Uncover Ultimate 2024 Costliving Tips Now!

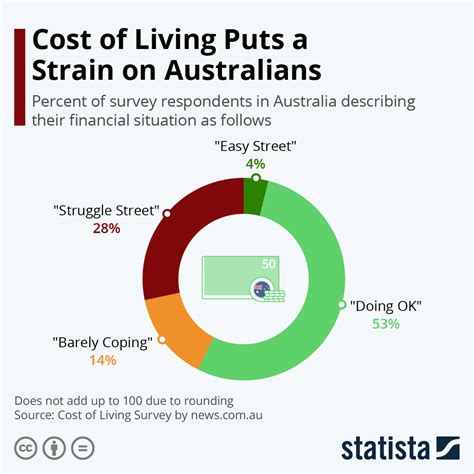

Inflation and rising costs have become an unavoidable reality for many people worldwide. The ever-increasing expenses of daily living can be a cause for concern, but fear not! This comprehensive guide will empower you with practical strategies to tackle cost-of-living challenges head-on. By implementing these tips, you can optimize your finances, save money, and achieve a more comfortable and sustainable lifestyle.

Mastering the Art of Cost-Effective Living

Living within your means and making conscious choices to reduce expenses is the cornerstone of cost-effective living. It's not about sacrificing quality of life but rather making smart decisions to stretch your income further. This section will provide you with a wealth of ideas to minimize unnecessary spending and maximize your savings.

1. Budgeting: The Foundation of Financial Success

Creating a budget is the first step towards gaining control over your finances. A budget allows you to track your income and expenses, identify areas where you can cut back, and set financial goals. Start by listing your monthly income, fixed expenses (such as rent, utilities, and insurance), and variable expenses (groceries, entertainment, etc.). Allocate a reasonable amount for each category, ensuring that your expenses do not exceed your income.

Note: Use budgeting apps or spreadsheets to make the process easier and more organized.

Note: Use budgeting apps or spreadsheets to make the process easier and more organized.

2. Smart Shopping Strategies

- Plan Your Meals: Create a weekly meal plan to reduce food waste and make grocery shopping more efficient. Stick to your list to avoid impulse purchases.

- Compare Prices: Research and compare prices online or at different stores to find the best deals. Consider buying in bulk for non-perishable items to save money in the long run.

- Coupons and Discounts: Take advantage of coupons, loyalty programs, and discounts offered by retailers. Sign up for email newsletters to receive exclusive offers and promotions.

- Shop Second-Hand: Explore thrift stores, consignment shops, and online marketplaces for gently used items. You can find great deals on clothing, furniture, and household goods.

3. Energy Efficiency: Lowering Utility Bills

Reducing your energy consumption not only benefits the environment but also your wallet. Here are some tips to lower your utility bills:

- Insulate Your Home: Proper insulation can significantly reduce heating and cooling costs. Check your attic, walls, and windows for insulation gaps.

- Energy-Efficient Appliances: Invest in energy-efficient appliances with the Energy Star label. They may cost more upfront but will save you money in the long term.

- LED Lighting: Replace traditional light bulbs with LED bulbs, which use less energy and last longer.

- Smart Thermostats: Install a smart thermostat to optimize your heating and cooling systems. These devices can learn your habits and adjust temperatures automatically.

4. Transportation and Commuting

Transportation costs can quickly add up, especially if you rely on a personal vehicle. Consider these alternatives to save money on transportation:

- Public Transportation: Explore bus, train, or subway options in your area. It's often more cost-effective and environmentally friendly than driving.

- Carpooling: Share rides with colleagues or friends to reduce fuel costs and parking fees.

- Walk or Bike: For shorter distances, consider walking or biking. It's a great way to stay active and save on transportation expenses.

- Ride-Sharing Services: Use ride-sharing apps like Uber or Lyft for occasional trips, especially if you don't drive regularly.

5. Entertainment and Leisure Activities

Entertainment doesn't have to break the bank. Here are some ideas to enjoy your free time without overspending:

- Free Events: Keep an eye out for free concerts, festivals, and community events in your area. These can be great opportunities to socialize and have fun without spending a dime.

- Library Resources: Utilize your local library for books, movies, and even free internet access. Many libraries also offer cultural events and workshops.

- Discount Websites: Sign up for websites that offer discounts on activities, restaurants, and experiences. You can find great deals on everything from movie tickets to spa treatments.

- DIY Projects: Get creative with DIY crafts, cooking, or gardening. These activities can be both enjoyable and cost-effective.

Maximizing Your Savings: Strategies for Financial Growth

Saving money is not just about cutting back; it's also about finding ways to grow your wealth. Here are some strategies to maximize your savings and achieve financial freedom.

