Uncover Ultimate Emergency Funds Now

In today's unpredictable world, having an emergency fund is crucial to financial stability and peace of mind. It acts as a safety net, providing a buffer against unexpected expenses and potential financial setbacks. Building an emergency fund is an essential step towards achieving long-term financial security, as it allows individuals to navigate life's unforeseen challenges with confidence.

This comprehensive guide will walk you through the ins and outs of emergency funds, offering valuable insights and practical steps to help you establish and maintain a robust financial safety net. From understanding the importance of emergency funds to determining the right amount for your situation and exploring various savings strategies, we've got you covered.

Understanding the Importance of Emergency Funds

Emergency funds play a vital role in safeguarding your financial well-being. They provide a crucial layer of protection against unexpected expenses, such as medical emergencies, car repairs, or sudden job loss. By having a dedicated fund, you can avoid relying on high-interest credit cards or loans, which can lead to a cycle of debt and financial stress.

Furthermore, emergency funds offer a sense of security and control during uncertain times. They empower you to make informed decisions without being rushed into financial compromises. Whether it's covering unexpected home repairs or providing a financial cushion during a temporary income disruption, emergency funds act as a reliable backup plan.

Determining the Right Amount for Your Emergency Fund

The amount you should save for your emergency fund depends on various factors, including your financial situation, income stability, and personal circumstances. While there is no one-size-fits-all answer, experts generally recommend saving between three and six months' worth of living expenses. This range allows for a comfortable safety net, providing sufficient coverage for most unexpected expenses.

However, it's essential to consider your individual needs and risk tolerance. If you have a stable income and few financial obligations, you may be comfortable with a smaller emergency fund. On the other hand, individuals with variable income or those who rely on a single source of income may benefit from a larger fund to provide a more extensive safety net.

