Uncover The Ultimate Guide To Band F Council Tax Costs Now

Exploring the complexities of local government finances, this guide delves into the intricacies of band F council tax costs, providing a comprehensive understanding of the factors that influence these expenses. By unraveling the nuances of property valuation, council tax bands, and the calculation of council tax liabilities, this article aims to equip homeowners and property owners with the knowledge necessary to navigate the financial landscape of local taxation.

Understanding Council Tax Bands

Council tax is a vital source of revenue for local authorities in the United Kingdom, contributing to the funding of essential services such as education, social care, and waste management. To ensure a fair and equitable distribution of the tax burden, properties are categorized into various bands based on their market value as of a specific date, typically 1991 for England and Scotland, and 2003 for Wales.

Band F represents a specific range of property values, with each band corresponding to a different level of council tax liability. The properties within band F are generally considered to be of medium to high value, falling between the values of bands E and G. It is important to note that the exact value ranges for each band can vary across different local authorities, as they are determined by the valuation office agency (VOA) or the Scottish assessors.

The council tax system aims to strike a balance between fairness and practicality. By grouping properties into bands, it simplifies the tax assessment process and ensures that properties of similar value are taxed at the same rate. This banding system also allows local authorities to set different tax rates for each band, providing a degree of flexibility in revenue generation.

Factors Influencing Band F Council Tax Costs

Several key factors come into play when determining the council tax costs for properties in band F. Understanding these factors is essential for property owners to assess their financial obligations accurately.

Property Value and Location

The market value of a property is a significant determinant of its council tax band. Properties within band F are typically valued higher than those in bands A to E, indicating a higher level of desirability and often a more central location. The location of a property can also influence its council tax band, as properties in desirable areas or with certain amenities may be valued higher.

Council Tax Rates and Bands

Local authorities have the autonomy to set their own council tax rates and bands within the guidelines provided by central government. This means that the council tax liability for a property in band F can vary depending on the local authority it falls under. Some authorities may have higher tax rates to fund specific local initiatives or to address budget shortfalls, while others may have lower rates to encourage economic growth.

Discounts and Exemptions

Certain circumstances can lead to discounts or exemptions from paying council tax. For example, if a property is unoccupied or is the sole residence of a full-time student, it may be eligible for a discount. Additionally, properties that are occupied by certain vulnerable individuals, such as those with severe mental impairments, may be exempt from paying council tax altogether. It is important for property owners to be aware of these potential discounts and exemptions to ensure they are not overpaying.

Calculating Council Tax Liability for Band F Properties

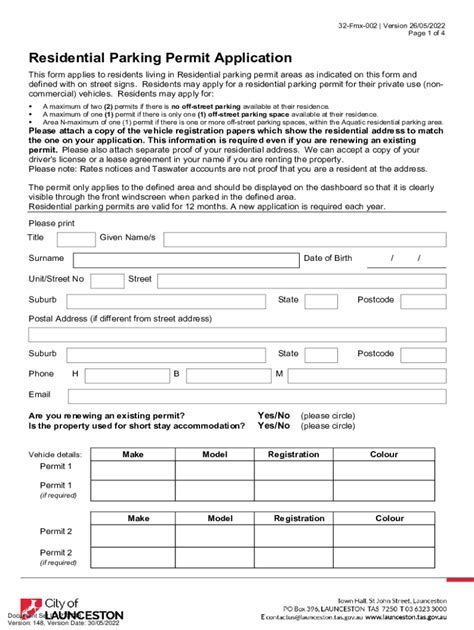

Calculating the council tax liability for a band F property involves a straightforward process. Here is a step-by-step guide to understanding the calculation:

-

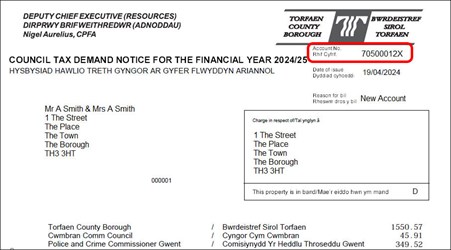

Determine the Council Tax Band: First, identify whether your property falls within band F. This information can be obtained from your council tax bill or by contacting your local authority.

