Ultimate Guide To Gov Vehicle Tax: 8 Expert Tips

Gov Vehicle Tax: A Comprehensive Overview for Effective Management

Vehicle tax, often referred to as road tax or vehicle excise duty (VED), is a crucial aspect of vehicle ownership in the UK. It is a legal requirement for most vehicles used on public roads to be taxed, and understanding the ins and outs of vehicle tax is essential for any driver. In this comprehensive guide, we will delve into the world of Gov Vehicle Tax, providing you with expert tips and insights to navigate the process smoothly. Whether you’re a new driver or an experienced motorist, this guide will ensure you stay compliant and make the most of your vehicle tax.

1. Understanding Vehicle Tax Categories

Vehicle tax is categorized into different classes based on various factors, including the vehicle’s type, age, fuel type, and emissions. Familiarizing yourself with these categories is crucial as it determines the applicable tax rate and any potential exemptions. Here’s a breakdown of the main vehicle tax categories:

- Private Cars and Motorcycles: The tax rate for private cars and motorcycles is primarily based on their CO2 emissions. Vehicles with lower emissions attract lower tax rates, while those with higher emissions face higher charges.

- Light Goods Vehicles (LGVs): LGVs, such as vans and pick-up trucks, have a separate tax structure. The rate depends on the vehicle’s weight, with lighter vehicles attracting lower taxes.

- Heavy Goods Vehicles (HGVs): HGVs, including trucks and large vans, have a complex tax system based on their gross vehicle weight, engine size, and fuel type.

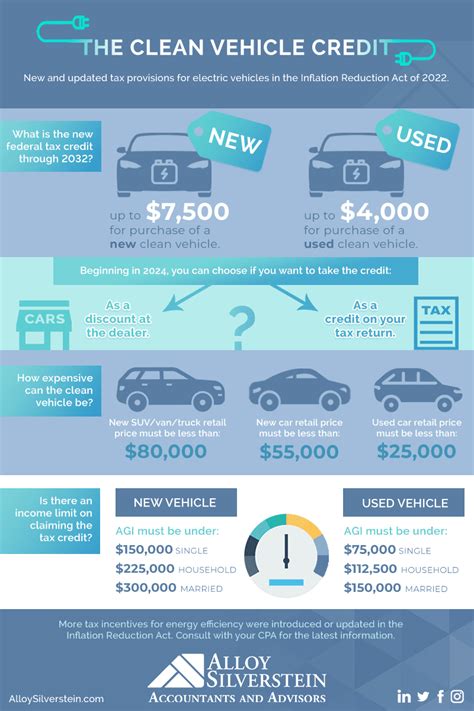

- Alternative Fuel Vehicles: Electric, hybrid, and hydrogen-powered vehicles often benefit from reduced or zero vehicle tax due to their environmentally friendly nature.

- Classic and Historic Vehicles: Older vehicles, typically over 40 years old, may be exempt from vehicle tax if they meet certain criteria and are used for specific purposes.

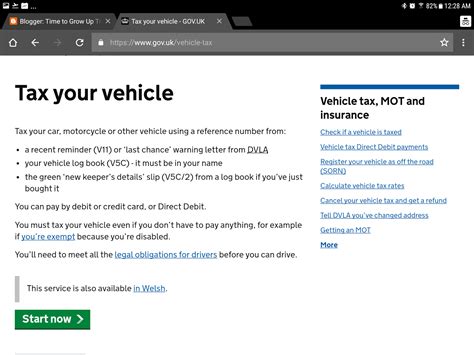

2. Online Taxing: A Convenient Option

One of the most convenient ways to pay your vehicle tax is through the government’s online portal. This method offers several advantages:

- Efficiency: Online taxing is quick and straightforward, allowing you to complete the process in a matter of minutes.

- Flexibility: You can choose the duration of your tax, from a month to a year, depending on your needs and budget.

- Payment Options: Various payment methods are available, including credit or debit cards, making it convenient for different users.

- Instant Confirmation: Upon successful payment, you receive an instant confirmation email, ensuring peace of mind.

3. Paper Tax Discs: A Thing of the Past

In 2014, the government phased out paper tax discs, replacing them with an electronic system. This change means you no longer receive a physical tax disc to display on your vehicle’s windscreen. Instead, the vehicle’s registration details, including its tax status, are stored electronically.

While you no longer need to display a tax disc, it’s essential to keep your vehicle taxed to avoid penalties. You can check the tax status of any vehicle by visiting the Gov.uk website and entering the registration number.

4. New Vehicle Tax Rates and Changes

Vehicle tax rates are subject to periodic changes, so staying updated is crucial. The government may introduce new tax bands, adjust existing rates, or introduce incentives for environmentally friendly vehicles. Here are some key points to consider:

- First-Year Rates: Vehicles registered after April 1, 2017, may be subject to a higher first-year rate, depending on their CO2 emissions.