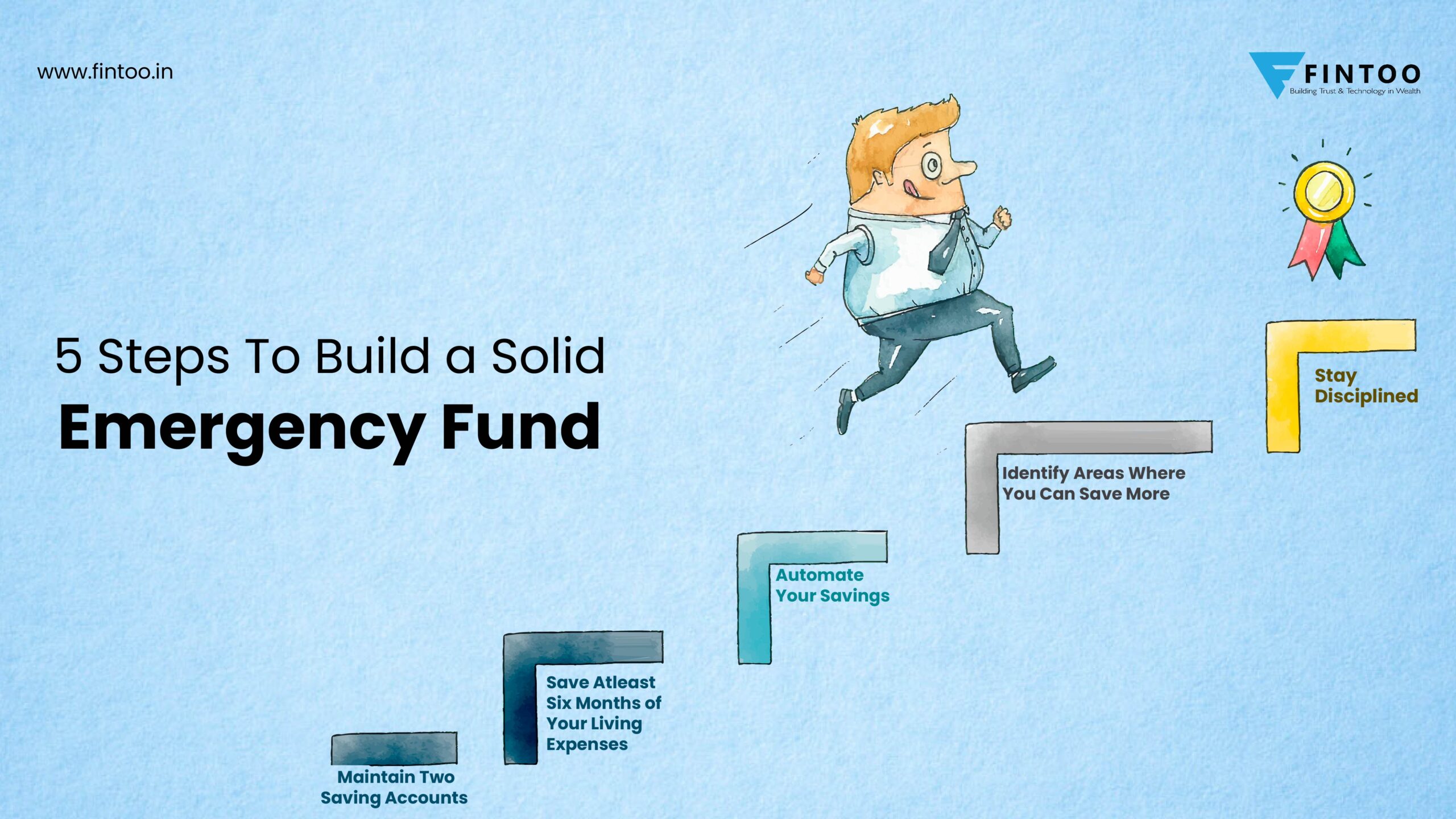

Building Your Emergency Fund: Strategies and Tips

1. Set Clear Goals

Define your emergency fund goal by calculating your monthly expenses, including essentials like rent, utilities, groceries, and transportation. Multiply this amount by the number of months you aim to cover (e.g., three to six months). This will give you a clear target to work towards.

2. Automate Your Savings

Make saving for your emergency fund effortless by setting up automatic transfers from your paycheck or regular income source to a dedicated savings account. This way, you won't have to remember to save manually, and your savings will grow steadily over time.

3. Explore High-Yield Savings Accounts

Consider opening a high-yield savings account specifically for your emergency fund. These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster. Research and compare different options to find the best fit for your needs.

4. Cut Unnecessary Expenses

Take a close look at your budget and identify areas where you can cut back on unnecessary expenses. Reducing discretionary spending, such as dining out or subscription services, can free up additional funds for your emergency fund. Even small changes can make a significant impact over time.

5. Utilize Windfalls and Bonuses

When you receive unexpected windfalls, such as tax refunds or bonuses, consider allocating a portion of these funds to your emergency savings. This is an excellent opportunity to boost your savings quickly and get closer to your goal.

6. Prioritize Debt Repayment

If you have high-interest debt, such as credit card balances, prioritize repaying them before building your emergency fund. While it's important to have a safety net, paying off debt can save you money in the long run by reducing interest charges. Once your debt is under control, you can focus on saving aggressively for your emergency fund.

Maintaining Your Emergency Fund

Once you've built your emergency fund, it's crucial to maintain and regularly review it. Here are some tips to ensure your fund remains effective:

- Regularly top up your emergency fund to maintain the desired balance.

- Review your emergency fund amount periodically to ensure it aligns with your current financial situation and expenses.

- Consider adjusting your savings rate or allocating a portion of your income directly to your emergency fund.

- Stay disciplined and avoid dipping into your emergency fund for non-essential expenses.

Notes

💡 Note: Remember, building an emergency fund is a journey, and it may take time to reach your goal. Stay committed, and don't be discouraged by setbacks. Your financial security is worth the effort!

Conclusion

An emergency fund is a crucial aspect of financial planning, offering a safety net during unexpected situations. By understanding the importance of emergency funds, determining the right amount, and implementing effective savings strategies, you can establish a robust financial safety net. Regularly maintain and review your fund to ensure it remains a reliable source of support. With a well-prepared emergency fund, you can navigate life's challenges with confidence and peace of mind.

FAQ

What is an emergency fund, and why is it important?

+

An emergency fund is a dedicated savings account set aside for unexpected expenses. It provides financial security and peace of mind during unforeseen circumstances, such as medical emergencies, job loss, or major home repairs. Having an emergency fund ensures you can cover these expenses without relying on high-interest loans or credit cards, which can lead to a cycle of debt.

How much should I save for my emergency fund?

+

The recommended amount for an emergency fund typically ranges from three to six months’ worth of living expenses. This range allows for a comfortable safety net, covering most unexpected expenses. However, your specific financial situation and risk tolerance may influence the exact amount you should save.

What are some effective strategies to build my emergency fund quickly?

+

To build your emergency fund quickly, consider the following strategies: automate your savings by setting up regular transfers, cut back on unnecessary expenses, utilize windfalls and bonuses, and prioritize debt repayment if you have high-interest debt. Additionally, explore high-yield savings accounts to maximize the growth of your emergency fund.

How often should I review and adjust my emergency fund?

+

It’s essential to review and adjust your emergency fund regularly, ideally at least once a year or whenever your financial situation changes significantly. This ensures your fund remains adequate to cover your current expenses and provides a sufficient safety net. Regular reviews allow you to make necessary adjustments and stay on track with your financial goals.

What should I do if I need to use my emergency fund?

+If you find yourself in a situation where you need to use your emergency fund, it’s important to remember that it’s there for a reason. Use the funds to cover the unexpected expense and then make a plan to replenish your emergency fund as soon as possible. Consider increasing your savings rate or finding ways to cut back on expenses to rebuild your financial safety net.