Ultimate Guide: Report Car Tax Issues Now!

Understanding Car Tax and Its Importance

Car tax, also known as vehicle excise duty (VED), is a crucial aspect of vehicle ownership. It is a legal requirement for all vehicles used on public roads to be taxed, ensuring compliance with environmental standards and contributing to road maintenance and development. In this comprehensive guide, we will delve into the world of car tax, exploring the process of reporting tax issues, understanding the consequences of non-compliance, and providing you with the knowledge to navigate the system effectively.

The Basics of Car Tax

What is Car Tax?

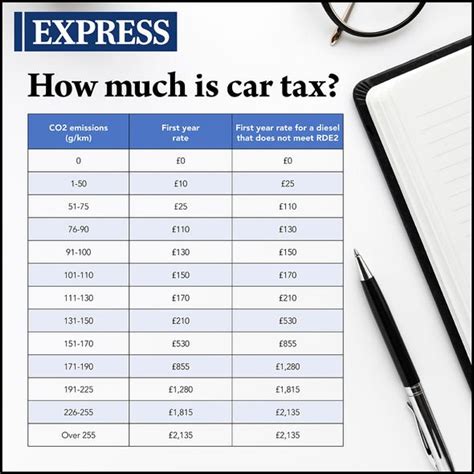

Car tax is a government-imposed duty that vehicle owners must pay to legally drive their cars on public roads. It is calculated based on various factors, including the vehicle’s fuel type, carbon dioxide (CO2) emissions, and engine size. The revenue generated from car tax goes towards funding essential road infrastructure projects and maintaining a safe and efficient transportation network.

Why is Car Tax Important?

Paying car tax is not just a legal obligation; it serves several vital purposes:

- Environmental Benefits: Car tax encourages the use of environmentally friendly vehicles by imposing higher taxes on vehicles with higher CO2 emissions. This incentivizes drivers to opt for greener alternatives, reducing air pollution and promoting a more sustainable future.

- Road Safety: The funds collected from car tax contribute to road safety initiatives, such as improving road conditions, installing safety features, and enhancing traffic management systems.

- Economic Impact: Car tax generates revenue for the government, which can be reinvested in various sectors, including healthcare, education, and social welfare programs.

- Legal Compliance: Failing to pay car tax can result in severe penalties, including fines, vehicle seizure, and even prosecution. It is essential to stay compliant to avoid legal consequences and maintain a clean driving record.

Identifying Car Tax Issues

Common Tax-Related Problems

There are several scenarios where car tax issues may arise:

- Overdue Tax Payments: If you forget or delay paying your car tax, it can lead to penalties and legal complications. It is crucial to keep track of tax due dates and ensure timely payments.

- Incorrect Tax Category: Misclassification of your vehicle’s tax category can result in overpayment or underpayment of taxes. Understanding the correct tax category based on your vehicle’s specifications is essential.

- Tax Avoidance or Evasion: Deliberately avoiding or evading car tax is illegal and can have serious consequences. It is important to report any instances of tax avoidance or evasion to the appropriate authorities.

- Changes in Vehicle Ownership: When selling or buying a vehicle, it is essential to transfer or update the car tax accordingly. Failing to do so can lead to confusion and potential legal issues.

Recognizing the Signs

Here are some signs that may indicate car tax issues:

- Receipt of Penalty Notices: If you receive penalty notices or reminders for overdue tax payments, it is a clear indication that you need to take action immediately.

- Confusion Over Tax Category: If you are unsure about the correct tax category for your vehicle, it is advisable to seek clarification from the relevant authorities or consult a professional.

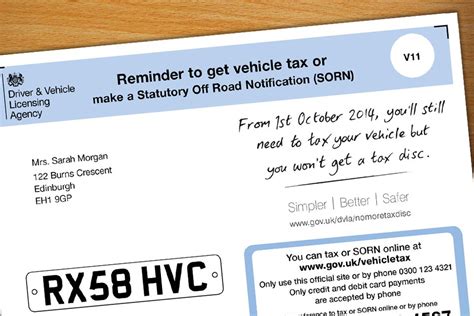

- Observing Unregistered Vehicles: If you notice vehicles on the road that appear to be unregistered or have expired tax discs, it is important to report them to the appropriate authorities.

