What Is An Hmo Property

An HMO (House in Multiple Occupation) property is a unique type of residential accommodation that caters to a specific market and comes with its own set of regulations and considerations. In this blog post, we will delve into the world of HMO properties, exploring what they are, their characteristics, and the benefits they offer to both landlords and tenants.

Understanding HMO Properties

HMO properties, often referred to as "houses of multiple occupancy," are dwellings that are occupied by three or more people who are not from the same household. These individuals share facilities such as kitchens, bathrooms, and living areas. HMO properties are commonly found in urban areas, particularly in student-populated neighborhoods or city centers where rental demand is high.

Key Characteristics of HMO Properties

Occupancy

The defining feature of an HMO property is its multiple occupancy. Unlike traditional rental properties where a single family or group of friends reside, HMO properties accommodate a larger number of individuals, often consisting of students, young professionals, or individuals seeking affordable housing options.

Shared Facilities

In an HMO property, tenants share essential amenities. This includes communal kitchens, where residents can prepare meals, and shared bathrooms, ensuring convenience and cost-effectiveness. Additionally, HMO properties may offer shared living spaces, providing an opportunity for tenants to socialize and build a sense of community.

Regulations and Licensing

HMO properties are subject to specific regulations to ensure the safety and well-being of tenants. Landlords are required to obtain an HMO license from their local authority, which involves meeting certain standards related to fire safety, electrical installations, and overall property maintenance. These regulations aim to provide a secure and comfortable living environment for all occupants.

Benefits of HMO Properties

Higher Rental Income

One of the primary advantages of investing in HMO properties is the potential for increased rental income. By renting out individual rooms within the property, landlords can charge separate rents, resulting in a higher overall income compared to traditional single-family rentals. This makes HMO properties an attractive option for investors seeking higher yields.

Stable Tenancy

HMO properties often attract long-term tenants, particularly students or young professionals. The shared nature of the accommodation fosters a sense of community, leading to a lower turnover rate. This stability provides landlords with a consistent stream of rental income and reduces the time and effort required for tenant turnover.

Low Maintenance Costs

The shared facilities in HMO properties can result in lower maintenance costs for landlords. With multiple tenants sharing amenities, the burden of maintaining and repairing these areas is distributed. Additionally, HMO properties are typically well-maintained by the tenants themselves, further reducing the maintenance responsibilities of the landlord.

Flexibility and Adaptability

HMO properties offer flexibility in terms of tenant demographics and occupancy rates. Landlords can cater to different market segments, such as students, young professionals, or short-term renters, depending on the location and demand. This adaptability allows for a more diverse tenant base and the ability to adjust to changing market conditions.

Considerations for Investing in HMO Properties

Legal Requirements

Before investing in an HMO property, it is crucial to understand the legal requirements and regulations associated with this type of accommodation. Obtaining an HMO license, complying with safety standards, and ensuring proper documentation are essential steps to avoid legal issues and penalties.

Tenant Management

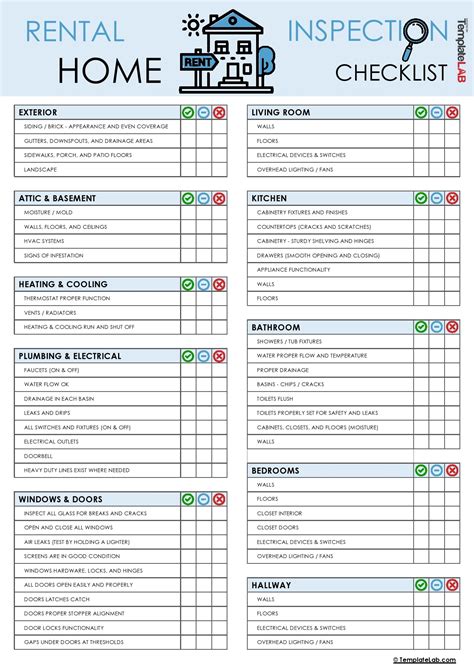

Managing multiple tenants in an HMO property requires effective communication and organization. Landlords should establish clear rules and expectations for tenants, ensuring a harmonious living environment. Regular inspections and prompt maintenance are also necessary to maintain the property’s condition and address any issues that may arise.