- Standard Rates: Standard vehicle tax rates apply to most vehicles and are based on their emissions and fuel type.

- Alternative Fuel Incentives: The government often provides incentives for electric and hybrid vehicles, offering reduced or zero vehicle tax.

- Diesel Surcharge: Some diesel vehicles may incur an additional surcharge due to their higher emissions.

5. Taxing a New or Second-Hand Vehicle

When you purchase a new or second-hand vehicle, you must ensure it is taxed before using it on public roads. Here’s a step-by-step guide:

- New Vehicles: If you buy a new vehicle from a dealership, the dealer will usually handle the taxing process for you. However, it’s essential to confirm this and provide the necessary information.

- Second-Hand Vehicles: For second-hand vehicles, you’ll need to tax the vehicle yourself. You can do this online or by visiting a Post Office that offers vehicle tax services. You’ll need the vehicle’s log book (V5C) and the 11-digit reference number on the tax reminder letter (V11).

6. Tax Refunds and Exemptions

In certain situations, you may be eligible for a vehicle tax refund or exemption. Here are some common scenarios:

- Selling or Scrapping Your Vehicle: If you sell or scrap your vehicle, you can apply for a tax refund for the remaining period of the tax year.

- Disabled Drivers: Disabled drivers may be entitled to a vehicle tax discount or exemption if their vehicle is adapted for their needs.

- Classic and Historic Vehicles: As mentioned earlier, older vehicles may be exempt from vehicle tax if they meet specific criteria.

- Off-Road Vehicles: If your vehicle is not used on public roads and is kept off-road, you can declare it as “off-road” and avoid paying vehicle tax.

7. Avoiding Penalties and Staying Compliant

Failing to pay your vehicle tax can result in severe penalties, including fines and even vehicle seizure. Here are some tips to avoid penalties:

- Set Reminders: Set up reminders for your vehicle tax renewal dates to ensure you don’t miss the deadline.

- Keep Records: Maintain a record of your vehicle tax payments and keep the confirmation emails for future reference.

- Report Changes: If you sell your vehicle or make significant modifications, report these changes to the DVLA to avoid any discrepancies.

- Check Regularly: Regularly check the tax status of your vehicle and ensure it remains valid.

8. Understanding Tax Bands and Emissions

Vehicle tax bands are determined by the vehicle’s CO2 emissions, and understanding these bands is crucial for calculating the applicable tax rate. Here’s a simplified breakdown:

| Band | CO2 Emissions (g/km) | Tax Rate |

|---|---|---|

| A | 0–100 | £0 |

| B | 101–110 | £15 |

| C | 111–130 | £30 |

| D | 131–150 | £115 |

| E | 151–170 | £140 |

| F | 171–190 | £160 |

| G | 191–225 | £205 |

| H | 226–255 | £505 |

| I | 256+ | £540 |

Please note that these rates are subject to change, and it’s essential to refer to the official Gov.uk website for the most up-to-date information.

Notes:

💡 Note: It’s important to keep your vehicle taxed even if it’s not in use. Uninsured and untaxed vehicles can be seized by the authorities.

⚠️ Note: Failure to tax your vehicle can result in a fine of up to £1,000. It’s crucial to stay compliant to avoid legal consequences.

📝 Note: Always keep a record of your vehicle tax payments and confirmation emails. These documents can be useful in case of any disputes or inquiries.

Final Thoughts

Managing your vehicle tax effectively is essential for any responsible driver. By understanding the different tax categories, staying updated with changes, and utilizing online taxing options, you can ensure a smooth and compliant experience. Remember to keep your vehicle taxed at all times and take advantage of any available exemptions or discounts. With this comprehensive guide, you’re well-equipped to navigate the world of Gov Vehicle Tax with confidence.

FAQ

How often do I need to renew my vehicle tax?

+

Vehicle tax typically needs to be renewed annually, but you can also choose shorter periods like 6 or 12 months. It’s important to set reminders to avoid missing the renewal date.

Can I get a refund if I sell my vehicle mid-tax year?

+

Yes, you can apply for a refund if you sell your vehicle or it’s declared off-road before the end of the tax year. You’ll need to provide the necessary details and follow the refund process on the Gov.uk website.

Are there any discounts for electric or hybrid vehicles?

+

Yes, electric and hybrid vehicles often benefit from reduced or zero vehicle tax due to their low emissions. The government encourages the use of environmentally friendly vehicles by offering these incentives.

What happens if I fail to tax my vehicle on time?

+

Failing to tax your vehicle on time can result in a fine and even the seizure of your vehicle. It’s crucial to stay compliant and avoid any legal consequences.

Can I tax my vehicle online if I don’t have a bank account?

+

Yes, you can still tax your vehicle online without a bank account. You can use a prepaid card or pay by cash at a Post Office that offers vehicle tax services.