1. High-Yield Savings Accounts

Traditional savings accounts often offer low-interest rates. Consider opening a high-yield savings account, which provides a higher interest rate, allowing your money to grow faster.

2. Investing for the Future

Investing can be a powerful tool to grow your wealth over time. Research and educate yourself about different investment options, such as stocks, bonds, mutual funds, or real estate. Start small and diversify your portfolio to minimize risk.

3. Emergency Fund

Building an emergency fund is crucial to prepare for unexpected expenses. Aim to save enough to cover at least three to six months' worth of living expenses. This fund will provide a safety net during financial emergencies.

4. Automate Your Savings

Set up automatic transfers from your checking account to your savings or investment accounts. This way, you'll save consistently without even thinking about it. Many banks offer this feature, making it convenient to save money effortlessly.

5. Pay Off Debt

Debt can be a significant financial burden. Prioritize paying off high-interest debt, such as credit cards, to save money on interest charges. Consider consolidating your debt or negotiating lower interest rates with your lenders.

Health and Wellness on a Budget

Maintaining a healthy lifestyle doesn't have to be expensive. With a little creativity and planning, you can take care of your well-being without breaking the bank.

1. Healthy Eating on a Budget

Eating healthily doesn't have to be costly. Here are some tips to maintain a nutritious diet without overspending:

- Buy in Season: Purchase fruits and vegetables that are in season. They are usually more affordable and taste better.

- Meal Prep: Prepare meals in advance to save time and money. Batch cooking and freezing meals can be a cost-effective and convenient option.

- Grow Your Own: If you have a green thumb, consider growing your own herbs and vegetables. It's a fun hobby and can provide you with fresh produce.

2. Affordable Fitness

Staying active and fit doesn't require a gym membership. Explore these budget-friendly fitness options:

- Outdoor Activities: Take advantage of nature and engage in hiking, running, or cycling. These activities are free and offer a great workout.

- Home Workouts: With the abundance of online resources, you can find free workout videos and routines. Invest in some basic equipment like resistance bands or dumbbells for a home gym.

- Community Centers: Check out local community centers or recreation facilities. They often offer affordable fitness classes and programs.

3. Mental Health and Well-Being

Taking care of your mental health is essential for overall well-being. Here are some affordable ways to prioritize your mental health:

- Meditation and Mindfulness: Explore free meditation apps or online resources to practice mindfulness and reduce stress.

- Journaling: Writing down your thoughts and feelings can be therapeutic. It's a simple and inexpensive way to process emotions.

- Support Groups: Join support groups or online communities where you can connect with others facing similar challenges. These groups can provide valuable support and a sense of community.

Home Improvement and Maintenance

Maintaining your home can be costly, but with some DIY skills and smart choices, you can save money on repairs and renovations.

1. DIY Repairs

Before calling a professional, try tackling minor repairs yourself. Many home improvement stores offer workshops or online tutorials to guide you through common repairs. This can save you money and empower you with new skills.

2. Energy-Efficient Upgrades

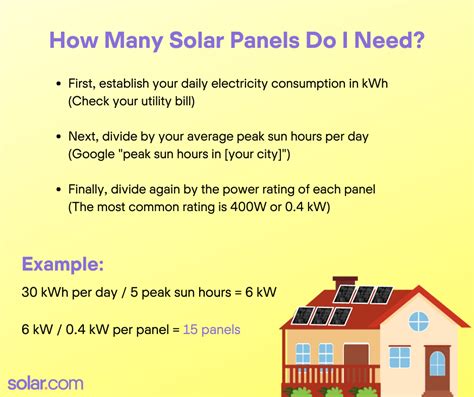

Consider investing in energy-efficient upgrades for your home. While they may require an initial investment, they can lead to long-term savings on utility bills. Examples include upgrading to a smart thermostat, installing solar panels, or replacing old windows with energy-efficient ones.

3. Home Maintenance Schedule

Create a home maintenance schedule to stay on top of regular tasks. Regular maintenance can prevent small issues from becoming costly repairs. Some tasks to include in your schedule are cleaning gutters, changing air filters, and inspecting plumbing and electrical systems.

Traveling on a Budget

Exploring the world doesn't have to be an expensive endeavor. With careful planning and flexibility, you can travel on a budget and create unforgettable memories.

1. Off-Season Travel

Consider traveling during the off-season when prices are lower and crowds are thinner. You can find great deals on flights, accommodations, and activities during these periods.