- Suspicious Tax Avoidance Practices: Be vigilant for any suspicious activities or offers related to tax avoidance. Reporting such practices can help combat illegal activities and protect the integrity of the tax system.

Reporting Car Tax Issues

Step-by-Step Guide

1. Gather Information

Before reporting any car tax issues, gather the following information:

- Vehicle Registration Number: Note down the registration number of the vehicle in question.

- Tax-Related Details: Collect information about the tax issue, such as the due date, amount owed, or any discrepancies.

- Supporting Documents: If available, gather relevant documents, such as tax receipts, vehicle registration documents, or correspondence related to the tax issue.

2. Contact the Appropriate Authorities

- DVLA (Driver and Vehicle Licensing Agency): The DVLA is responsible for registering and taxing vehicles in the UK. You can contact them via their official website, phone, or by post. Provide them with the necessary details and explain the nature of the tax issue.

- Local Authorities: In some cases, local authorities may be involved in car tax-related matters, especially regarding local road tax or congestion charges. Check with your local council or government website for specific contact information.

- Police: If you witness or suspect tax-related offenses, such as tax evasion or fraudulent activities, it is essential to report them to the police. They have the authority to investigate and take appropriate action.

3. Provide Accurate and Detailed Information

When reporting car tax issues, ensure that you provide accurate and comprehensive information. This includes:

- Vehicle Details: Clearly state the make, model, and registration number of the vehicle.

- Tax-Related Information: Describe the nature of the tax issue, including any relevant dates, amounts, and circumstances.

- Supporting Evidence: If you have any evidence or documentation related to the issue, provide it to the authorities for a more thorough investigation.

4. Follow Up and Stay Informed

After reporting the tax issue, it is essential to follow up and stay informed about the progress:

- Keep Records: Maintain a record of all communications, including dates, times, and reference numbers, for future reference.

- Check for Updates: Regularly check the status of your report through the relevant channels provided by the authorities.

- Cooperate with Investigations: If an investigation is initiated, cooperate fully with the authorities and provide any additional information or evidence requested.

Consequences of Non-Compliance

Legal Penalties

Failing to comply with car tax regulations can result in severe legal consequences:

- Fines: Overdue tax payments or non-compliance with tax regulations may lead to substantial fines. The amount of the fine depends on the severity of the offense and the specific circumstances.

- Vehicle Seizure: In extreme cases, the authorities may seize your vehicle if it is being used without valid tax. This can result in additional costs and legal complications.

- Prosecution: Deliberate tax evasion or repeated non-compliance can lead to criminal prosecution. Convictions may result in significant fines, community service, or even imprisonment.

Impact on Insurance and Driving Record

Non-compliance with car tax regulations can also have a negative impact on your insurance coverage and driving record:

- Insurance Claims: If you are involved in an accident while driving an untaxed vehicle, your insurance claim may be denied, leaving you financially responsible for any damages.

- Driving Record: Unpaid car tax can result in a mark on your driving record, which may affect your insurance premiums and future driving privileges.

Frequently Asked Questions

How often do I need to pay car tax?

+

Car tax is typically paid annually. However, the frequency may vary depending on your vehicle's age and tax category. It is important to check the due dates and ensure timely payments to avoid penalties.

Can I transfer my car tax to a new vehicle?

+

No, car tax is specific to the vehicle and cannot be transferred. When you sell or buy a vehicle, you must update the tax details accordingly. The new owner is responsible for paying the tax for their vehicle.

What happens if I sell my vehicle before the tax expires?

+

If you sell your vehicle before the tax expires, you can apply for a tax refund. The refund amount will depend on the remaining tax period. Contact the DVLA for instructions on how to claim your refund.

Are there any exemptions or discounts for car tax?

+Yes, certain vehicles may be eligible for exemptions or reduced rates. This includes electric vehicles, disabled drivers' vehicles, and some classic cars. Check the official guidelines to see if your vehicle qualifies for any exemptions.

Conclusion

Car tax is an essential aspect of vehicle ownership, and understanding its importance and the reporting process is crucial for every driver. By staying informed, complying with tax regulations, and reporting any issues promptly, you can avoid legal complications and contribute to a safer and more sustainable road network. Remember, reporting car tax issues is not only a responsibility but also a collective effort to maintain a fair and efficient tax system. Stay vigilant, and let’s work together to ensure a smooth and compliant driving experience for all.