-

Find the Council Tax Rate: Each local authority sets its own council tax rate for each band. You can find this information on the local authority's website or by contacting them directly. The rate is typically expressed as a percentage.

-

Calculate the Annual Council Tax: To calculate the annual council tax liability for your band F property, simply multiply the council tax rate by the value of your property. For example, if the council tax rate is 1.5% and your property is valued at £200,000, your annual council tax would be £3,000.

It is important to note that council tax rates and bands can change annually, so it is advisable to check the latest information from your local authority to ensure accuracy.

Tips for Reducing Council Tax Costs

While council tax is a mandatory expense for property owners, there are some strategies that can help reduce the financial burden. Here are a few tips to consider:

-

Review Your Council Tax Band: If you believe your property has been incorrectly banded, you have the right to appeal. Contact your local authority to initiate the appeals process, providing evidence to support your case.

-

Explore Discounts and Exemptions: As mentioned earlier, certain circumstances may qualify you for discounts or exemptions. Ensure you are aware of these options and take advantage of them if applicable.

-

Consider Sharing the Property: If you live with others, you may be eligible for a discount on your council tax. For example, if you share a property with one other person, you could receive a 25% discount. However, it is important to check the specific rules and regulations in your area.

-

Make Energy Efficiency Improvements: Investing in energy-efficient upgrades for your property can not only reduce your energy bills but may also lead to a lower council tax band. Local authorities consider energy efficiency when valuing properties, so improving your property's energy performance could result in a lower band and reduced council tax costs.

Challenges and Considerations

While the council tax system aims to be fair and equitable, there are certain challenges and considerations that property owners should be aware of:

-

Rising Property Values: As property values increase over time, more properties may find themselves in higher bands, resulting in higher council tax liabilities. This can be particularly challenging for homeowners on fixed incomes or those facing financial difficulties.

-

Local Authority Budget Constraints: Local authorities often face budget constraints, which can lead to increases in council tax rates to cover rising costs. While this is necessary to maintain essential services, it can place a financial strain on property owners.

-

Regional Variations: Council tax rates and bands can vary significantly across different regions and local authorities. This means that property owners in certain areas may face higher council tax costs compared to those in other regions, even if their properties have similar values.

Conclusion

Understanding the factors that influence band F council tax costs is crucial for property owners to manage their financial obligations effectively. By staying informed about property values, council tax rates, and potential discounts or exemptions, homeowners can navigate the council tax system with confidence. While challenges and considerations exist, the council tax system plays a vital role in funding essential local services, ensuring that communities receive the support they need.

FAQs

How often do council tax rates change?

+

Council tax rates are typically reviewed and set annually by local authorities. They may increase or decrease based on various factors, including the local authority’s budget requirements and any changes in central government guidelines.

Can I appeal my council tax band if I believe it is incorrect?

+

Yes, you have the right to appeal your council tax band if you believe it is incorrect. You can contact your local authority to initiate the appeals process, providing evidence to support your case. It is important to note that appeals can be complex, and seeking professional advice may be beneficial.

Are there any discounts available for council tax?

+

Yes, there are several discounts available for council tax. These include discounts for unoccupied properties, full-time students, and vulnerable individuals. It is important to check the specific eligibility criteria and apply for discounts where applicable.

How can I pay my council tax?

+

Council tax can be paid through various methods, including direct debit, online payments, and at local authority offices. It is advisable to contact your local authority to explore the available payment options and choose the most convenient method for you.

What happens if I fail to pay my council tax?

+

Failure to pay council tax can result in legal consequences, including court action and the possibility of bailiffs being sent to your property. It is important to keep up with your council tax payments to avoid any penalties or legal issues. If you are facing financial difficulties, contact your local authority to discuss potential payment plans or support options.