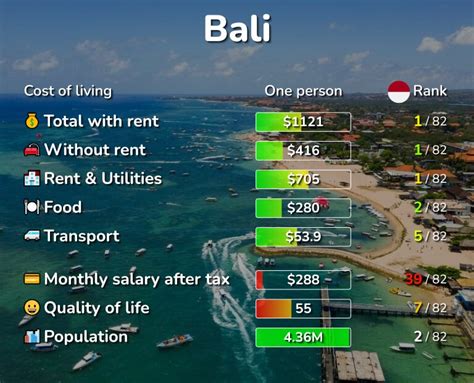

2. Budget-Friendly Destinations

Research destinations that offer excellent value for money. Look for countries or regions with a lower cost of living, where your budget can go further. Consider exploring nearby cities or countries that offer cultural experiences without the high price tag.

3. Travel Hacking

Travel hacking involves using strategies to maximize rewards and discounts. Sign up for rewards programs with airlines and hotels, and consider using credit cards that offer travel rewards. You can also take advantage of last-minute deals or bundle packages to save on travel expenses.

Embracing a Sustainable Lifestyle

Living sustainably is not only good for the environment but can also save you money in the long run. Here are some tips to embrace a more sustainable lifestyle:

1. Reduce, Reuse, Recycle

Follow the three R's of sustainability: reduce, reuse, and recycle. Reduce your consumption of single-use items, reuse items whenever possible, and recycle materials to minimize waste.

2. Energy Conservation

Continue to make energy-efficient choices in your daily life. Turn off lights and electronics when not in use, and unplug devices to avoid vampire power consumption. Consider using renewable energy sources like solar panels to power your home.

3. Sustainable Transportation

Opt for more sustainable transportation options. Walk, bike, or use public transportation whenever possible. If you need a car, consider purchasing an electric or hybrid vehicle to reduce your carbon footprint and save on fuel costs.

4. Support Local Businesses

Shopping locally not only supports your community but can also be more sustainable. Local businesses often have a smaller carbon footprint and may offer unique, eco-friendly products.

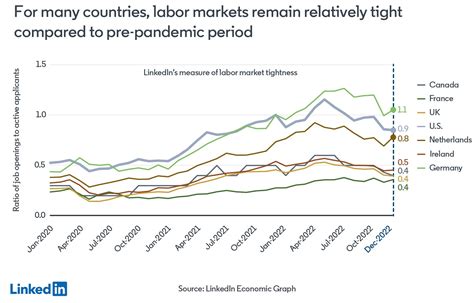

The Power of Education and Skill Development

Investing in your education and skill development can open doors to new opportunities and higher-paying jobs. Here's how you can make the most of educational resources:

1. Online Courses and MOOCs

Take advantage of the abundance of online courses and Massive Open Online Courses (MOOCs) available. Many platforms offer free or low-cost courses on a wide range of topics. You can learn new skills or enhance your existing ones without incurring significant expenses.

2. Local Community Colleges

Explore the educational opportunities offered by community colleges in your area. These institutions often provide affordable and flexible programs, allowing you to pursue further education without taking on excessive student loan debt.

3. Skill-Building Workshops

Keep an eye out for skill-building workshops and seminars in your community. These events can provide valuable knowledge and networking opportunities. Many organizations offer these workshops at little to no cost, making them accessible to a wide range of individuals.

Conclusion

Living within your means and adopting cost-effective strategies is not just about saving money; it's about gaining control over your financial future. By implementing the tips outlined in this guide, you can navigate the rising cost of living with confidence and achieve a more stable and fulfilling life. Remember, small changes can lead to significant savings, so start implementing these ideas today and watch your financial goals become a reality.

How can I save money on groceries without compromising on quality?

+To save money on groceries while maintaining quality, consider buying in bulk for non-perishable items, planning your meals to reduce food waste, and taking advantage of discounts and coupons. Also, explore local farmers’ markets for fresh produce at competitive prices.

What are some tips for reducing energy consumption at home?

+To lower your energy bills, invest in energy-efficient appliances, use LED lighting, and consider installing a smart thermostat. Additionally, simple habits like turning off lights and electronics when not in use can make a significant difference.

How can I save money on entertainment and leisure activities?

+There are several ways to save on entertainment. Explore free community events, utilize your local library for books and movies, and take advantage of discount websites for deals on activities and experiences. DIY projects and outdoor activities can also be cost-effective and enjoyable.

What are some strategies for paying off debt faster?

+To accelerate debt repayment, consider consolidating your debt to lower interest rates. Prioritize paying off high-interest debt first, and consider negotiating with lenders for more favorable terms. Additionally, creating a budget and cutting back on non-essential expenses can free up more money for debt repayment.

How can I stay healthy without spending a fortune on gym memberships and supplements?

+You can maintain a healthy lifestyle without expensive gym memberships or supplements. Explore outdoor activities like hiking or running, which are free and provide a great workout. Utilize online resources for free workout routines and focus on a balanced diet with whole foods. Also, consider joining community fitness groups or classes, which often offer affordable options.