Uncover The Ultimate Cost Of Band E Council Tax Now!

Understanding Council Tax and its Structure

Council Tax is a system used in England, Scotland, and Wales to fund local government services. It is a tax based on the residential property you own or occupy. Unlike other taxes, Council Tax is unique as it takes into account the number of people living in a household and their respective financial situations. This means that the cost of Council Tax can vary significantly depending on various factors.

In this blog post, we will delve into the intricacies of Council Tax, specifically focusing on Band E properties. We will explore the factors that influence the cost of Council Tax for these properties and provide you with a comprehensive understanding of the ultimate cost you may need to bear. By the end of this guide, you will have a clear picture of the financial implications associated with Band E Council Tax.

Factors Affecting Council Tax Costs

Several key factors contribute to the determination of Council Tax costs, and these factors can significantly impact the overall amount you pay. Let’s take a closer look at each of these factors:

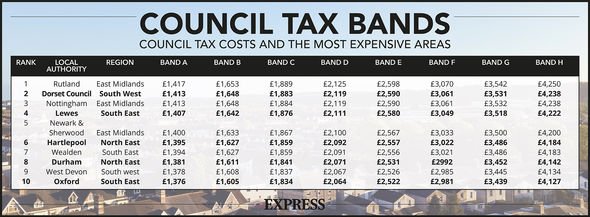

Property Valuation: Council Tax bands are determined by the valuation of your property. In England and Scotland, properties are assessed and placed into one of eight bands (A to H) based on their value as of April 1991 (1993 in Wales). Band E properties fall into the middle range, typically representing properties with a moderate level of value.

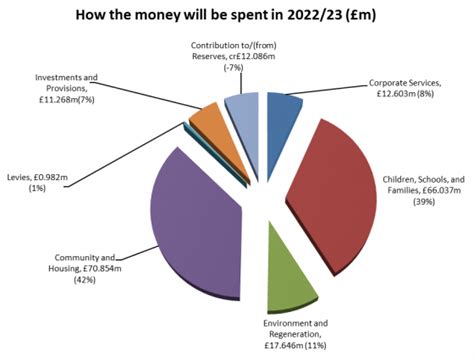

Local Authority: Each local authority or council sets its own Council Tax rates. This means that the cost of Council Tax can vary significantly from one area to another. Factors such as the level of services provided, local infrastructure projects, and the financial needs of the council influence the rates set.

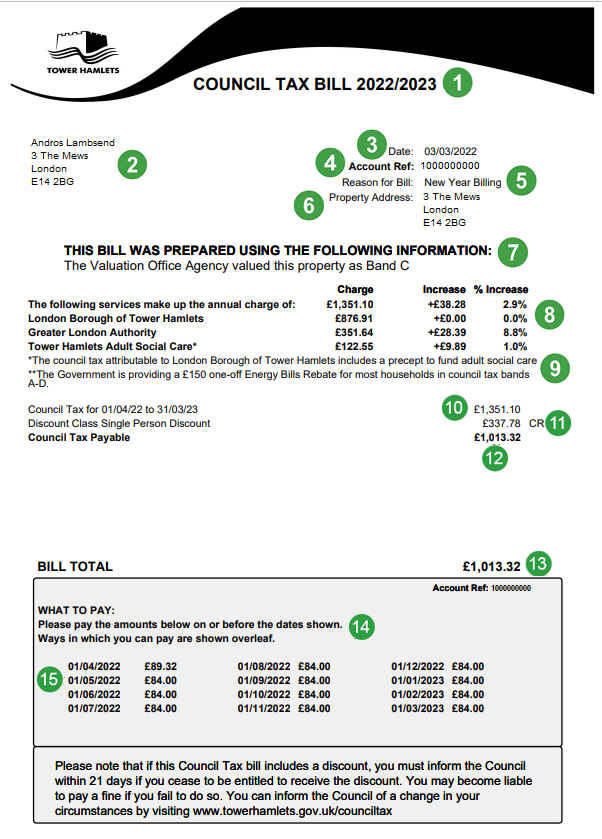

Occupancy Status: The number of people living in your household and their financial circumstances play a crucial role in determining your Council Tax liability. If you are the sole adult occupant of a Band E property, you may be eligible for a discount. However, if you have additional adults living with you, the full Council Tax rate will apply.

Discounts and Exemptions: Council Tax offers various discounts and exemptions to certain individuals or households. For example, if you are a single adult living alone in a Band E property, you may be entitled to a 25% discount. Additionally, certain properties, such as those occupied by full-time students or those with severe mental impairments, may be exempt from Council Tax altogether.

