What Hmo Stand For

Understanding the Healthcare System: Unraveling the Meaning of HMO

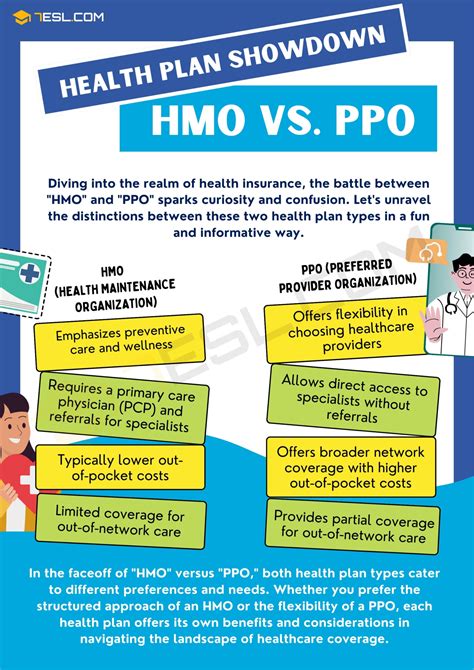

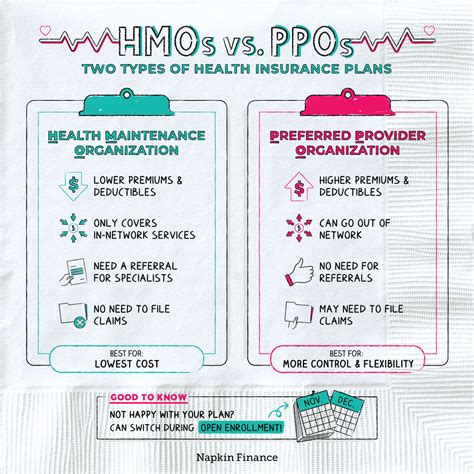

When it comes to navigating the complex world of healthcare, you might have come across the term “HMO” and wondered what it stands for. HMO, or Health Maintenance Organization, is a type of healthcare plan that offers a unique approach to managing your medical needs. In this blog post, we will delve into the meaning of HMO, how it works, and its benefits and considerations.

What is an HMO?

An HMO is a prepaid healthcare plan that provides comprehensive medical services to its members. It operates on the principle of coordinating and managing healthcare services to ensure efficient and cost-effective care. HMOs typically have a network of healthcare providers, including doctors, hospitals, and specialists, with whom they have negotiated discounted rates for their members.

How Does an HMO Work?

To understand how an HMO functions, let’s break down the key components:

- Network of Providers: HMOs maintain a network of contracted healthcare professionals and facilities. Members are required to choose a primary care physician (PCP) from this network, who acts as their initial point of contact for any medical concerns.

- Primary Care Physician (PCP): The PCP plays a crucial role in an HMO plan. They serve as the gatekeeper to the healthcare system, coordinating and managing all aspects of your care. Whether it’s referring you to specialists, ordering tests, or prescribing medications, your PCP ensures that you receive the necessary treatment within the HMO network.

- Referrals and Pre-authorization: In an HMO plan, referrals from your PCP are often required for specialist care or certain procedures. Additionally, pre-authorization may be necessary for specific services or treatments. This process helps ensure that the care provided is necessary and cost-effective.

- Out-of-Network Care: While HMOs encourage members to seek care within their network, they may provide limited coverage for out-of-network services. However, it’s important to note that out-of-network care can be more expensive and may require additional out-of-pocket expenses.

Benefits of an HMO Plan

Choosing an HMO plan offers several advantages:

- Comprehensive Coverage: HMOs typically provide a wide range of medical services, including preventive care, doctor visits, hospital stays, and prescription medications. This comprehensive coverage ensures that your healthcare needs are well-managed.

- Cost-Effectiveness: With negotiated rates and a focus on preventive care, HMOs often offer more affordable healthcare options. Members usually have lower out-of-pocket costs, making it a budget-friendly choice.

- Coordinated Care: The involvement of a PCP ensures that your healthcare is well-coordinated. Your PCP can provide referrals, manage your medical records, and ensure that you receive appropriate and timely care.

- Preventive Care Emphasis: HMOs place a strong emphasis on preventive care, encouraging regular check-ups, screenings, and immunizations. This proactive approach can help identify and address health issues early on.

Considerations and Limitations

While HMOs offer many benefits, there are some considerations to keep in mind:

- Limited Choice of Providers: HMOs have a network of contracted providers, which means you may have a more limited choice compared to other plans. If you have a preferred doctor or specialist outside the network, you might need to switch plans.

- Referral Requirements: Obtaining referrals from your PCP can be a necessary step for certain services. While this ensures coordinated care, it may add an extra layer of bureaucracy.

- Out-of-Network Costs: As mentioned earlier, out-of-network care can be costly. It’s important to understand the extent of your coverage and potential out-of-pocket expenses before seeking care outside the HMO network.

Choosing the Right HMO Plan

When selecting an HMO plan, consider the following factors:

- Network of Providers: Review the HMO’s network to ensure that your preferred healthcare professionals and facilities are included.

- Covered Services: Understand the scope of coverage provided by the plan. Check for any exclusions or limitations that may impact your specific healthcare needs.

- Cost and Out-of-Pocket Expenses: Compare the premiums, deductibles, and co-pays associated with different HMO plans. Assess whether the plan aligns with your budget and financial goals.

- Customer Service and Reviews: Research the HMO’s reputation and customer satisfaction. Read reviews and seek recommendations to get a sense of the plan’s overall performance.

Frequently Asked Questions

Can I choose my own doctor with an HMO plan?

+

Yes, you can choose your own doctor within the HMO's network of providers. However, it's important to ensure that your preferred doctor is part of the network before enrolling in the plan.

What happens if I need to see a specialist with an HMO plan?

+

In an HMO plan, you typically need a referral from your PCP to see a specialist. Your PCP will assess your medical needs and provide the necessary referral if required.

Are there any age restrictions for HMO plans?

+

HMO plans are generally available to individuals of all ages. However, some plans may have specific age requirements or offer different benefits for different age groups.

Can I switch my HMO plan if I'm not satisfied?

+

Yes, you have the option to switch your HMO plan during open enrollment periods or if you experience a qualifying life event. It's important to review your options and choose a plan that best suits your needs.

Wrapping Up

Understanding the meaning of HMO is crucial when navigating the healthcare system. HMOs offer a coordinated and cost-effective approach to managing your medical needs, with a focus on preventive care and efficient care coordination. While they provide comprehensive coverage, it’s essential to consider the limitations and choose a plan that aligns with your healthcare preferences and financial situation.

By exploring the benefits and considerations of HMO plans, you can make an informed decision and take control of your healthcare journey. Remember to review the network of providers, covered services, and out-of-pocket expenses to find the right HMO plan for your individual needs.