Uncover The Ultimate Guide To Contacting Council Tax Authorities Now!

Contacting the council tax authorities is an essential process for homeowners and tenants alike. Whether you're looking to clarify tax-related matters, dispute a council tax bill, or simply seek guidance on your liabilities, this comprehensive guide will lead you through the process seamlessly. Let's dive in and explore the steps to ensure a smooth interaction with the council tax authorities.

Understanding Council Tax and Its Importance

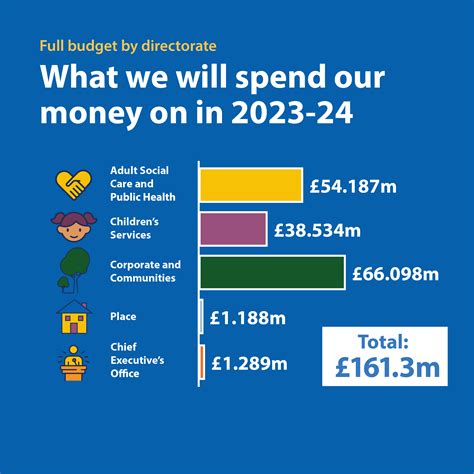

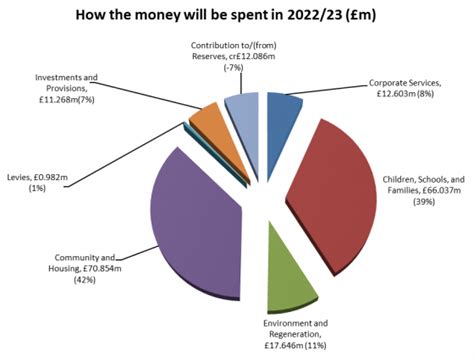

Council tax is a vital source of revenue for local authorities in the United Kingdom. It helps fund essential services such as education, social care, and waste management. As a responsible citizen, it's crucial to understand your council tax obligations and ensure accurate payments.

Identifying the Right Council Tax Authority

The first step in contacting the council tax authorities is identifying the right department or organization responsible for managing tax affairs in your area. While the UK has a unified council tax system, the administration of tax matters is often handled by local councils or government bodies.

To locate the correct authority, you can:

- Visit the official website of your local council or borough.

- Search for "council tax" followed by the name of your area on popular search engines.

- Contact the National Assessment Authority (VOA) for business rates inquiries.

Preparing for Your Council Tax Inquiry

Before reaching out to the council tax authorities, it's beneficial to gather relevant information and documents. This will streamline the process and ensure a more efficient interaction.

Documents to Have Ready

- Council tax bill or assessment notice.

- Proof of identity (e.g., passport, driving license, or national insurance number).

- Property ownership or tenancy documents.

- Bank statements or payment records related to council tax.

- Any correspondence or documents related to your inquiry.