Payment Options: Councils provide different payment options for Council Tax, allowing you to choose the most suitable method. You can opt for a single annual payment, monthly installments, or even weekly payments. The payment option you choose may impact the overall cost due to potential administrative fees or interest charges.

Calculating the Ultimate Cost of Band E Council Tax

To calculate the ultimate cost of Band E Council Tax, we need to consider the combined effect of the factors mentioned above. Here’s a step-by-step guide to help you understand the process:

Step 1: Determine the Council Tax Band

- Check the valuation of your property and confirm if it falls within Band E. You can find this information on your Council Tax bill or by contacting your local authority.

Step 2: Research Local Council Tax Rates

- Visit the website of your local council or contact them directly to obtain the current Council Tax rates for Band E properties. These rates are typically published annually and may vary from one year to the next.

Step 3: Consider Occupancy Status

- Assess the number of adults living in your household. If you are the sole adult occupant, you may be eligible for a discount. However, if you have additional adults, the full Council Tax rate will apply.

Step 4: Apply Discounts and Exemptions

- Research and determine if you qualify for any discounts or exemptions based on your personal circumstances. For example, if you are a full-time student or have a severe mental impairment, you may be exempt from paying Council Tax.

Step 5: Choose a Payment Option

- Decide on the most suitable payment option for your financial situation. Consider factors such as administrative fees, interest charges, and your ability to make regular payments.

Step 6: Calculate the Ultimate Cost

- Multiply the Council Tax rate for Band E by the number of adults in your household (or apply the discount if you are the sole adult occupant).

- If you qualify for any discounts or exemptions, subtract those amounts from the calculated total.

- Finally, add any applicable administrative fees or interest charges based on your chosen payment option.

Example Calculation

Let’s illustrate the calculation process with an example. Assume you are a single adult occupant of a Band E property in a local authority with the following Council Tax rates:

- Band E Council Tax Rate: £1,200 per year

- Discount for Single Adult Occupancy: 25%

Calculation:

- Base Council Tax: £1,200

- Discount: 25% of £1,200 = £300

- Ultimate Cost: £1,200 - £300 = £900

In this example, as a single adult occupant, you would be eligible for a 25% discount on the Band E Council Tax rate, resulting in an ultimate cost of £900 per year.

Important Notes

- Council Tax rates and discounts may vary depending on your local authority and the specific circumstances of your household. It is essential to consult your local council for accurate and up-to-date information.

- The calculation provided is a simplified example and may not reflect the exact costs in your situation. It is recommended to use the official Council Tax calculators or contact your local authority for a more precise estimate.

- Remember to consider any changes in your personal circumstances, such as an increase in the number of adults in your household, as these can impact your Council Tax liability.

Conclusion

Understanding the ultimate cost of Band E Council Tax involves considering various factors, including property valuation, local authority rates, occupancy status, discounts, and payment options. By following the steps outlined in this blog post, you can estimate the financial commitment associated with owning or occupying a Band E property. Remember to stay informed about any changes in Council Tax rates and to regularly review your eligibility for discounts or exemptions. With this knowledge, you can effectively manage your Council Tax obligations and ensure a more accurate understanding of your financial responsibilities.

FAQ

How often do Council Tax rates change?

+

Council Tax rates are typically reviewed and set annually by local authorities. Changes in rates may occur from year to year, so it’s important to stay updated with the latest information from your local council.

Can I appeal my Council Tax band if I believe it is incorrect?

+

Yes, you have the right to appeal your Council Tax band if you believe it is inaccurate. You can contact the Valuation Office Agency (VOA) or your local council to initiate the appeals process. It’s important to gather evidence and provide supporting documentation to strengthen your case.

Are there any alternatives to paying Council Tax in full?

+

Yes, local authorities offer various payment options to help spread the cost of Council Tax. You can choose to pay in monthly or weekly installments, making it more manageable for your financial situation. However, it’s important to note that some payment options may incur additional administrative fees or interest charges.

What happens if I fail to pay my Council Tax?

+

If you fail to pay your Council Tax, the local authority may take legal action to recover the outstanding amount. This can include sending reminder notices, issuing a liability order, and potentially using enforcement agencies to collect the debt. It’s crucial to communicate with your local council if you are facing difficulties paying, as they may offer support or payment plans.

Are there any ways to reduce my Council Tax bill?

+Yes, there are several ways to potentially reduce your Council Tax bill. Exploring discounts and exemptions based on your personal circumstances, such as being a student, having a severe mental impairment, or being on certain benefits, can help lower your liability. Additionally, ensuring your property is accurately valued and challenging any incorrect assessments can also lead to a reduction in your Council Tax bill.