Location and Demand

The success of an HMO property heavily relies on its location and the demand for such accommodation. Researching the local market, identifying areas with a high demand for shared housing, and considering factors such as proximity to universities, transportation hubs, and amenities are crucial steps in finding the right investment opportunity.

Maximizing Returns on HMO Properties

Quality Furnishings

Investing in high-quality furnishings and appliances can enhance the overall tenant experience and attract desirable renters. Providing comfortable and well-equipped bedrooms, as well as functional communal areas, can set your HMO property apart from the competition and command higher rents.

Regular Maintenance

Consistent maintenance is key to ensuring the long-term success of your HMO property. Regular inspections, timely repairs, and a proactive approach to maintenance issues will not only keep your tenants happy but also extend the lifespan of your investment. Building a good relationship with reliable contractors can streamline the maintenance process.

Marketing and Tenant Selection

Effective marketing is essential to attract the right tenants for your HMO property. Utilize online platforms, social media, and local advertising to reach your target audience. Additionally, carefully screening potential tenants and implementing a thorough application process can help minimize the risk of tenant-related issues.

Case Study: A Successful HMO Investment

Let's explore a real-life example of a successful HMO investment to gain insights into the potential returns and challenges associated with this type of property.

The Property

Mr. Johnson, an experienced landlord, purchased a three-bedroom terraced house in a popular student area. The property was located within walking distance of a renowned university, making it an ideal location for student accommodation.

Renovation and Licensing

Mr. Johnson invested in extensive renovations to transform the property into an HMO. He upgraded the kitchen and bathrooms, installed fire safety measures, and ensured compliance with all HMO regulations. The property was then licensed by the local authority, allowing him to legally operate as an HMO landlord.

Rental Strategy

Mr. Johnson implemented a strategic rental approach, renting out each bedroom separately. He advertised the rooms online, targeting students and young professionals. By offering competitive rents and providing high-quality furnishings, he attracted a steady stream of tenants, ensuring a full occupancy rate.

Results

Over the course of three years, Mr. Johnson’s HMO investment proved to be highly successful. The property generated a substantial income, with rents consistently higher than those of traditional single-family rentals in the area. The stable tenancy and low maintenance costs contributed to a healthy cash flow, allowing Mr. Johnson to further expand his property portfolio.

Conclusion

HMO properties present an exciting investment opportunity for landlords seeking higher rental yields and a stable income stream. By understanding the characteristics, benefits, and considerations associated with HMO properties, investors can make informed decisions and maximize their returns. Whether you're a seasoned landlord or a first-time investor, exploring the world of HMO properties can open up new avenues for growth and success in the rental market.

What is the minimum number of occupants required for a property to be classified as an HMO?

+An HMO property typically requires a minimum of three occupants who are not from the same household. This criterion defines the shared nature of the accommodation and distinguishes it from traditional rental properties.

Are there any tax benefits associated with owning an HMO property?

+Yes, HMO properties may offer certain tax advantages. Landlords can claim deductions for expenses related to maintaining and operating the property, such as repairs, maintenance, and mortgage interest. It’s advisable to consult a tax professional for specific advice.

What are the key considerations when managing an HMO property?

+Managing an HMO property involves several key considerations, including regular maintenance, effective communication with tenants, compliance with health and safety regulations, and ensuring a harmonious living environment. It’s crucial to stay organized and proactive to maintain a successful HMO investment.

Can HMO properties be a good option for long-term investments?

+Absolutely! HMO properties can be an excellent long-term investment strategy. The stable tenancy, higher rental income, and potential for capital appreciation make HMO properties a desirable option for investors seeking consistent and sustainable returns over an extended period.

What are some common challenges faced by HMO landlords?

+HMO landlords may encounter challenges such as tenant turnover, managing multiple tenants simultaneously, and ensuring compliance with strict regulations. However, with proper planning, effective tenant management, and a proactive approach to maintenance, these challenges can be overcome.