Information to Note

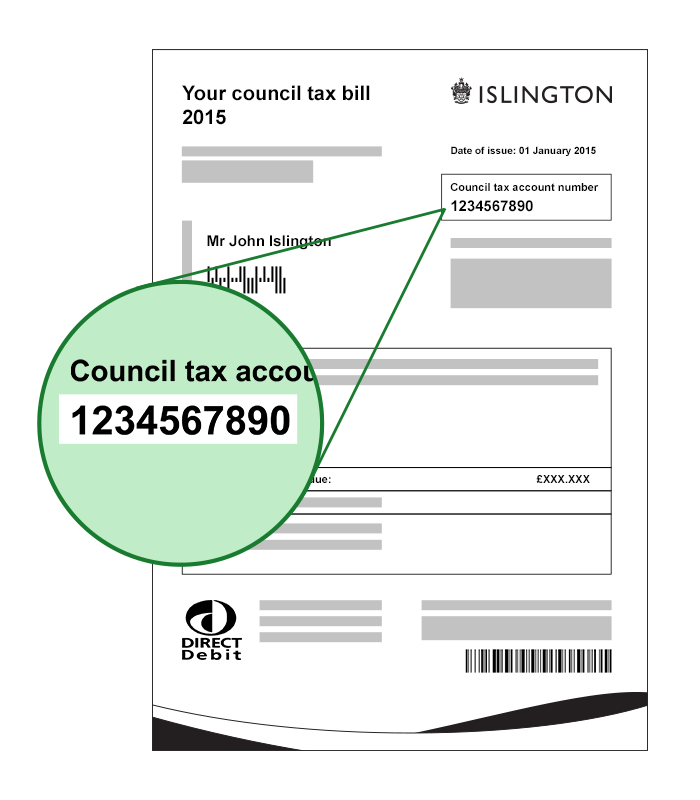

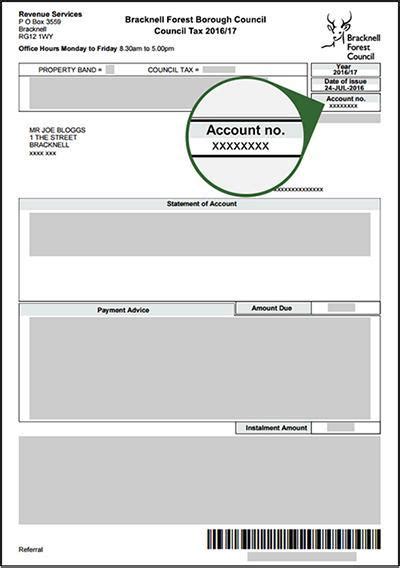

- Your council tax account number (usually found on your bill or correspondence).

- The property's address and valuation band.

- Details of any changes in circumstances (e.g., moving house, change in occupancy, or a change in personal circumstances that may affect your tax liability).

Contacting the Council Tax Authorities

Once you've identified the right authority and gathered the necessary information, it's time to initiate contact. There are several methods to reach out to the council tax authorities, and choosing the most suitable option depends on your preference and the nature of your inquiry.

Online Contact Methods

Many local councils and government bodies offer online platforms and websites where you can submit inquiries, make payments, and access valuable resources.

- Website Inquiry Forms: Look for a "Contact Us" or "Customer Services" section on the council's website. These forms often provide a convenient way to submit your inquiry, and you may receive an automated response confirming receipt.

- Online Chat or Live Support: Some councils offer real-time chat support, allowing you to connect with a customer service representative instantly. This can be especially useful for quick clarifications or simple inquiries.

- Email Correspondence: If your inquiry is more detailed or requires attachments, sending an email to the council's designated email address may be the best option. Ensure you include all relevant information and attach any necessary documents.

Telephone Support

If you prefer a more direct and personalized approach, contacting the council tax authorities via telephone can be an effective method.

- Locate the telephone number for the council tax department on the council's website or in official correspondence.

- Call during their business hours to avoid long wait times.

- Have your council tax account number and other relevant details ready when you connect with a customer service representative.

In-Person Visits

While less common, some individuals may prefer to visit the council tax office in person. This can be particularly useful if you need to submit physical documents or require immediate assistance.

- Check the council's website for the address and opening hours of their council tax office.

- Arrive prepared with all necessary documents and information.

- Be mindful of any COVID-19 related restrictions or guidelines when visiting in-person.

Common Council Tax Inquiries and How to Address Them

When contacting the council tax authorities, you may have specific inquiries or concerns. Here are some common scenarios and guidance on how to address them effectively:

Disputing a Council Tax Bill

- Gather evidence: If you believe your council tax bill is incorrect, gather supporting evidence such as property valuations, tenancy agreements, or proof of occupancy.

- Contact the council: Reach out to the council tax department and explain your dispute. Provide clear and concise details, and be prepared to discuss your evidence.

- Request a review: The council may offer a formal review process. Follow their instructions and provide any additional information they require.

