Ultimate Guide To Filling Out The Right To Buy Form

Understanding the Right to Buy Process

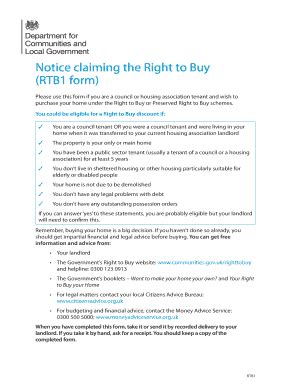

The Right to Buy scheme is a government initiative that allows secure tenants of council properties in England to purchase their home at a discounted price. This scheme empowers tenants to become homeowners, providing them with an opportunity to invest in their future and build equity. In this comprehensive guide, we will walk you through the process of filling out the Right to Buy Form, ensuring you have all the necessary information to make an informed decision and take the first step towards homeownership.

Eligibility Criteria

Before diving into the form, it’s crucial to understand the eligibility criteria for the Right to Buy scheme. Not all tenants are eligible, and there are specific requirements that must be met:

- Tenure: You must be a secure tenant of a council property. This means you have a long-term tenancy agreement with the local authority.

- Minimum Tenure: Typically, you need to have been a tenant for a certain period, often 3 years. However, this can vary depending on your local council’s policies.

- Discount Eligibility: The amount of discount you can receive is based on how long you’ve been a tenant. The longer you’ve held your tenancy, the higher the potential discount.

- Property Type: Right to Buy applies to most council-owned properties, including houses, flats, and maisonettes. However, some properties are exempt, such as those used for social care or designated as “affordable homes.”

Preparing for the Right to Buy Form

To ensure a smooth application process, it’s essential to gather the necessary documents and information before filling out the Right to Buy Form. Here’s a checklist to help you prepare:

- Tenancy Agreement: Locate and review your tenancy agreement to understand your rights and responsibilities as a tenant.

- Identification: Gather valid forms of identification, such as a passport, driving license, or national identity card.

- Proof of Address: Collect recent utility bills or bank statements that confirm your current address.

- Financial Information: Prepare recent payslips, bank statements, and any other relevant financial documents to demonstrate your ability to afford the purchase.

- Property Details: Obtain information about your property, including its address, type, and any relevant council tax or rent details.

- Contact Information: Have the contact details of your local council’s housing department readily available.

Step-by-Step Guide to Filling Out the Right to Buy Form

Now that you have gathered the necessary documents and information, let’s walk through the process of completing the Right to Buy Form:

Step 1: Access the Form

- Visit the official website of your local council or the government’s Right to Buy scheme portal.

- Look for the “Right to Buy” or “Housing” section and download the application form. Ensure you are using the most recent version of the form.

Step 2: Personal Details

- Begin by filling in your personal information, including your full name, date of birth, and contact details (address, phone number, and email).

- Provide the details of your current tenancy, such as the address of the property you wish to purchase and the date you became a tenant.

Step 3: Property Information

- In this section, provide accurate details about your property. Include the property’s address, type (house, flat, etc.), and any relevant council tax or rent information.

- If you have any doubts or concerns about the property’s eligibility, contact your local council’s housing department for clarification.

Step 4: Tenure and Discount Calculation

- Here, you will need to calculate the discount you are eligible for based on the length of your tenancy. The form will guide you through this process, providing a formula or a table to determine the discount.

- Ensure you understand the discount calculation and double-check your figures to avoid any errors.

Step 5: Financial Information

- Provide details of your financial situation, including your income, savings, and any other relevant financial commitments.

- Attach supporting documents, such as payslips and bank statements, to substantiate your financial position.

- Be honest and accurate in your financial disclosure, as it will impact your ability to proceed with the purchase.

Step 6: Declaration and Signatures

- Read and understand the declaration statement, which confirms your eligibility and commitment to the Right to Buy process.

- Sign the form in the designated area, ensuring your signature is clear and legible.

- If you are completing the form jointly with a partner or co-tenant, ensure that all parties sign the form.

Step 7: Supporting Documents

- Attach all the supporting documents you prepared earlier, such as identification, proof of address, and financial information.

- Ensure that each document is clearly labeled and easily identifiable.

- Keep a copy of the completed form and supporting documents for your records.

Step 8: Submission

- Carefully review your completed form and supporting documents to ensure accuracy and completeness.

- Submit the form and documents to your local council’s housing department following their specified instructions. This may involve mailing, emailing, or submitting the form in person.

- Keep a record of the submission date and any reference numbers provided by the council.

Notes:

📌 Note: The Right to Buy Form is a legal document, so ensure you provide accurate and truthful information. Any false statements or omissions could result in legal consequences.

📝 Note: Keep in mind that the Right to Buy process can vary slightly between local councils. Familiarize yourself with your council’s specific requirements and timelines.

💰 Note: Consider seeking professional advice, such as from a solicitor or financial advisor, to understand the potential financial implications of purchasing your council property.

The Next Steps

Once you have submitted your Right to Buy Form, the council will assess your application and provide a decision. If your application is approved, you will receive an offer letter outlining the terms and conditions of the purchase. At this stage, you can proceed with the legal process, engage a solicitor, and complete the necessary paperwork to finalize the purchase of your home.

Remember, the Right to Buy scheme is a valuable opportunity for secure tenants to become homeowners. By following this comprehensive guide and staying organized, you can navigate the process with confidence and take the first step towards achieving your homeownership goals.

FAQ

What happens if I’m not eligible for the Right to Buy scheme?

+

If you’re not eligible for the Right to Buy scheme, you may still have other options for purchasing your council property. Alternative schemes, such as the Right to Acquire or Right to Shared Ownership, might be available depending on your local council’s policies. It’s advisable to contact your local council’s housing department to explore these alternatives.

Can I apply for the Right to Buy scheme if I’m a joint tenant?

+

Yes, joint tenants can apply for the Right to Buy scheme. However, all joint tenants must be named on the application form and agree to the purchase. It’s essential to discuss the process with your co-tenants and ensure everyone is on board before proceeding.

How long does the Right to Buy process typically take?

+

The Right to Buy process can vary in duration, depending on factors such as the complexity of your application and the workload of your local council. On average, it can take several months to complete the entire process, from submitting the application to finalizing the purchase. It’s advisable to stay in touch with your local council’s housing department to keep track of the progress.

Are there any restrictions on what I can do with the property after purchasing it through the Right to Buy scheme?

+

Yes, there are certain restrictions and conditions that apply when purchasing a property through the Right to Buy scheme. These restrictions may include limitations on subletting, selling, or making significant alterations to the property. It’s crucial to understand and adhere to these conditions to avoid any legal issues or penalties. Consult your local council’s guidelines or seek legal advice for more detailed information.