Ultimate Guide: Change Your Council Tax Payment Date Now!

Looking for a way to better manage your finances and gain more control over your monthly expenses? Changing your council tax payment date could be the solution you've been searching for. This comprehensive guide will walk you through the process, providing you with all the information you need to take action and improve your financial situation.

Understanding Council Tax and Payment Dates

Council tax is a vital source of funding for local authorities, helping them provide essential services like education, social care, and waste management. As a resident, you contribute to these services through regular council tax payments.

The standard council tax year runs from April to March, and payments are typically collected in ten instalments. However, the payment dates can vary depending on your local authority and the billing cycle they follow.

By changing your council tax payment date, you can align it with your personal financial situation and ensure a more manageable monthly outgo. This simple adjustment can make a significant difference in your financial planning and help you avoid any unexpected shortfalls.

The Benefits of Adjusting Your Payment Date

- Improved Cash Flow Management: By aligning your council tax payments with your payday, you can ensure that you have the funds available to cover the expense. This prevents the need to juggle finances or rely on overdrafts, reducing financial stress.

- Avoiding Late Payment Fees: If you struggle to meet the standard payment deadlines, changing your payment date can help you avoid late payment fees and penalties. This ensures you stay in control of your finances and maintain a good relationship with your local authority.

- Customized Payment Schedule: Adjusting your payment date allows you to create a schedule that suits your individual circumstances. Whether you receive your income monthly, fortnightly, or weekly, you can set up a payment plan that aligns with your income pattern.

How to Change Your Council Tax Payment Date

Changing your council tax payment date is a straightforward process, and most local authorities offer online portals or dedicated phone lines to facilitate the request. Here’s a step-by-step guide to help you through the process:

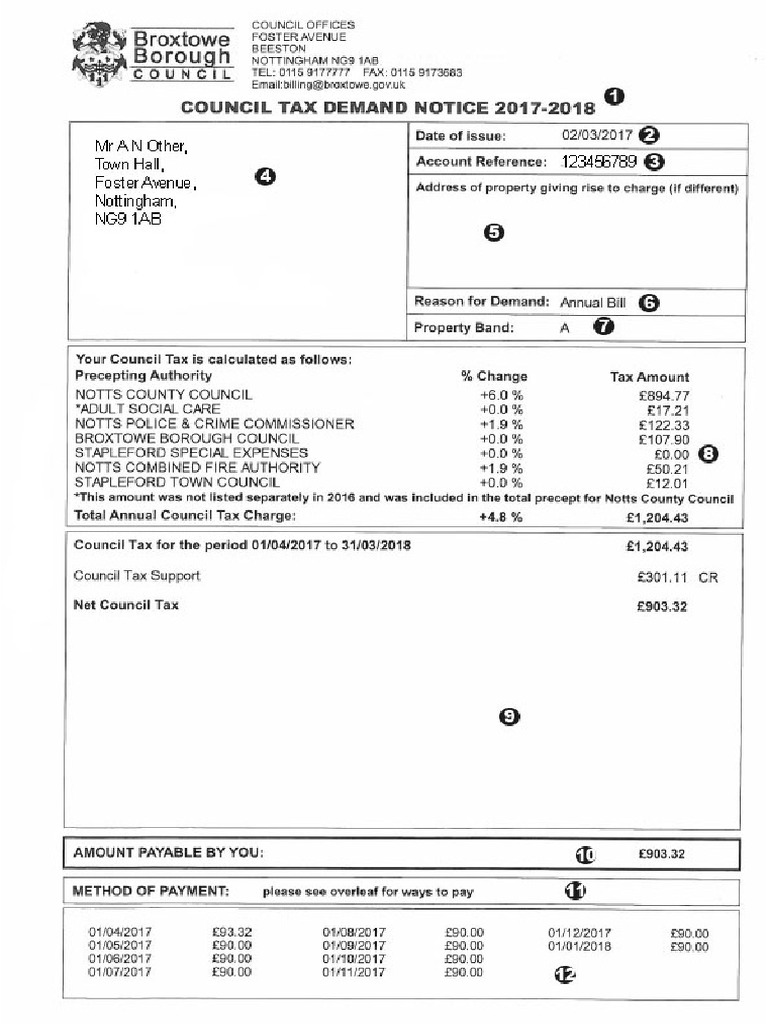

Step 1: Check Your Current Payment Date

Before making any changes, it’s essential to know your current council tax payment date. You can find this information on your council tax bill or by contacting your local authority’s billing department.

Step 2: Choose a New Payment Date

Consider your income pattern and financial commitments when selecting a new payment date. Aim for a date that aligns with your payday or a time when you have sufficient funds to cover the payment.

Step 3: Contact Your Local Authority

Reach out to your local authority’s billing department to request a change in your payment date. You can usually do this online, over the phone, or by post. Provide them with your preferred new payment date and any relevant details about your financial situation.

Step 4: Confirm the Change

Once your local authority has processed your request, they will send you a confirmation letter or email. This will outline the new payment date and any other important information regarding your council tax bill.

Step 5: Set Up a Direct Debit (Optional)

To ensure your payments are made on time and to avoid any administrative hassle, consider setting up a direct debit. This automatic payment method will deduct the council tax amount from your bank account on the specified date, providing peace of mind and simplifying your financial management.

Additional Tips for Effective Council Tax Management

- Review Your Bill Regularly: Stay informed about your council tax liability by reviewing your bill each year. This allows you to spot any potential errors or changes in your circumstances that may impact your payments.

- Explore Discounts and Exemptions: Depending on your personal situation, you may be eligible for council tax discounts or exemptions. Common scenarios include being a full-time student, living alone, or having a low income. Check with your local authority to see if you qualify for any relief.

- Budgeting and Financial Planning: Changing your payment date is just one aspect of effective financial management. Ensure you have a comprehensive budget in place and plan your expenses accordingly. This will help you stay on top of your finances and avoid any unexpected financial hurdles.

Conclusion

Changing your council tax payment date is a simple yet powerful step towards better financial management. By aligning your payments with your income and personal circumstances, you can gain more control over your finances and avoid unnecessary stress. Remember, a well-managed financial life starts with small, intentional actions like this. So, take the time to review your council tax situation and make the necessary adjustments to improve your financial well-being.

Can I change my council tax payment date at any time?

+

While most local authorities allow you to change your payment date, there may be specific time frames or deadlines to consider. Contact your local authority to understand their policies and ensure you submit your request within the designated period.

What happens if I miss the deadline to change my payment date?

+

If you miss the deadline, you may still be able to request a change, but it might not be processed immediately. Contact your local authority to discuss your options and explore alternative payment arrangements if necessary.

Are there any additional fees for changing my payment date?

+

Changing your payment date is usually a free service provided by local authorities. However, it’s always a good idea to check with your local authority to confirm there are no hidden charges or administrative fees associated with the request.

Can I change my payment date if I’m already in a payment plan?

+

Yes, you can change your payment date even if you’re already in a payment plan. Contact your local authority to discuss your options and ensure the change is reflected in your existing arrangement.

How often can I change my council tax payment date?

+

Local authorities typically allow you to change your payment date once a year. However, some may have more flexible policies, so it’s best to check with your local authority to understand their specific guidelines.