Changes in Circumstances

- Notify the council: If you've experienced a change in circumstances (e.g., moving house, change in occupancy, or a significant life event), it's crucial to inform the council tax authorities promptly.

- Provide details: Explain the nature of the change and any relevant dates. This helps the council update your records accurately.

- Inquire about potential tax implications: Ask the council tax department about any potential impact on your tax liability due to the change in circumstances.

Seeking Payment Assistance

- Discuss options: If you're facing financial difficulties and need assistance with council tax payments, contact the council tax department to explore available options.

- Provide financial details: Be prepared to discuss your financial situation honestly. The council may offer payment plans, discounts, or exemptions based on your circumstances.

- Apply for benefits: Inquire about potential benefits or support programs that could help alleviate your council tax burden.

What to Expect During Your Interaction

When contacting the council tax authorities, it's helpful to have a general idea of what to expect. Here are some key points to keep in mind:

- Response Time: Depending on the method of contact and the complexity of your inquiry, response times may vary. Online forms and emails may take a few days, while telephone support often provides more immediate assistance.

- Professionalism: Council tax authorities aim to provide a professional and courteous service. However, it's essential to approach interactions with respect and patience, especially if your inquiry is complex or time-sensitive.

- Follow-up: If you haven't received a response within a reasonable timeframe, don't hesitate to follow up. This shows your commitment to resolving the matter promptly.

Additional Resources and Support

While this guide provides a comprehensive overview of contacting the council tax authorities, additional resources and support are available to enhance your understanding and navigate the process more effectively.

Online Resources

- GOV.UK Council Tax: The official UK government website offers a wealth of information on council tax, including guides, forms, and contact details for local councils.

- Money Advice Service: This independent service provides guidance on council tax, including tips on managing payments and understanding your rights.

Helpful Tools

- Council Tax Calculators: Online tools can help you estimate your council tax liability based on your property's location and valuation band. This can be a useful starting point for understanding your tax obligations.

- Council Tax Reduction Calculators: Some websites offer calculators to estimate potential reductions or exemptions based on your income and circumstances.

Seeking Professional Advice

If you have complex tax matters or require specialized advice, consider consulting a tax professional or accountant. They can provide tailored guidance and ensure you navigate the council tax landscape effectively.

Conclusion and Next Steps

Contacting the council tax authorities is a crucial step in managing your tax obligations and ensuring compliance with local regulations. By following the steps outlined in this guide, you can approach the process with confidence and clarity. Remember to gather relevant information, choose the most suitable contact method, and seek additional support when needed.

As you navigate the world of council tax, stay informed about any changes in legislation or local policies. Regularly review your council tax bill and keep an eye out for any discrepancies or updates. By staying proactive and engaged, you can ensure a smooth and stress-free relationship with the council tax authorities.

How often should I contact the council tax authorities for updates on my account?

+It’s generally recommended to review your council tax account annually, especially if your circumstances have changed. However, if you have specific concerns or inquiries, don’t hesitate to contact the authorities promptly.

Can I make council tax payments online securely?

+Yes, most local councils offer secure online payment portals. Ensure you’re on the official council website and look for the padlock icon in the address bar, indicating a secure connection.

What happens if I fail to pay my council tax on time?

+Late or non-payment of council tax can result in penalties, interest charges, and even legal action. It’s crucial to stay on top of your payments to avoid these consequences.

Are there any exemptions or discounts available for council tax?

+Yes, various exemptions and discounts may apply, such as discounts for single occupancy, disabled person discounts, or exemptions for students or those on low incomes. Contact your local council to inquire about your eligibility.

Can I appeal a council tax valuation if I believe it’s incorrect?

+Yes, you have the right to appeal a council tax valuation if you believe it’s inaccurate. Contact the Valuation Office Agency (VOA) to initiate the appeals process. They will guide you through the necessary steps and provide information on deadlines and requirements.