Effective financial planning is vital for successful property investment. Here's how to ensure you're on the right track:

Budgeting and Affordability

- Calculate your budget, including the initial purchase price, legal fees, and potential renovation costs.

- Consider the ongoing expenses, such as property taxes, insurance, and maintenance.

- Evaluate your financial capacity and ensure you have a comfortable safety net.

Mortgage and Financing Options

- Research and compare mortgage rates and terms from different lenders.

- Consider the impact of interest rates on your monthly payments and overall investment.

- Explore alternative financing options, such as private lending or equity release.

Identifying the Right Property Type

Choosing the right property type is crucial for aligning your investment with your goals. Consider the following factors when selecting a property:

Residential vs. Commercial Properties

- Residential properties, such as houses or apartments, are ideal for long-term capital growth and rental income.

- Commercial properties, like offices or retail spaces, offer different investment opportunities and may suit specific business ventures.

New Build vs. Existing Properties

- New build properties often come with modern amenities and lower maintenance costs but may have higher initial prices.

- Existing properties may require renovations but can offer more character and potential for customization.

Negotiating and Making an Offer

When you've found the right property, it's time to negotiate and make an offer. Here's how to approach this crucial step:

Researching Market Value

- Research recent sales in the area to determine the property's fair market value.

- Consider any unique features or conditions that may impact the property's price.

Making a Competitive Offer

- Present a well-researched and competitive offer that demonstrates your seriousness.

- Be prepared to negotiate and consider the seller's perspective to reach a mutually beneficial agreement.

Managing Tenants and Rental Income

If your investment strategy focuses on rental income, effective tenant management is crucial. Here's how to ensure a positive rental experience:

Screening Potential Tenants

- Conduct thorough background checks, including credit history and rental references.

- Consider implementing a screening process to ensure responsible and reliable tenants.

Setting Rental Rates

- Research the local rental market to set competitive rental rates.

- Consider the property's location, amenities, and condition when determining the rental price.

Maintaining and Upgrading Your Property

Regular maintenance and timely upgrades are essential to protect your investment and attract quality tenants. Here's what you need to know:

Routine Maintenance

- Create a maintenance schedule and address any issues promptly.

- Consider hiring a property manager or a reliable maintenance team to handle repairs.

Upgrades and Renovations

- Identify areas where upgrades can enhance the property's value and appeal.

- Prioritize renovations that offer the best return on investment, such as kitchen and bathroom upgrades.

Building a Network of Experts

Surrounding yourself with a network of reliable experts can make a significant difference in your property investment journey. Here are some key professionals to consider:

Real Estate Agents

- Work with experienced agents who have a deep understanding of the Birmingham property market.

- Their local knowledge and connections can be invaluable in finding the right properties and negotiating deals.

Property Managers

- If you plan to rent out your property, consider hiring a property manager to handle tenant relations and property maintenance.

- A good property manager can save you time and ensure a positive rental experience.

Legal and Financial Advisors

- Consult with legal experts to ensure you understand the legal aspects of property investment and any potential risks.

- Financial advisors can provide valuable guidance on tax strategies, investment planning, and wealth management.

Staying Informed and Adapting

The property market is dynamic, and staying informed is crucial for long-term success. Here's how to stay ahead of the curve:

Market Updates and Research

- Regularly review market trends and analysis to identify emerging opportunities.

- Stay updated on local developments and infrastructure projects that may impact property values.

Adaptability and Flexibility

- Be prepared to adapt your investment strategy based on market changes and your evolving goals.

- Consider diversifying your portfolio to mitigate risks and take advantage of different investment opportunities.

Conclusion: Navigating the Birmingham Property Market

Investing in property in Birmingham can be a rewarding venture, but it requires careful planning, research, and a strategic approach. By understanding the local market, setting clear goals, and surrounding yourself with a network of experts, you can navigate the complexities of property investment and achieve your financial objectives. Remember, success in property investment often comes from a combination of knowledge, due diligence, and adaptability. Stay informed, stay focused, and seize the opportunities that Birmingham's vibrant property market has to offer.

FAQ

What are the key factors to consider when choosing a property in Birmingham for investment purposes?

+When selecting a property for investment in Birmingham, consider factors such as location, rental demand, property condition, and potential for capital growth. Researching market trends and seeking expert advice can help you make an informed decision.

How can I finance my property investment in Birmingham if I have limited funds?

+There are various financing options available, including mortgages, private lending, and equity release. Research and compare different lenders to find the best terms and rates that align with your financial situation.

What are the potential risks of property investment in Birmingham, and how can I mitigate them?

+Potential risks include market fluctuations, tenant issues, and property maintenance. To mitigate these risks, conduct thorough research, maintain a well-diversified portfolio, and seek professional advice from legal and financial experts.

How can I maximize rental income from my Birmingham property investment?

+To maximize rental income, focus on properties in high-demand areas with strong rental markets. Set competitive rental rates, maintain the property’s condition, and attract quality tenants through effective marketing and screening processes.

What are some common mistakes to avoid when investing in property in Birmingham?

+Common mistakes include rushing into a purchase without thorough research, neglecting property maintenance, and failing to diversify your portfolio. Take the time to understand the market, conduct due diligence, and seek expert advice to avoid these pitfalls.