Ultimate Guide: Change Your Name On Council Tax Now

Dealing with Council Tax: How to Change Your Name

Changing your name is an important life event that often requires updating various personal records and documents. One crucial aspect that might not immediately come to mind is updating your details with the local council for council tax purposes. This process is essential to ensure you are correctly identified and billed for the correct property. In this comprehensive guide, we will walk you through the steps to change your name on council tax, ensuring a smooth and efficient transition.

Understanding the Importance of Name Changes

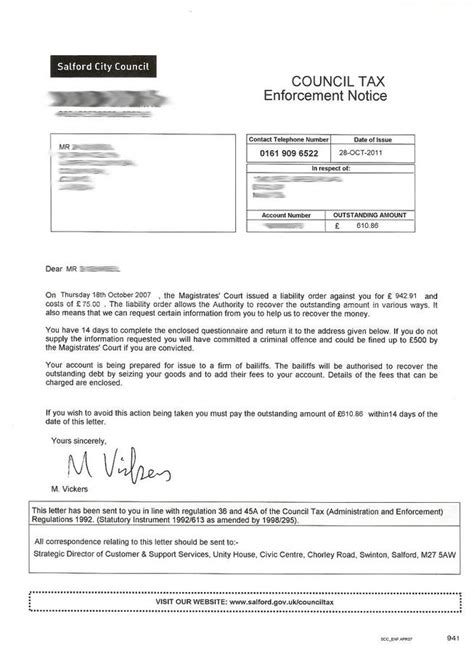

When it comes to council tax, your name is more than just a label; it is a critical identifier that links you to your property and determines your liability for paying taxes. Failing to update your name can lead to administrative issues, incorrect billing, and potential legal complications. Therefore, it is imperative to prioritize this task when undergoing a name change.

Step-by-Step Guide to Changing Your Name on Council Tax

1. Gather the Necessary Documentation

Before initiating the name change process, ensure you have the following documents ready:

- Proof of Name Change: This could be a marriage certificate, divorce decree, deed poll certificate, or any official document that legally changes your name.

- Council Tax Bill or Account Number: Locate your most recent council tax bill or have your account number handy for reference.

- Personal Identification: Have a valid form of ID, such as a passport or driving license, to verify your identity.

2. Contact Your Local Council

Reach out to your local council’s revenue or council tax department. You can do this via:

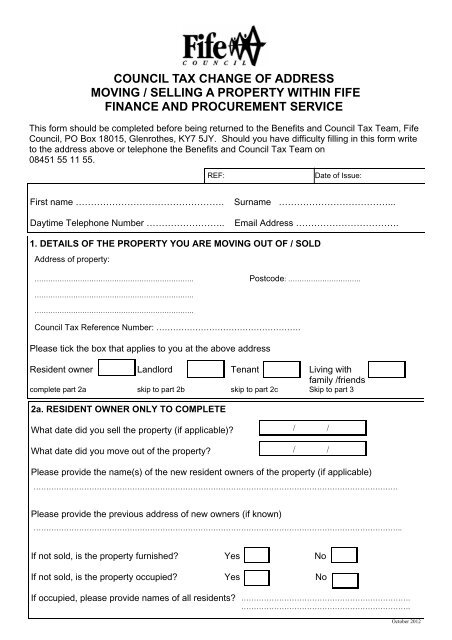

- Online: Many councils offer an online form or portal for name change requests. Simply log in to your council tax account and follow the instructions to submit your details.

- Email: Send an email to the council’s dedicated council tax email address, providing your name, address, and account number. Attach a copy of your name change documentation for verification.

- Phone: Call the council’s helpline and speak to a customer service representative. They will guide you through the process and may request that you send the necessary documents via post or email.

- In-Person: Visit your local council office and speak to an advisor. Bring your documents and be prepared to fill out any required forms.

3. Provide Accurate and Complete Information

When interacting with the council, ensure you provide all the necessary details:

- Full Name: Clearly state your new name, including any middle names or initials.

- Address: Confirm the property address associated with your council tax account.

- Reason for Name Change: Briefly explain the reason for your name change, such as marriage, divorce, or a legal name change.

- Supporting Documentation: Attach or provide copies of your name change documents as requested.

4. Await Confirmation and Updates

Once you have submitted your name change request, the council will process it. Depending on the council’s procedures, this may take some time. Keep an eye on your council tax account or check your emails for any updates or confirmation of the name change.

Additional Considerations

1. Informing Other Authorities

Changing your name on council tax is just one aspect of the process. Remember to update your details with other relevant authorities, such as:

- HMRC (HM Revenue and Customs): If you pay income tax or receive benefits, inform HMRC of your name change to ensure accurate records.

- Bank and Financial Institutions: Update your name with your bank, building society, and any other financial institutions you use.

- Passport and Driving License: Apply for new documents with your updated name to avoid any travel or driving-related issues.

- Utility Companies: Contact your gas, electricity, and water suppliers to notify them of your name change.

2. Avoiding Delays and Penalties

To avoid any delays in processing your name change or potential penalties, ensure you:

- Act Promptly: Initiate the name change process as soon as possible after the legal change has taken place.

- Provide Clear and Legible Documents: Ensure your name change documentation is easy to read and understand.

- Keep Records: Maintain a record of your communications with the council, including email confirmations and any reference numbers provided.

Tips for a Smooth Transition

- Stay Organized: Keep a file or digital folder with all your name change-related documents, including council tax correspondence.

- Set Reminders: Create reminders to follow up with the council if you haven’t received confirmation within a reasonable timeframe.

- Be Proactive: If you anticipate any issues or have specific circumstances, reach out to the council beforehand to discuss your situation.

Conclusion

Changing your name on council tax is a straightforward process that ensures your records are accurate and up-to-date. By following the steps outlined in this guide and being proactive in your communications with the local council, you can navigate this administrative task with ease. Remember, accurate identification is crucial for proper billing and maintaining a positive relationship with your local authority.

💡 Note: Keep a copy of your name change documentation and any correspondence with the council for future reference. It's always good to have a backup in case of any discrepancies or queries.

FAQ

What happens if I don’t change my name on council tax after a legal name change?

+

Failing to update your name on council tax can lead to administrative errors, incorrect billing, and potential penalties. It is important to inform the council of your name change to avoid any legal or financial complications.

Can I change my name on council tax online?

+

Yes, many councils offer online portals or forms for name change requests. Simply log in to your council tax account and follow the instructions to submit your details and supporting documentation.

How long does it take for the council to process a name change request?

+

The processing time can vary depending on the council’s procedures and workload. It is advisable to allow a few weeks for the name change to be reflected in your council tax records. Keep an eye on your account or check with the council for updates.

Do I need to inform the council if I change my name back to my original name?

+

Yes, any legal name change, whether it’s a change to a new name or a reversion to your original name, should be reported to the council. This ensures your records are accurate and up-to-date.

Can I change my name on council tax if I’m a tenant or living in shared accommodation?

+

Yes, tenants and individuals living in shared accommodation can also change their names on council tax. The process remains the same, and you should contact the council to initiate the name change.